Range Trading Strategies for Beginners: How to Navigate Market Ranges with Confidence

Ever wondered how savvy traders make consistent profits even in stagnant markets? The secret lies in range trading, a time-tested strategy that thrives when prices bounce between key levels. Whether you're just starting out or refining your skills, range trading offers a unique blend of predictability and flexibility that appeals to traders of all experience levels.

Breakout Trading Explained: Strategies, Examples, and Best Practices

In trading, a "breakout" means a price movement that occurs when an asset moves beyond a determined support or resistance level. This pivotal moment signals a shift in market dynamics and often leads to notable price changes. Breakouts occur when the price surpasses a level that has previously acted as a barrier, such as a previous high (resistance) or a previous low (support).

The Vital Role of Support and Resistance in Trading: Unlocking Strategic Success

Support and resistance are cornerstone principles in trading that offer crucial insights into price dynamics and market behavior. These levels act as key indicators, signaling points where an asset's price is likely to either pause or reverse direction. Support refers to the price level where strong demand prevents further declines, while resistance marks the point where selling pressure halts a price rise.

Support and Resistance in Forex Trading | Definition & Strategies

Support and resistance levels play a crucial role in the world of trading, particularly in forex markets. These levels represent areas on a price chart where buyers and sellers interact, shaping market dynamics. Understanding how support and resistance levels affect the market is essential for traders to make informed decisions and maximize their trading opportunities. This article will delve into the significance of support and resistance levels, how to identify and draw them correctly, strategies to trade them effectively, and methods to filter out false signals.

All You Need to Know About Andrews' Pitchfork

Alan Hall Andrews is a rather famous trader, formerly engaged in the study of financial markets. One of the areas of his work was to find ways to determine the expected boundaries of the future trend by the first movement after the anticipated reversal. Andrews` pitchfork indicator appeared as a solution to this problem, this tool has become so popular that today it is included in the standard set of most trading terminals.

Understanding Price Action Patterns: Rails

In addition to the main patterns, which include pin bars and engulfing, there are some secondary patterns. They are somewhat less strong, but they can be found on the charts and if there are strengthening factors, such as support in the form of a level, they can be used as market entry signals. Today we will start with a pattern called Rails.

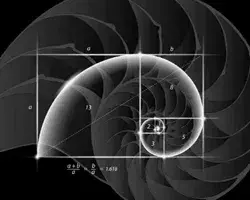

What Is Fibonacci Retracement? Definition & How to Use It

Setting the support and resistance levels is usually a problem for traders. It is especially inconvenient when trying to figure out from the beginning where to place them on the chart: one may think there are no good points to be plotted and it may be better to choose another time frame. Then the chart begins to change direction - and the support that has just been plotted becomes resistance. Immediately the question arises: "Where to build new support and how long to wait for it?"