Range Trading Strategies for Beginners: How to Navigate Market Ranges with Confidence

Ever wondered how savvy traders make consistent profits even in stagnant markets? The secret lies in range trading, a time-tested strategy that thrives when prices bounce between key levels. Whether you're just starting out or refining your skills, range trading offers a unique blend of predictability and flexibility that appeals to traders of all experience levels.

At its core, range trading capitalizes on market indecision. Prices fluctuate within a defined "range" between support and resistance levels. Support acts as a price floor, where buyers step in, and resistance functions as a ceiling, where sellers take control. Unlike trend trading, which relies on market momentum, range trading is all about exploiting these predictable oscillations. Understanding these levels can be your ticket to identifying profitable entry and exit points, no matter the overall market direction.

What Is Range Trading? A Comprehensive Overview

Range trading is a strategy that leverages the market's inclination to fluctuate within a defined price band, rather than exhibiting a clear upward or downward trend. This approach involves purchasing assets at support levels, where buying pressure halts further declines, and selling at resistance levels, where selling pressure caps price increases. The appeal of range trading is its straightforwardness: instead of pursuing trends, you focus on predicting reversals. By identifying these recurring patterns, you can make strategic choices in various markets, including stocks, forex, or commodities.

Range trading fits within the broader category of technical analysis, which relies on historical price data to forecast future price movements. Unlike fundamental analysis, which looks at company earnings, economic indicators, or interest rates, technical analysis - and by extension, range trading - focuses purely on price action and patterns. This makes it particularly useful for short-term traders who want to make quick decisions based on real-time data.

Importance of Support and Resistance Levels

Support and resistance levels are fundamental to range trading. Support refers to the price point where an asset tends to halt its decline, effectively finding a floor as it drops. For instance, if a stock repeatedly rebounds from $50, that price point is recognized as a significant support level. Resistance, conversely, is the price level where an asset encounters selling pressure, preventing it from climbing further. For example, if a stock struggles to surpass $100, then $100 serves as its resistance level.

Accurately identifying these levels goes beyond merely observing peaks and troughs on a chart. Successful traders employ various analytical tools, such as moving averages or Bollinger Bands, to validate these levels and minimize the risk of false signals. Mastery in pinpointing support and resistance can help you uncover profitable trading opportunities and devise effective entry and exit strategies. For instance, when a price approaches a robust support level, it might signal a buying opportunity, while nearing resistance could suggest a favorable time to sell.

Also read: Support and Resistance in Forex Trading | Definition & Strategies

Strategies for Successful Range Trading

Mastering range trading involves more than just identifying support and resistance levels; it requires a strategic approach to timing and trade execution. To successfully navigate the range, traders must develop effective entry and exit strategies, recognizing the nuances of price behavior within the defined boundaries. This includes avoiding common pitfalls like false breakouts and utilizing volume analysis to confirm the strength of price movements. By honing these skills, traders can improve their ability to capitalize on predictable price fluctuations and enhance their overall trading performance.

Entry and Exit Points

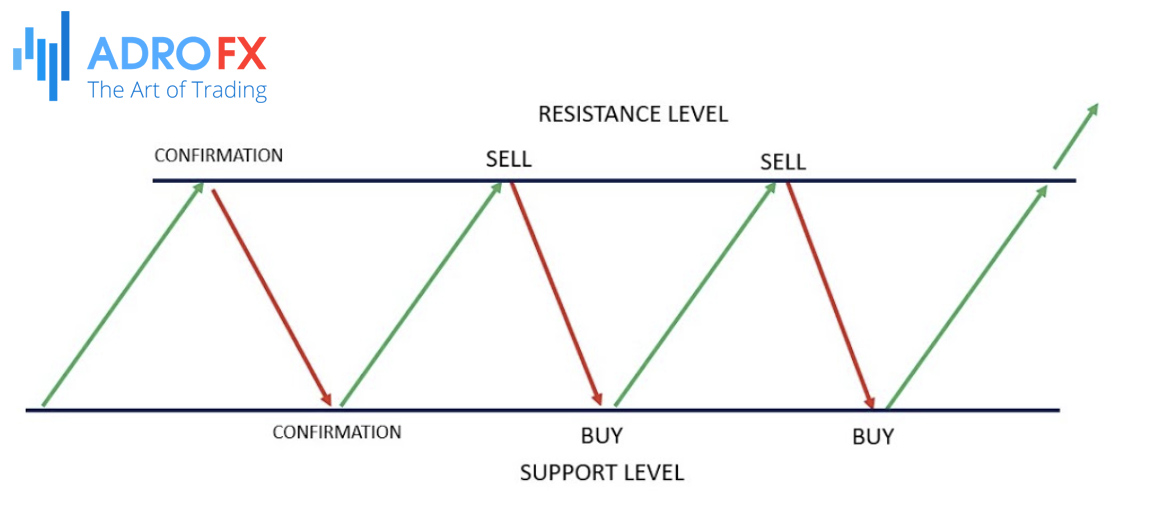

Timing is crucial in range trading, as successful trades depend on precise entry and exit points within the established range. To capitalize on the price oscillations between support and resistance, traders need to develop strategies for buying low at support and selling high at resistance.

Buying at Support and Selling at Resistance:

- Buying at Support

When the price approaches a strong support level, it often indicates a buying opportunity. The rationale is that the support level has historically prevented the price from falling further. Traders look for signs that the price is bouncing off this level, such as a bullish candlestick pattern or a positive divergence on momentum indicators like the Relative Strength Index (RSI). Placing a buy order near support can maximize the potential for profit if the price rebounds as expected.

- Selling at Resistance

Conversely, when the price nears resistance, it is often a signal to consider selling. The resistance level has previously halted price increases, suggesting it may do so again. Traders might look for bearish reversal patterns or overbought conditions on indicators like the RSI to confirm that the price is likely to drop from this level. Setting a sell order close to resistance can help capture the anticipated decline before it reverses.

Avoiding False Breakouts

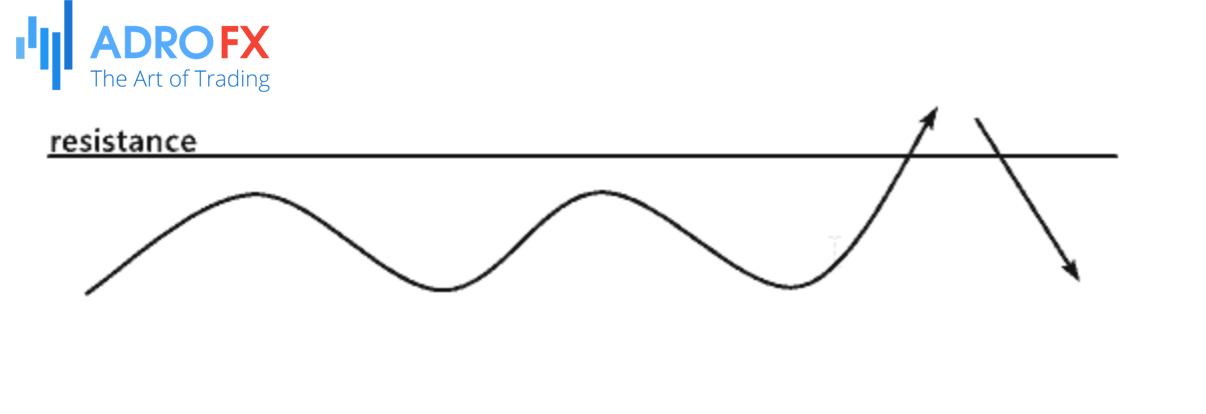

False breakouts happen when the price temporarily exceeds support or resistance levels but quickly reverses back into the established range. These can mislead traders into unfavorable positions if they wrongly assume a new trend is emerging.

A false breakout occurs when the price surpasses a support or resistance level but fails to maintain this movement, returning instead to the prior range. For example, if a stock briefly exceeds a resistance level but then falls back, it's classified as a false breakout.

To avoid falling victim to false breakouts, consider these strategies:

- Confirm Breakouts with Volume

Genuine breakouts are typically supported by increased trading volume. If a breakout occurs with low volume, it may lack sustainability. Analyzing volume can help verify the strength of the breakout.

- Wait for Confirmation

Before acting on a breakout, wait for the price to close beyond the support or resistance level on a daily or weekly chart. This approach helps minimize the risk of reacting to a false signal.

- Use Additional Indicators

Enhance the reliability of breakout signals by combining them with other technical indicators, such as trend lines or moving averages. This multi-faceted approach can help validate the breakout's authenticity.

Also read: Taming False Breakouts: Proven Methods for Traders

Role of Volume Analysis in Confirming Breakouts

Volume analysis plays a critical role in distinguishing genuine breakouts from false ones. A true breakout is often supported by a surge in volume, indicating strong interest and momentum. Conversely, a breakout on low volume might lack the backing necessary for a sustained move. By monitoring volume alongside price action, traders can better assess whether a breakout is likely to lead to a new trend or merely a short-term fluctuation.

Ready to master range trading? Open a demo account today and start practicing with real-time data. Check out our additional resources and tutorials to deepen your trading knowledge.

Tools and Indicators to Enhance Range Trading

Utilizing the right tools and indicators can greatly enhance your range trading approach. These instruments assist traders in pinpointing essential support and resistance levels, as well as potential entry and exit points. By employing technical indicators such as moving averages, RSI, and Bollinger Bands, traders gain valuable insights into market conditions and price movements. Additionally, advanced charting platforms offer sophisticated features for precise analysis. Effective use of these tools enables traders to make well-informed decisions, optimize their strategies, and boost their success rates in range trading.

Technical Indicators

Technical indicators are crucial for discovering trading opportunities within a range. Here are some widely-used indicators to help identify support and resistance levels:

Moving Averages

Moving averages help smooth price data to reveal trends and key support/resistance levels. A popular technique involves using both short-term and long-term moving averages to detect potential reversals at these levels.

Relative Strength Index (RSI)

The RSI gauges the speed and magnitude of price changes on a scale from 0 to 100. Values exceeding 70 suggest overbought conditions (potential resistance), while values below 30 indicate oversold conditions (potential support).

Bollinger Bands

Bollinger Bands feature a central band (usually a moving average) and two outer bands that adjust based on market volatility. Prices frequently oscillate between these bands, with the upper band serving as resistance and the lower band as support.

Charting Tools

Effective charting tools are crucial for visualizing support and resistance levels and executing range trading strategies. Here are some recommended platforms:

- TradingView

Known for its user-friendly interface and extensive range of technical indicators, TradingView offers powerful charting tools and social features for sharing insights with other traders.

- MetaTrader 4

Popular among forex traders, MetaTrader provides advanced charting capabilities, including customizable indicators and automated trading options.

- Allpips WebTrader

Allpips webtrader is an innovative platform designed to offer an accessible and efficient trading experience. It features advanced charting tools that include real-time price data, multiple chart types, and a range of technical indicators. The platform’s intuitive interface is particularly beneficial for traders who need to quickly analyze price movements and execute trades directly from their web browser. Allpips webtrader supports a wide variety of asset classes and provides seamless integration with other trading tools, making it a versatile option for traders looking to enhance their range trading strategies.

By leveraging these tools and indicators, traders can enhance their range trading strategies, effectively identify key levels, and make informed decisions to maximize their trading success.

Risk Management in Range Trading

Effective risk management is crucial for successful range trading, as it helps protect your capital and ensures sustained profitability. Implementing robust risk management practices allows traders to guard against substantial losses and enhance trading performance. Key strategies include setting Stop Loss orders to limit potential losses and managing position sizes to control risk exposure. By adopting these practices, traders can handle the uncertainties of range trading with increased confidence and stability.

Setting Stop Losses

Stop Loss orders are a vital part of risk management in range trading. They act as a safety net against unfavorable price movements, helping to cap potential losses on each trade.

A Stop Loss order automatically exits a trade when the price hits a pre-set level, preventing further losses. Without such an order, traders could face significant losses if the market moves against their position.

Here are some guidelines for setting Stop Loss levels:

- Below Support

For a long position, place a Stop Loss just below the support level. This way, if the price breaks through support, your position will be closed before you incur major losses. - Above Resistance

For a short position, set a Stop Loss slightly above the resistance level. This approach safeguards you if the price rises above resistance, thus limiting potential losses.

Position Sizing

Effective position sizing is essential for managing risk properly. It involves deciding how much capital to allocate to each trade based on your risk tolerance and the specific details of the trade. Here are key tips for managing trade sizes:

- Calculate Risk per Trade

Decide what percentage of your trading capital you're willing to risk on each trade. A common recommendation is to risk no more than 1-2% of your total capital. - Adjust for Volatility

Take into account the volatility of the asset when determining your position sizes. More volatile assets might require smaller positions to accommodate larger price fluctuations.

Advanced Tips for Range Trading

To elevate your range trading strategy, consider integrating advanced techniques that offer deeper insights and create additional opportunities. By leveraging multiple time frames and combining range trading with other strategies, you can craft a more holistic trading approach.

Using Multiple Time Frames

Examining multiple time frames provides a broader view of price movements and helps validate the ranges you're trading.

How to confirm ranges across different time frames:

- Identify Ranges on Higher Time Frames

Begin by analyzing higher time frames, such as daily or weekly charts, to pinpoint major support and resistance levels. This approach helps establish the overall trading range. - Refine Entries on Lower Time Frames

Use lower time frames, such as 1-hour or 15-minute charts, to fine-tune your entry and exit points within the established range. This allows for more precise trading decisions and better timing.

Combining with Other Strategies

Merging range trading with additional trading strategies can provide extra confirmation and enhance your overall trading plan.

- Trend Following

Pair range trading with trend-following techniques to take advantage of both range-bound and trending market conditions. For example, use range trading to spot consolidation phases and apply trend-following methods to capture breakout opportunities. - Breakout Trading

Utilize range trading to define key support and resistance levels, then incorporate breakout trading strategies to capitalize on significant price movements that occur when the price breaches the established range.

By adopting these advanced techniques, traders can gain a more comprehensive understanding of market dynamics and improve their ability to navigate various trading scenarios effectively.

Conclusion

Range trading is a powerful strategy that thrives in markets where prices oscillate between well-defined support and resistance levels. By focusing on these key price boundaries, traders can strategically buy near support and sell near resistance, capitalizing on predictable price movements. Effective range trading requires precise timing, strong risk management practices, and the ability to avoid pitfalls such as false breakouts. Utilizing technical indicators and charting tools enhances your ability to identify and confirm trading opportunities. Advanced techniques, such as analyzing multiple time frames and combining range trading with other strategies, can provide additional layers of insight and increase your trading effectiveness.

Now that you have a comprehensive understanding of range trading, it's time to apply these concepts in practice. Begin by opening a demo account to experiment with range trading strategies without the risk of real financial loss. This will allow you to refine your skills, test different approaches, and gain confidence in your trading decisions. Additionally, continue your learning journey by exploring further reading materials and tutorials on range trading, technical analysis, and related trading strategies. Staying informed and continuously practicing will help you adapt to market conditions and enhance your trading proficiency. Embrace the opportunity to experiment and learn, and watch as your range trading skills evolve and improve over time.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.