All You Need to Know About Andrews' Pitchfork

Alan Hall Andrews is a rather famous trader, formerly engaged in the study of financial markets. One of the areas of his work was to find ways to determine the expected boundaries of the future trend by the first movement after the anticipated reversal. Andrews` pitchfork indicator appeared as a solution to this problem, this tool has become so popular that today it is included in the standard set of most trading terminals.

What Is Andrews' Pitchfork and Logic Behind It

Andrews` pitchfork is an MT4 trading indicator that shows on a chart the range of trend changes that form a price channel. It consists of 1 midline and 2 parallel lines, located at the same distance. The middle line shows the trend following or prevailing trend and the parallel lines show the support and resistance values in the market. In addition, the chart allows you to track possible pullbacks in price dynamics.

Pitchfork is a tool for exploring price channels used in the methodology of trading techniques. It got its name from its developer and for the chart's garden tool-like appearance.

First of all, to place the indicator on the chart is to find an emerging or already prevailing trend in the futures market or currency market with steadily rising or falling price dynamics (so-called upward or downward trends). The beginning of its movement is marked by the conventional point A.

After that, the breakout line, i.e. a sharp reversal of the price dynamics, is found. The price minimum (B) and maximum (C) points are marked, and the distance between them is divided into two equal pieces. The midline is drawn through the obtained middle of the breakout line and point A marking the beginning of a movement. Auxiliary lines, showing resistance and support, are drawn parallel to the midline through points B and C.

The figure obtained from the constructions is a pitchfork. There is a modification of this figure that allows for avoiding too narrow a channel - Schiff's pitchfork. Its midline is drawn not from the initial point of the trend (A), but from the point that moved up by 50% along the axis.

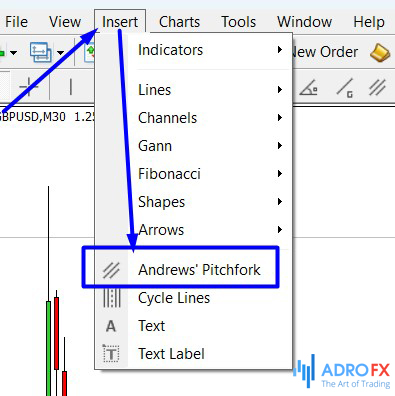

It is easy to draw the pitchfork using the latest technologies. Any trading terminal has the function of adding this indicator to a chart.

However, knowing how to correctly draw the indicator helps to better understand how its components work, and analysis of the indicator helps a trader to develop a flexible market strategy for attaining yiled trading forex or any other assets.

How to Trade Andrews` Pitchfork Correctly

Andrews` pitchfork demonstrates patterns within a trend. The midline indicates the true value, while the prongs indicate a possible range of bounces. The trader can see a possible bounce from both borders. The probability of a bounce is directly proportional to the amount of funds involved. It does not matter if it is a few strong players or many small players. The dependence holds in all cases.

Andrews` Pitchfork Trading Strategy

Price changes within a trend stimulate the trader to change behavior in the market. So, it is recommended to use lower time frames to get the best results.

The main Andrews` pitchfork trading strategy is the intrinsic tendency of the asset price to return to the midline. As long as the price is near the midline, the trend continues as usual. However, if the price of the asset approaches one of the two auxiliary lines, there is a high probability of a bounce and a return of the value to the midline. The trend still continues, but the trader gets an opportunity to get good earnings on price jumps.

Approximately in 10% of cases the trader sees a false breakout. For a short time, the price will go out of the trend line, but then it will come back. The probability is insignificant and can be ignored.

The trend reversal occurs in the case of:

- A sustained trend breakout in terms of depth and duration of changes;

- Confirmation on the part of other indicators. For example, a trend shift can be observed.

The speculator should determine the further strategy. It is allowed:

- Exit the trade;

- Place an opposite order;

- Wait for the price to return to the boundaries.

Price Exit Beyond Andrews` Pitchfork

Sooner or later the price leaves any channel, i.e. breaks it out. What to do in such cases? Let's analyze the situation with an example.

The Andrews' pitchfork is considered to be worked out when at least two candles have closed outside the channel. If the previous trend is upward, and the price breaks out the lower boundary of the channel, you should open a short position after the lowest minimum of the two candlesticks that closed below the lower boundary of the channel is broken out. If the upper boundary is broken out, it means you may open a long position after the breakout of the highest maximum of the two candles which closed above the upper boundary.

Traders usually enter the market after the price exits the channel against the main trend.

The disadvantage of this approach is the dynamic Stop Loss. It is usually set inside the channel, but in the course of the pair movement, it can be moved not in favor of the trader.

Initially, the Stop Loss is set just above the previous local high. This variant corresponds to common sense, as it is inside the channel and is the highest point on the chart at that moment. After placing a trade, the price will sharply go upward. The order will be closed by the initial Stop Loss if it is not moved higher in advance, as the channel range has also moved upwards.

To avoid unnecessary losses, it is recommended to ignore market entries using Andrews' pitchfork if the price does not immediately break out the signal candles downwards (for shorting) or upwards (for longing), and remains in a flat position for a long time (more than 10 candles).

The trend line drawn through points 1 and 3 can be used as a false entry filter when breaking out the Andrews'pitchfork. If we were going to enter the market due to its breakout downwards, there would be no order placed.

Automated and Modified Versions of Andrews` Pitchfork

One of the key disadvantages of working with this tool is the need to constantly reconstruct the range. This needs to be done both when the trend changes and when new corrective movements appear.

There are Andrews' pitchfork indicators, which make it easier to construct. Also, the authors slightly modify the standard channel, for example, they add additional levels. In KL Andrews` Pitchfork Pro indicator, the width of the channel is increased by adding 50 and 100 levels (meaning the percentage of the base price channel width).

There are other similar indicators:

- Dynamic Andrews` Pitchfork. It can independently find reference points and update the position of the pitchfork. A modified version of Andrews' development is also built into the algorithm.

- Andrews` Pitchfork Indicator. A standard indicator duplicates the standard Andrews` pitchfork, but the algorithm does the markup of the chart itself.

- Auto Pitchfork. In contrast to the previous indicators, it tries to update the position of the pitchfork every day, the support and resistance levels are used in the markup.

There are other indicators, and all of them, for the most part, copy each other's functionality. The accuracy of the markup is not optimal, it is not recommended to use their constructions without additional corrections.

Benefits and Drawbacks of Andrews` Pitchfork

Let's first start with the advantages:

- The tool is time-tested;

- Andrews` pitchfork does not "break", it was relevant 10 years ago and will remain relevant in the future;

- It is possible to predict the trend development on the first movement;

- It is suitable for trading both along and counter the trend;

- It provides good reference points - support and resistance lines.

There are also disadvantages:

- There is a factor of subjectivity;

- Signals can be ambiguous, they need to be filtered.

Tips for Using Andrews` Pitchfork

The information that you will learn below can only be found in highly specialized sources. There are no magic formulas here, only facts that traders have successfully worked with for a century:

- There is a high probability that the price will return to the midline (based on his research, Andrews stated that this probability is 80%);

- The price reacts to the midline in a specific way: it either reverses near it, consolidates or breaks it out with a powerful move, often with a gap;

- After the price breaks out of the midline, it often pulls back to it;

- The price often reverses near either of the lines: the midline or the two extreme lines which are parallel to it;

- If the price reverses before it reaches the midline, it will move further in the opposite direction.

Moreover, Alan Andrews has noticed that when the price is out of the channel (above or below the upper or lower line), it often reacts to equidistant parallel lines above or below the main ones.

Conclusion

Andrews` pitchfork is a useful tool for analyzing price channels, also in the MetaTrader 4 terminal. The reliability of this indicator, as per the author himself, readings exceeds 80%. However, a trader should build a trading strategy by analyzing other market indicators to minimize risks. It makes sense to use the considered indicator as a part of the system analysis of the situation.

About AdroFx

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.