US Inflation Drops, Rate Cuts Possible, Retail Sales Eyed | Daily Market Analysis

Key events:

- USA – Retail Sales (MoM) (Mar)

Yesterday, the luxury sector drove a positive session in European markets, resulting in new record highs for the CAC 40 and modest gains for the DAX and FTSE 100. On the day, this optimism drove US equity markets higher, with the Nasdaq 100 leading the way, and the S&P 500 posting its best close in two months. Interestingly, there was no significant decline in US bond yields.

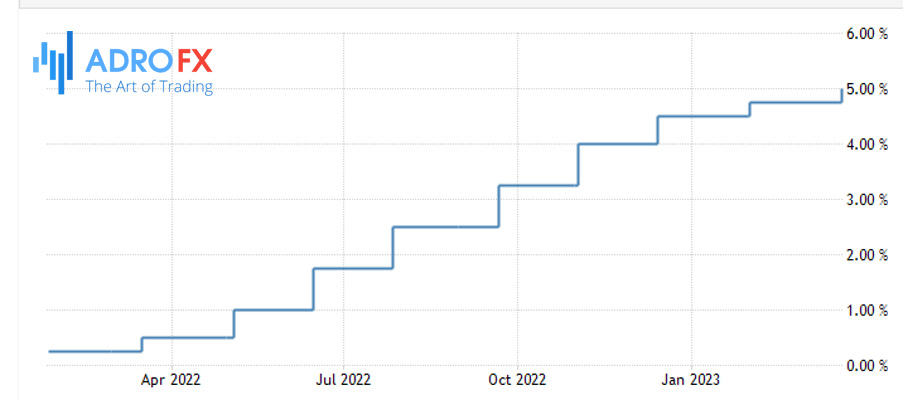

In the US, there was another significant drop in inflation, as both headline PPI and core prices for March decreased, leading to increased optimism that this trend could transfer to CPI numbers in the upcoming months. As a result, there is speculation that we may see rate cuts later in the year.

Later, we will receive updates on how consumer sentiment has fared in March, along with the latest US retail sales numbers and Q1 updates from JPMorgan Chase, Citigroup, and Wells Fargo.

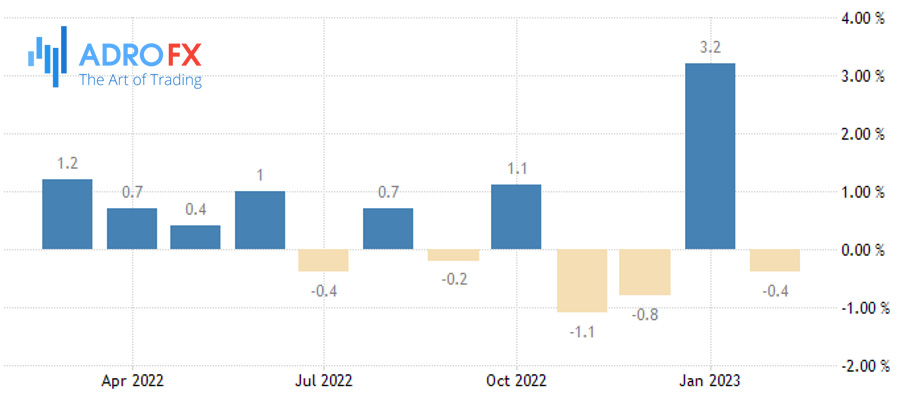

US retail sales saw a decline of -0.4% in February, following a surge of 3.2% in January. Similarly, personal spending slowed down from 2% in January to 0.2% in February. Despite concerns over bank run in the US during March and consumers shifting their funds from smaller to larger banks, consumer confidence has managed to hold up well. However, it is uncertain if this confidence will lead to a similar increase in retail sales, with expectations for another weak reading of -0.4%. Nonetheless, the US labor market remains stable, and gasoline prices have dropped to a 15-month low, which may support spending in other areas of the economy. The upcoming US bank earnings season will provide a bigger test of the sector's stability during the turbulent first quarter. When JPMorgan Chase reported its last fiscal year, it set aside a reserve build of $1.4bn due to an increase in credit costs to $2.3bn and the expectation of a mild recession. The recent banking turmoil has only heightened concerns, and the focus is now on how much it has impacted the sector's profit numbers, including loan demand, deposit inflow, and credit card lending. Many clients of SVB have moved their funds to JPMorgan and other US banks following the collapse.

The price of gold is currently consolidating near a thirteen-month high of mid-$2,000 after a three-day winning streak. The United States Dollar (USD) remains weak, hovering near yearly lows ahead of the release of US Retail Sales and Consumer Sentiment data. The non-interest-bearing gold price has surpassed the $2,030 hurdle and is now challenging the $2,050 barrier. The direction of the gold price will depend on the US dollar's price action following the release of the US Retail Sales and Consumer Sentiment data later in the North American session. It is expected that US Retail Sales will decrease by 0.4% in March on a monthly basis, while Core Retail Sales will decrease by 0.3% MoM in the reported period. The University of Michigan's Preliminary Consumer Sentiment data is expected to remain steady at 62.0 in April. The 5-year Consumer Inflation Expectations will also be reported and could have an impact on Fed expectations.

At the same time, investment bank Goldman Sachs is confident that the Federal Reserve is no longer going to raise interest rates after the May meeting, writes Business Insider.

The investment bank's chief economist, Jan Hatzius, sees a 35% chance of a US recession in the next 12 months.

The reason Goldman Sachs no longer expects a US interest rate hike in June is because of slowing inflation, a weakening labor market, and the Federal Reserve's own concerns about the banking crisis.

"We still expect a rate hike in May to 5-5.25 percent," the GS team, led by chief economist Jan Hatzius, wrote.

Thus, the Fed will hold a final rate hike of 25 basis points at its May 3 meeting and then keep it at that level through the second quarter of next year.