Dow Surges, Chinese GDP Disappoints, and Dollar Faces Uncertainty Amidst Eurozone Focus | Daily Market Analysis

Key events:

- USA - Core Retail Sales (MoM) (Jun)

- USA - Retail Sales (MoM) (Jun)

On Monday, the Dow closed higher, with technology and financial sectors leading the way. Investors were eagerly anticipating quarterly results from major Wall Street banks and corporations later in the week. However, the gains in the broader market were somewhat limited by a stumble in the telecom sector.

The Dow Jones Industrial Average recorded a 0.2% increase, equivalent to 76 points. The Nasdaq saw a more significant rise of 0.9%, while the S&P 500 also showed a positive movement of 0.3%.

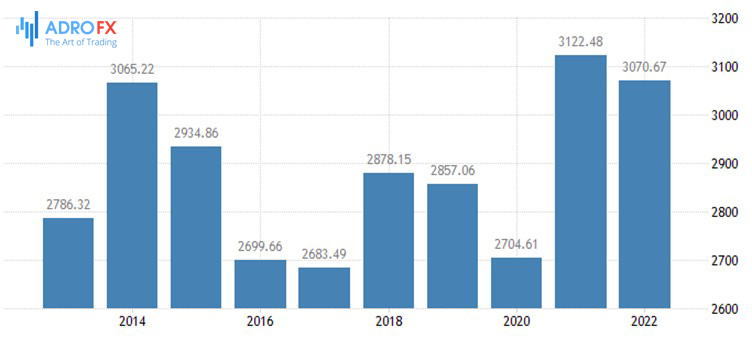

Meanwhile, Chinese GDP data disappointed as it came in weaker than expected. The quarterly growth rate was 0.8%, lower than the 2.2% rate in the previous quarter (Q1), and the annualized growth was 6.3%, falling short of the expected 7.3%. Retail sales for June were also lackluster, showing a year-on-year increase of 3.1%, far below the 12.7% growth achieved in May. This data confirms the belief that China's post-Covid economic boom has lost momentum. The European indices felt the impact of this news, leading to a decline across the board.

The dollar index experienced a significant decline of around 2.34% during the previous week, raising questions about its future strength. Whether the dollar continues to weaken will largely depend on signals from the Federal Reserve during its upcoming meeting.

If the Fed indicates that it has finished raising interest rates, it is likely that the dollar will struggle to recover in the short to medium term. However, there are a few potential scenarios that could trigger a dollar recovery: first, weaker-than-expected corporate earnings (although this seems unlikely), and second, a shift in economic data from Europe and the UK that may weigh on the pound and the euro, both of which have been strong against the dollar. This week, the focus will be on inflation data in the UK, with the market anticipating a decline to 8.2% from the previous 8.7%. This would create one of the widest inflation gaps between the UK and the US since the 1970s when US headline inflation dropped to 3% last month.

This disparity has been a driving force behind the strength of GBP/USD. If the UK's inflation rate does come in at 8.2%, higher than the Bank of England's forecast of 7.9% for June, it will underscore the UK's position as a global inflation outlier. This could lead to further strength in the pound in the short term unless the UK's economic growth shows more significant signs of strain, prompting the Bank of England to tighten monetary policy and address price pressures.

EUR/USD is currently reaching its highest levels since early 2022, and CFTC data indicates a significant long position (+19% of open interest) on the euro ahead of the Consumer Price Index (CPI) release. While the eurozone's data releases are relatively light this week, all eyes are on a conference organized by the European Central Bank (ECB), where President Christine Lagarde and other ECB speakers will share insights. This event could impact market expectations leading up to next week's policy meeting, even though it appears likely that a rate hike in July has already been decided, and discussions have begun regarding September.

Given the absence of tier-one data in the US this week, market participants are closely observing developments to gauge the behavior of FX markets going forward. The key question is whether investors have enough reasons to add short positions on the dollar before the Federal Open Market Committee (FOMC) meeting or if they will take a more cautious approach. The latter scenario, which seems slightly more probable from my perspective, may result in the dollar recovering some of its recent losses and potentially providing support for the Dollar Index (DXY) as it climbs back above the 100.00 level.