US Retail Sales Data Fails to Add Any Clarity | Daily market Analysis

Key events:

- Australia – Employment Change (Jan)

- USA – Building Permits (Jan)

- USA – Initial Jobless Claims

- USA – Philadelphia Fed Manufacturing Index (Feb)

- USA – PPI (MoM) (Jan)

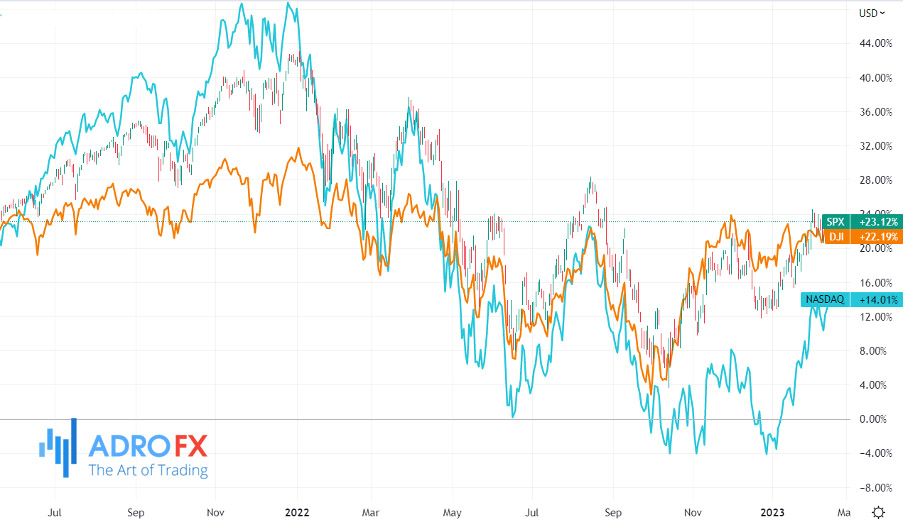

The U.S. stock market ended Wednesday's trading on the plus with growth in the last hour of the session. Traders tried to assess the next batch of statistical data on the U.S. economy and draw conclusions as to what they could mean for the further policy direction of the Federal Reserve System.

The main event of the week was the release of consumer inflation data, namely the CPI index, but we can't say that it added clarity to the current situation. Maybe, on the contrary, it confused it even more. Though why be surprised, in fact, it always turns out that way.

January inflation data was slightly better than December's but worse than analysts' forecasts. Judging by the trading dynamics, investors do not know what to do with this data.

Of course, the changes are so insignificant that they do not affect the general state of affairs. However, many investors were hoping to get more valuable, and most importantly, clear information from the inflation data, which would allow making clear and weighted investment decisions. This did not happen - the situation remains vague and completely uncertain. It is impossible to predict where the market will go now.

The release of inflation data in the U.S. has sent a big wave of pessimism to the world stock markets. That's why all markets were painted only red on Wednesday morning. Luckily there is no panic sell-off, but overall markets are down 1% or more, which is not a pretty picture either.

The leader in this decline is unfortunately Hong Kong, where the local Hang Seng index is losing 1.3% by yesterday's close. Again, the concern here is not so much the magnitude of the drop, but the fact that out of the 76 stocks in that index, only 5 are in the plus today.

The Asian market was also negatively affected by the news that Warren Buffett's company Berkshire Hathaway sold most of its shares in chipmaker Taiwan Semiconductor Manufacturing and increased its stake in Apple.

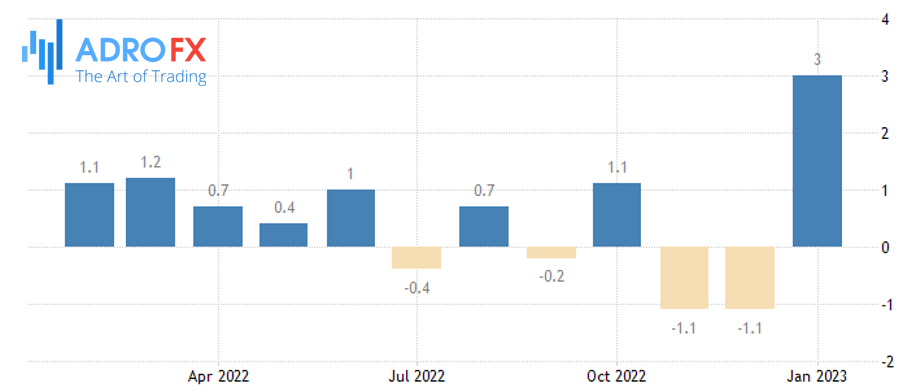

In addition, data from the U.S. Commerce Department showing the nation's highest jump in Retail Sales since March 2021 in January was taken by investors as a signal that strong consumer spending will push up inflation, requiring the Federal Reserve to further tighten policy. Retail Sales rose 3 percent last month relative to December, while experts on average had expected an increase of 1.8 percent.

Analysts agree that the unexpected jump in retail sales supports the view that the Fed will remain very assertive in fighting inflation.

At the same time, the Retail Sales report and strong labor market data released last Friday show that the U.S. economy remains resilient. We see that the economy remains strong and inflation is slowing, although it remains too high, and that the golden mean scenario has defined the market sentiment.

U.S. industrial production in January was unchanged from the previous month, according to a Federal Reserve report released Wednesday. The consensus forecast from experts was for a 0.5% growth.

The Dow Jones Industrial Average was up 38.78 points at market close Wednesday, the Standard & Poor's 500 rose 11.47 points and the Nasdaq Composite added 110.45 points.