A Slowdown in U.S. Inflation Causes a Rally in the Stock Market | Daily Market Analysis

Key events:

UK – GDP (MoM)

UK – GDP (YoY) (Q3)

UK – GDP (QoQ) (Q3)

UK – Manufacturing Production (MoM) (Sep)

UK – Monthly GDP 3M/3M Change

U.S. stock indices rose strongly in the first half of trading Thursday. A positive driver was the inflation data. In addition, the reporting season is nearing its end.

According to the congressional election results, the Republicans are in the majority and this threatens with difficulties to coordinate the bills with the White House – Joe Biden is a Democrat.

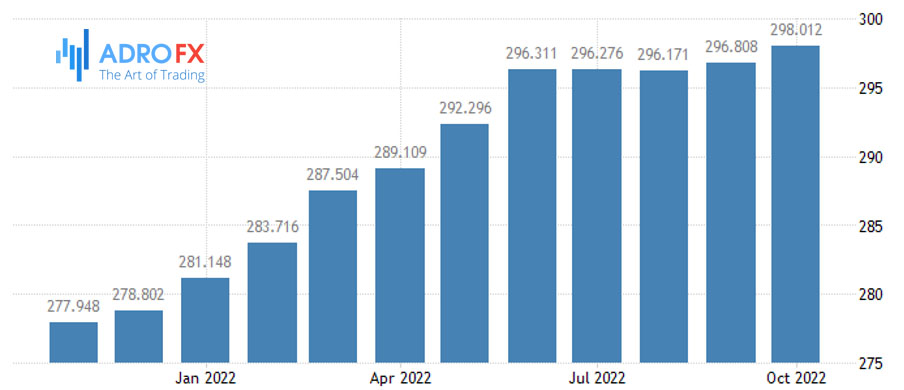

The October consumer inflation statistics were released today before the US trading opened. The CPI, a key indicator of inflation, comes out the very first of the price indicators in the States.

Year-over-year consumer inflation rose 7.7% after 8.2% in September (forecast: 8%). CPI is at a 9-month low. The core index, which excludes volatile food and energy prices, rose 6.3% (forecast: 6.5%).

Notably, according to the report, we are seeing disinflation in goods, but still solid inflation in services. Commodity inflation was a key driver of rising price pressures during the pandemic. However, supply chain bottlenecks have now largely been resolved, and consumer demand has slowed amid, among other things, a cooling real estate market.

Housing costs, however, rose 0.8% in October. True, growth in home rents and equivalent rents (for homeowners) slowed on a month-to-month basis, which is a good sign. But nevertheless, service inflation still looks solid. So for now, we can't agree that the futures market has lowered its expectations for the Fed's peak rate in 2023 so sharply.

The last Fed meeting of the year will be held on December 13-14. According to CME FedWatch, there is an 81% chance that the key rate could be raised by 0.5 p.p. - to 4.25-4.5%. The day before it was 57%.

The news of lower inflationary pressure had a bombshell effect:

▪️ The S&P 500 Index rose 5.5%,

▪️ Dow Jones Industrial Average up 3.7%,

▪️ NASDAQ Composite up 7.4%,

▪️ Russell 2000 up 6.1%,

▪️ U.S. ten-year yields, collapsed by 7.8%,

▪️ the DXY dollar index fell to 108.

The midterm elections are unlikely to be affected by this event, but monetary policy will be.

Thus, Dallas Fed President Laurie Logan, Chicago Fed Chairman Charles Evans, as well as Susan Collins of the Boston Fed, have all said it would be wise to slow the pace of rate hikes. Unless things get worse in the coming weeks, it looks like the "dovish rhetoric" will only intensify.

The Biden team, of course, saw the CPI decline as a result of the earlier economic plan. This probably refers to the $430 billion anti-inflation legislation signed into law in August.

Repeated rate hikes and lower energy prices apparently did not make such a difference.

The inflation target is 2%, so yesterday's market reaction seems excessive. Even if a recession can be avoided, it is highly likely that the economy will continue to slow. That's why Amazon.com, Inc. (NASDAQ: AMZN) is getting rid of its unprofitable business and why Meta Platforms, Inc. (NASDAQ: META) (an extremist organization banned in Russia) is laying off over 11,000 employees.

We believe that the labor market numbers for November will show a rather steep rise in unemployment. That's not a bad thing for the markets, though.