Fed Signals Potential Rate Cuts, Currencies Eye Interest Rate Cut Speculations | Daily Market Analysis

Key events:

- USA - Initial Jobless Claims

- USA - Trade Balance (Feb)

- USA - FOMC Member Mester Speaks

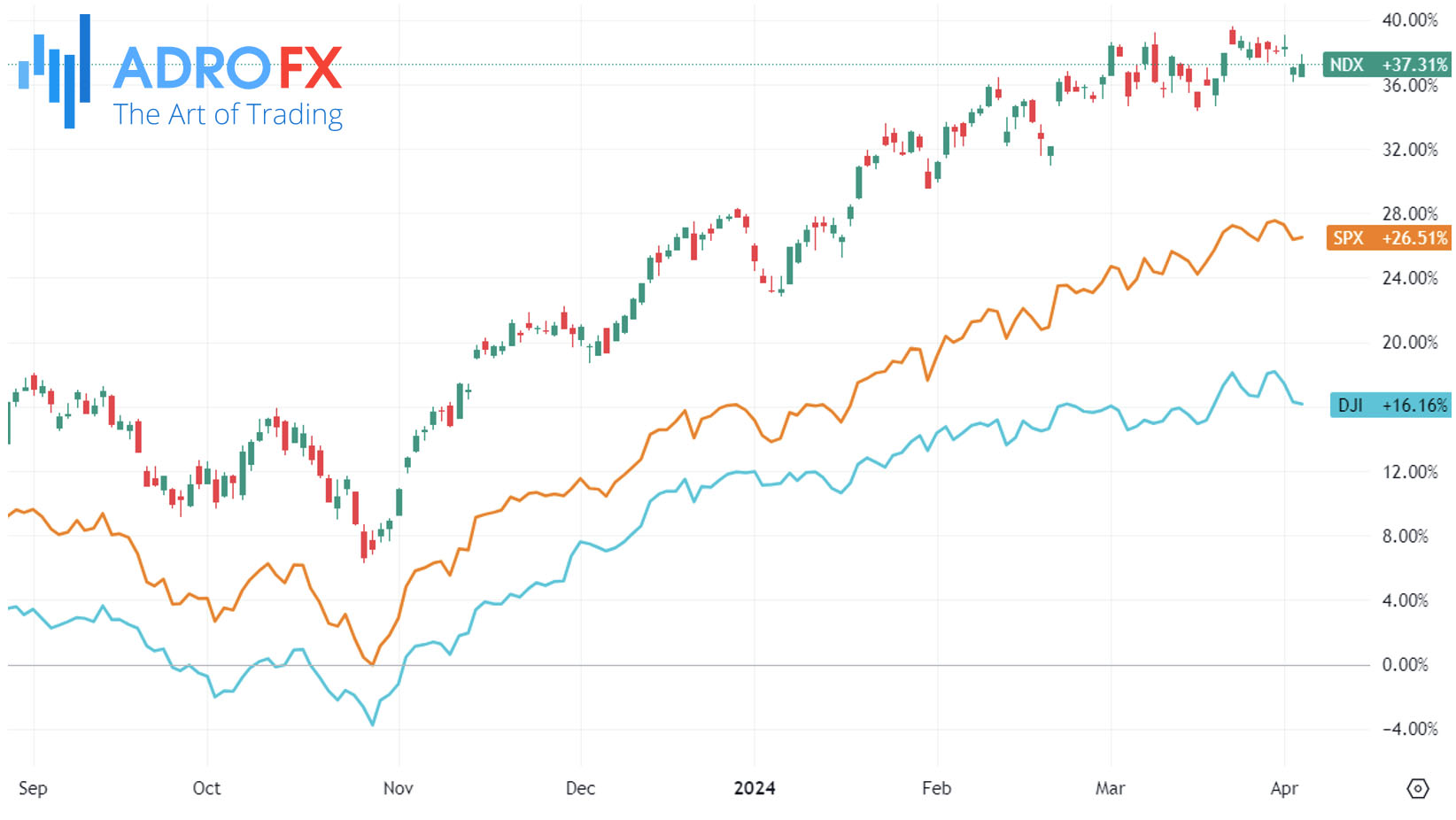

On Wednesday, the S&P 500 managed to secure a modest gain, buoyed by Federal Reserve Chairman Jerome Powell's remarks hinting at potential rate cuts later this year. Powell's comments alleviated concerns among investors who feared a more hawkish stance from the Fed chief in light of the recent robust economic performance.

The S&P 500 edged up by 0.2%, while the Nasdaq Composite also advanced by 0.2%. However, the Dow Jones Industrial Average experienced a slight decline of 43 points, or 0.1%.

Powell noted that a majority of voting Fed participants favor lowering interest rates at some point in the year, contingent upon the central bank gaining greater confidence from incoming data indicating a sustainable downward trajectory in inflation.

Despite recent indicators pointing to strong economic growth and elevated inflation, Powell reiterated the Fed's stance, emphasizing a commitment to solid growth, a resilient labor market, and a gradual decline in inflation toward the 2 percent target.

Meanwhile, Treasury yields retreated slightly from their daily lows. The yield on the 2-year Treasury decreased by 2.7 basis points to 4.674%, while the 10-year Treasury yield dipped by 1.1 basis points to 4.352%.

Powell's remarks followed the release of data revealing stronger-than-expected job additions in the US private sector for March. According to ADP, private sector employment surged by 184,000 jobs last month, marking the largest increase since July and surpassing expectations of 148,000 jobs. Job gains were broad-based across industries, except for professional services.

During the Asian session on Thursday, the NZD/USD pair extended its upward trajectory for the third consecutive day, nearing the 0.6020 mark. The release of seasonally adjusted Building Permits data by Statistics New Zealand revealed a significant improvement, with February witnessing a notable surge of 14.9%, bouncing back from the previous month's decline of 8.6%.

However, the Reserve Bank of New Zealand highlighted concerns about headline inflation persisting outside the desired range of 1 to 3%. Investors are eagerly anticipating the RBNZ's policy meeting scheduled for next week. Additionally, apprehensions loom over the potential economic repercussions of the 7.2 magnitude earthquake that struck Taiwan on Wednesday, particularly concerning the semiconductor supply chain in New Zealand.

Meanwhile, the Japanese Yen edged lower against its American counterpart during the Asian session on Thursday, remaining within striking distance of a multi-decade low touched last week. The Bank of Japan's dovish stance after the March meeting, coupled with a lack of guidance regarding future policy steps or the pace of policy normalization, exerted downward pressure on the safe-haven JPY. This, combined with a generally optimistic sentiment surrounding equity markets, encouraged dip-buying near the 151.55 area for the USD/JPY pair.

Investors are closely monitoring speculations regarding potential intervention by Japanese authorities to prevent a destabilizing depreciation of the domestic currency. This cautious stance might deter JPY bears from aggressive betting and limit further appreciation of the USD/JPY pair.

The Australian Dollar continued its ascent for the third consecutive session following the release of improved Judo Bank PMI data on Thursday. Additionally, upbeat Building Permits (YoY) figures released by the Australian Bureau of Statistics provided further support to the AUD's advance.

On Wednesday, the AUD/USD pair recorded substantial gains as the US Dollar weakened due to declining US Treasury yields.

Meanwhile, the GBP/USD pair hovered around 1.2650 during the Asian session on Thursday. Amid signs of diminishing global inflationary pressures, speculation arises regarding potential interest rate cuts by central banks. BoE Governor Andrew Bailey hinted at a cooling inflation trend, suggesting that the UK economy is moving towards a phase where the central bank could consider interest rate reductions.

Money market futures traders are pricing in a 25 basis point rate cut by the Bank of England in June, with odds currently at 66%. Similarly, traders anticipate a 25-basis point cut by the Federal Reserve in July. The projected rate cut by the BoE in June may exert downward pressure on the British Pound, potentially undermining the GBP/USD pair.