US Stocks Navigate Holiday Trading, Eyes on Economic Indicators, and Global Economic Landscape | Daily Market Analysis

Key events:

- USA - Building Permits

- USA - New Home Sales (Oct)

- Eurozone - ECB President Lagarde Speaks

In Friday's holiday-shortened trading session, US stocks experienced marginal changes with low volume and investor caution, particularly focused on the beginning of the seasonal shopping season for indications of consumer resilience.

The S&P 500 concluded the day with a nominal uptick, while the Dow secured a modest gain. The Nasdaq, however, faced slight downward pressure due to weakness in megacap momentum stocks. Impressively, all three indexes secured their fourth consecutive weekly gains. Specifically, the Dow Jones Industrial Average rose by 117.12 points (0.33%) to 35,390.15, the S&P 500 gained 2.72 points (0.06%) at 4,559.34, and the Nasdaq Composite declined by 15.00 points (0.11%) to 14,250.86.

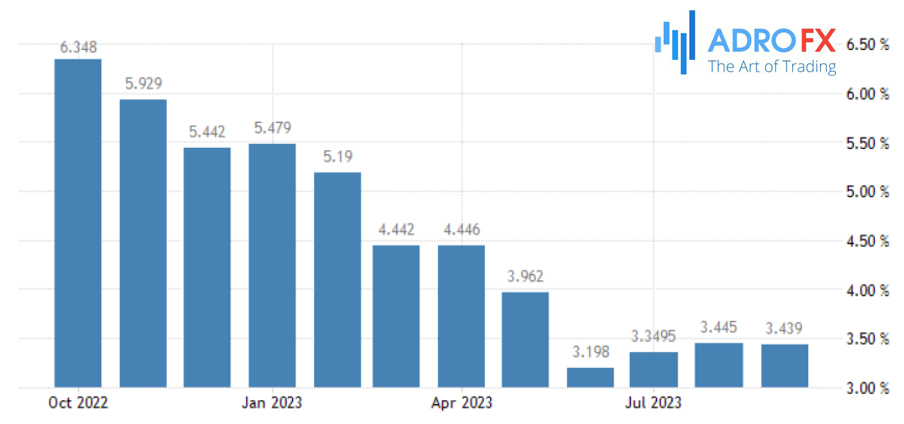

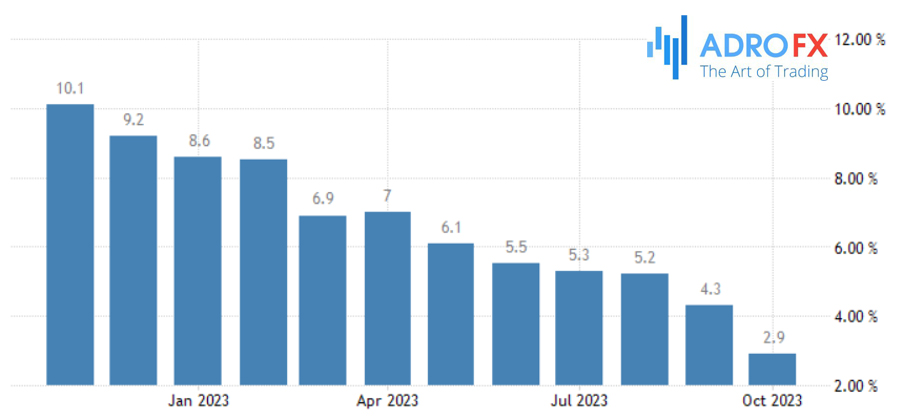

With a focus on economic indicators, the markets, having seen an unchanged reading on consumer price inflation in October, now await another US inflation report scheduled for Thursday. Investors hope this report will reinforce the case for an end to Federal Reserve rate hikes. The anticipated rise of 0.1% in the Fed's preferred inflation gauge, the personal consumption expenditures price index, for November is crucial. In September, the PCE index matched the rise in August, increasing by 0.4%.

Additionally, other key economic data expected during the week includes a consumer confidence index for November on Tuesday, with October showing a third consecutive monthly decline. The week will also witness the first revision of third-quarter GDP, figures on new home sales for October, the weekly report on jobless claims, and the release of the Fed's Beige Book.

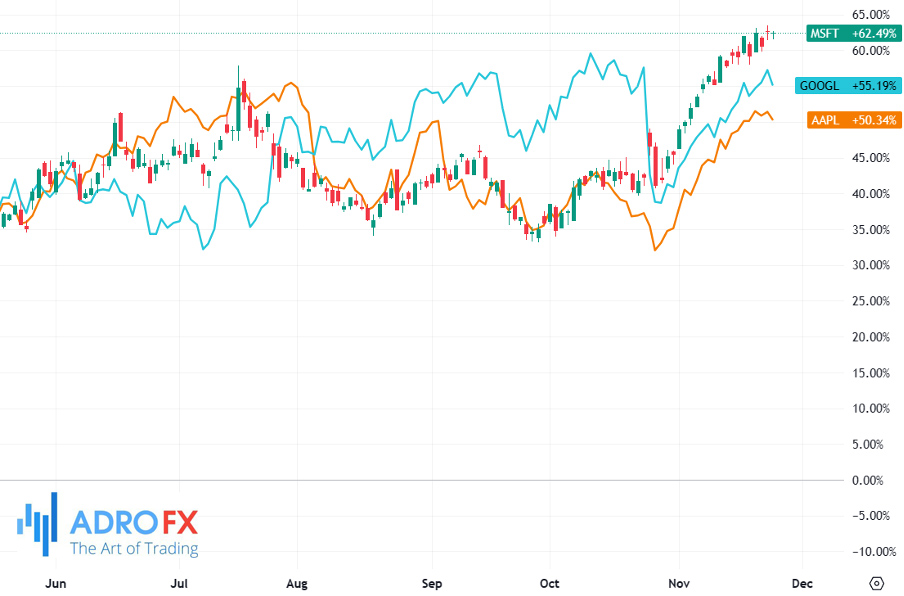

Investor optimism is being fueled by signs that the US stock market rally is broadening beyond the "Magnificent Seven" mega-cap growth and technology companies. This group, comprising Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta (META), and Tesla (TSLA), collectively holds a 28% weight in the S&P 500 index and nearly 50% of the Nasdaq 100's weighting, contributing to its nearly 47% year-to-date gain.

Equities have seen a sharp rise, with the S&P 500 advancing approximately 10% over the last three weeks. This surge is attributed to falling Treasury yields and cooling inflation readings, suggesting a potential end to Federal Reserve rate hikes. However, investors remain watchful, as upcoming inflation and consumer confidence data may influence Treasury yields, potentially triggering a market reaction.

On Thursday, the Eurozone is set to release inflation data, which is expected to indicate a slight moderation in price pressures for November. Consumer price inflation is projected to rise annually by 2.8%, a marginal decrease from the previous month's 2.9%. Underlying inflation is anticipated to ease to 3.9%.

Despite the signs of inflation cooling, European Central Bank President Christine Lagarde has cautioned that borrowing costs will need to remain restrictive for an extended period. The minutes of the ECB's recent policy meeting, disclosed last Thursday, revealed a consensus among officials that they should be prepared to implement rate hikes if necessary.

Notably, inflation is predicted to return to the ECB's target of 2% only in the second half of 2025.

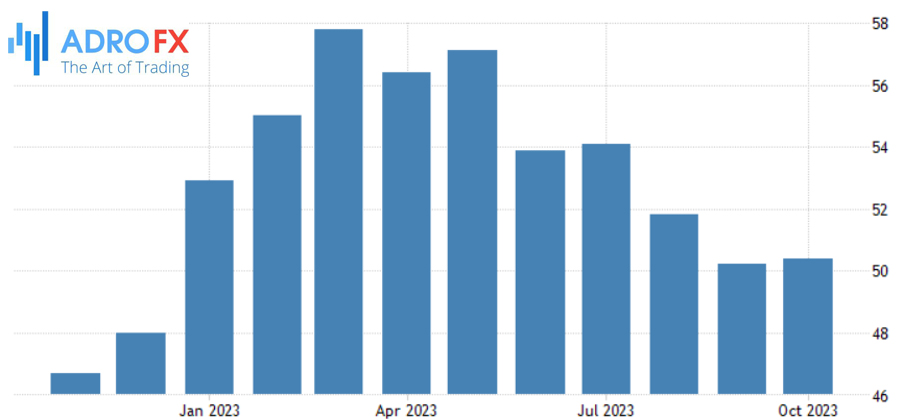

Simultaneously, China is scheduled to release the official purchasing manager indices for November on Thursday. Investors are keenly observing these indicators for any indications of a recovery in the world's second-largest economy. In October, factory activity showed a contraction despite extensive government measures aimed at stabilizing the struggling economy, which has been impacted by weak consumption and a crisis in the country's debt-laden property sector, constituting about a quarter of the gross domestic product.

While China's economy exhibited faster-than-expected growth of 4.9% in the third quarter, Beijing continues to face challenges in achieving its annual growth target of approximately 5%, given the complexities arising from weak consumption and the property sector crisis.