US Stocks Rise on Rate Hike Speculation and Debt Ceiling Relief; Nasdaq Hits 13-Month High, Gold Declines | Daily Market Analysis

Key events:

- UK - Composite PMI (May)

- UK - Services PMI (May)

- USA - Services PMI (May)

- USA - ISM Non-Manufacturing PMI (May)

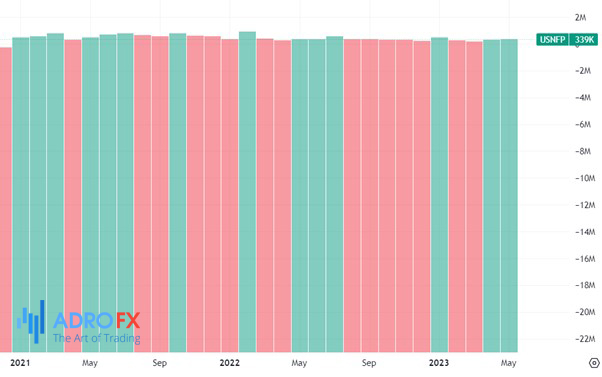

US stocks ended the week on a positive note as investors reacted to several key developments. A labor market report revealing slower wage growth in May suggested that the Federal Reserve might delay a potential interest rate hike in the coming weeks. Additionally, a deal in Washington to avert a disastrous debt default was well-received by market participants.

The Nasdaq index, which is heavily weighted towards technology stocks, reached a 13-month intraday high and extended its winning streak for the sixth consecutive week, representing its strongest stretch since January 2020.

In May, US job growth showed an acceleration, indicating positive momentum. However, there was an uptick in the unemployment rate, reaching a seven-month high of 3.7%. This increase was primarily due to a larger number of individuals actively seeking employment, which suggests a slight easing of labor market conditions, according to the Labor Department.

The rise in the unemployment rate from the historically low level of 3.4% in April was driven by a decrease in household employment and an expansion of the overall workforce. The growth in the labor pool has helped alleviate pressure on businesses to raise wages, contributing to a deceleration in inflationary pressures.

The release of the data provided a sense of relief to investors who anticipate that the Federal Reserve will temporarily halt its rate hikes during its upcoming policy meeting on June 13-14. This pause would mark the first break in the Fed's aggressive anti-inflation policy tightening, which has been ongoing for over a year.

However, there were some observers who highlighted the fact that the jobs data exceeded expectations by a significant margin, suggesting that the Federal Reserve may not have fully contained inflationary pressures yet.

With the Federal Reserve's rate decision approaching in two weeks, market participants are eagerly awaiting data related to key consumer prices. This information will play a crucial role in shaping expectations and influencing the Fed's decision-making process.

On a positive note, the Senate successfully passed a bill on Thursday to raise the government's debt ceiling, averting the potentially catastrophic consequences of a first-ever default. This development alleviated concerns among investors, leading to a decline in the CBOE volatility index, also known as Wall Street's fear gauge. The index dropped by 1.1 points to 14.6 points, reaching its lowest level since November 2021.

Meanwhile, the price of gold is experiencing a decline as a result of the labor market's resilience, which has delayed predictions of an impending recession.

Initially, gold appeared to be on a positive trajectory as a few Federal Reserve officials, known as doves, indicated that a rate hike in June might be skipped. In fact, if the data continued to support this view, some traders even speculated that rate hikes could be entirely off the table. However, the strong performance of the US economy has led to the belief that the risk of further tightening by the Federal Reserve still remains.

The challenge for gold lies in the fact that even when markets become convinced that the Federal Reserve has concluded its tightening cycle, there is still uncertainty regarding the impact of the Treasury replenishing its reserves in the coming months. With a substantial amount of money remaining on the sidelines, investors are likely to continue favoring assets denominated in US dollars. This preference for dollar-denominated assets may hinder the price of gold.

The US Dollar Index (DXY) is maintaining its recovery from the previous day, despite a slow start to the week. The DXY has reached a new intraday high near 104.15, building on its rebound following the release of the Non-Farm Payrolls (NFP) report. The current market sentiment is influenced by a mix of factors and the absence of significant data or events.

The DXY's strength against the six major currencies is also reflecting concerns surrounding US-China relations, which have resurfaced. Additionally, the market is cautiously optimistic in anticipation of the release of the US ISM Services PMI and Factory Orders data.

Overall, the US dollar is displaying resilience and showing upward momentum in its recovery, as market participants closely monitor the unfolding developments and upcoming economic indicators.

On Monday, the US will release the ISM services data for May, and market expectations are that the data will show further expansion in the services sector. This highlights the strong driver of economic activity in the country.

In terms of central banks, the Reserve Bank of Australia (RBA) will take the spotlight early in the week. After pausing in April at a rate of 3.6%, the RBA surprised the markets in May by raising the Official Cash Rate (OCR) by 25 basis points to 3.85%. Currently, there is a near-40.0% probability priced in by the markets for another 25 basis-point increase on Tuesday, which would bring the OCR to 4.1%. This is a significant shift from just over a week ago. Another major central bank in focus this week is the Bank of Canada (BoC). Market expectations lean towards a pause in the Official Overnight Rate (60.0% probability) rather than a 25 basis-point hike (40.0% probability).