How Changes in the Unemployment Rate Influence Global Trade and Markets

How much does the unemployment rate really influence the global markets? With every economic report, traders and investors anxiously watch the numbers, knowing that even a slight shift can ripple across industries and asset classes. As a vital economic indicator, the unemployment rate plays a central role in shaping market trends, impacting everything from stock prices to forex movements.

The unemployment rate is more than just a measure of people out of work; it reflects the overall health of an economy. High unemployment signals economic challenges, while low unemployment indicates growth and stability. For traders, understanding how the unemployment rate affects markets can provide essential insights for forecasting market direction and refining trading strategies. In this article, we’ll explore how this key indicator drives market movements, helping traders to anticipate shifts and adjust their positions accordingly.

What is the Unemployment Rate?

The unemployment rate is a fundamental economic indicator used to gauge the health of a nation's labor market. It represents the percentage of people who are actively looking for work but are unable to find employment. Typically, it’s calculated by dividing the number of unemployed individuals by the total workforce and then multiplying the result by 100 to get a percentage.

For example, if a country has a workforce of 50 million people and 5 million are unemployed, the unemployment rate would be 10%. This figure helps analysts and policymakers assess the efficiency of the labor market, indicating whether jobs are being created or lost.

As a leading economic indicator, the unemployment rate provides critical insights into the overall strength of an economy. A rising jobless rate often signals economic downturns or recessions, prompting central banks to consider monetary policy adjustments, such as cutting interest rates to stimulate growth. Conversely, a declining unemployment rate suggests economic expansion, which can lead to rising inflation and potential interest rate hikes. For traders, these trends are vital for predicting market behavior and making informed decisions.

Also read: Boost Your Forex Trading Success with Economic Calendars

Why Does the Unemployment Rate Matter to Traders?

The unemployment rate is more than just a number for economists; it is a critical indicator that traders rely on to gauge the overall health of an economy. When unemployment is high, it suggests that businesses are struggling, consumers are spending less, and economic growth is slowing. On the other hand, low unemployment generally signals a thriving economy where companies are hiring, and consumer spending is on the rise. This direct relationship between unemployment and economic performance is essential for traders, as it helps predict how various markets will react.

For instance, a rising jobless rate often leads to falling stock markets as investor confidence wanes. Companies may report lower earnings, reduce their workforce, and cut spending, all of which can negatively affect stock prices. Similarly, forex markets are influenced by the unemployment rate. A country with rising unemployment might see its currency weaken as economic growth stalls. On the other hand, lower unemployment can boost a currency's value as it reflects stronger economic prospects. Commodity markets like oil or precious metals are also sensitive to unemployment data, with high jobless numbers often reducing demand and driving prices down. For traders, tracking the unemployment rate provides key insights for understanding shifts in market performance.

The Impact of Rising and Falling Unemployment Rates on Markets

A rising unemployment rate can have a broad, negative effect on multiple markets. In the stock market, increased unemployment often signals weaker corporate earnings, reduced consumer spending, and a potential slowdown in economic growth. As companies struggle to maintain profitability, stock prices tend to drop, particularly in sectors that are sensitive to consumer spending, such as retail, travel, and leisure. Additionally, a rise in unemployment generally causes a flight to safer assets, with investors moving their capital to safe havens like government bonds or gold, further pressuring stock prices.

In the forex markets, a rising unemployment rate can lead to a decline in the value of a nation’s currency. Countries with high unemployment typically experience slower economic growth, which diminishes investor confidence and prompts currency devaluation. For instance, if the US sees an increase in unemployment, the US dollar may weaken against other major currencies like the euro or yen.

Conversely, a falling unemployment rate usually has a positive impact on markets. A decrease in the jobless rate tends to boost investor confidence, as it indicates that businesses are hiring, consumer spending is rising, and the overall economy is improving. Stock markets often benefit, with sectors like construction, manufacturing, and services seeing particular gains. In the forex markets, a lower unemployment rate often leads to a stronger currency, as investors view the country’s economy as more stable and investable. Traders also see commodities like oil rise in value when unemployment drops, as increased demand for goods and services typically pushes commodity prices higher.

How Unemployment Affects Different Asset Classes

The unemployment rate directly influences various asset classes, including stocks, forex, and commodities. When unemployment rises, the negative impact on these markets can be substantial, as traders reassess the strength of the economy.

- Stocks

Different sectors react differently to shifts in the unemployment rate. For example, the retail and manufacturing sectors are particularly vulnerable to rising unemployment. When fewer people have jobs, there is less disposable income to spend on consumer goods, which hurts retail companies' revenues. Likewise, manufacturers may see a decline in demand for products as businesses scale back their operations. On the other hand, sectors like healthcare and utilities, which provide essential services, tend to be more resilient during periods of high unemployment.

- Forex

The release of unemployment data can cause significant movements in currency pairs like the USD, EUR, and GBP. If a country's unemployment rate is higher than expected, its currency may weaken as traders anticipate lower economic output and reduced consumer spending. For instance, if the US unemployment rate spikes, the US dollar may fall against other currencies such as the euro or yen, as it reflects economic instability. Conversely, when unemployment rates decline, a country’s currency typically strengthens, as it signals economic growth and attracts investors.

- Commodities

There is a strong correlation between employment trends and the demand for commodities. Rising unemployment usually means reduced demand for commodities like oil and metals, as both consumers and businesses cut back on spending. Lower demand for oil, for example, is common during economic slowdowns, which drives down prices. Metals such as copper, which are heavily used in construction and manufacturing, also tend to experience price drops when unemployment rises and economic activity declines.

Unemployment Rate and Central Bank Policies

Central banks closely monitor the unemployment rate as a key indicator when shaping their monetary policy. A higher unemployment rate often signals economic weakness, prompting central banks to adjust their policies in an effort to stimulate growth.

- Monetary Policy

Central banks like the Federal Reserve or the European Central Bank use unemployment data to decide on interest rate adjustments. If unemployment is high, central banks may lower interest rates to encourage borrowing and investment, thereby stimulating economic growth and job creation. On the other hand, if unemployment is low and the economy is overheating, central banks may raise interest rates to cool inflationary pressures and prevent the economy from becoming too reliant on easy credit.

- Impact on Markets

These interest rate decisions have a direct impact on markets such as forex and bonds. For instance, when central banks cut interest rates to combat rising unemployment, currencies often weaken as investors seek higher returns elsewhere. A lower interest rate environment can also push bond prices higher, as the yields on new bonds become less attractive compared to existing ones. In contrast, an improving unemployment rate might lead central banks to raise rates, which can strengthen the currency and depress bond prices. Understanding this dynamic helps traders navigate market movements based on shifts in central bank policies related to unemployment rates.

Also read: The Federal Reserve and Economic Equilibrium: A Comprehensive Analysis

Trading Strategies Based on Unemployment Data

Savvy traders often capitalize on unemployment data to inform their trading strategies, as shifts in the unemployment rate can lead to significant market movements. By understanding the potential effects on various asset classes, traders can develop tailored strategies.

- Forex Trading Strategies

For forex traders, unemployment data can be a major market-moving event. When a country’s unemployment rate increases unexpectedly, its currency may depreciate as economic growth prospects dim. Traders can position themselves by selling currency pairs that involve the weakening currency, such as shorting the USD if US Nonfarm Payrolls data comes in worse than expected. Alternatively, if unemployment falls, indicating a stronger economy, traders might take long positions on currency pairs involving that country’s currency.

- Stock Market Strategies

Certain stock market sectors are highly sensitive to unemployment data, particularly those that rely on consumer spending and business investment. For instance, sectors like retail, automotive, and consumer goods tend to perform poorly when unemployment rises, as reduced disposable income affects consumer behavior. Traders can focus on shorting stocks in these sectors during periods of high unemployment. On the flip side, defensive stocks like utilities and healthcare may perform better as they provide essential services, regardless of employment conditions.

- Commodities Trading Strategies

When unemployment signals a broader economic slowdown, demand for key commodities like oil and industrial metals often declines. Traders can employ a bearish commodities strategy, selling or shorting commodities that are sensitive to economic activity. For instance, if unemployment spikes, oil prices may drop due to reduced industrial activity, making it a prime time for short positions. Conversely, when unemployment rates fall, traders may anticipate an increase in demand for these commodities, driving up prices and providing opportunities for long positions.

Key Dates for Monitoring Unemployment Data

For traders, knowing the key dates when unemployment data is released can provide a significant advantage. Major unemployment announcements often trigger strong market reactions, and traders can position themselves accordingly by monitoring these dates on their economic calendar.

- US Nonfarm Payrolls

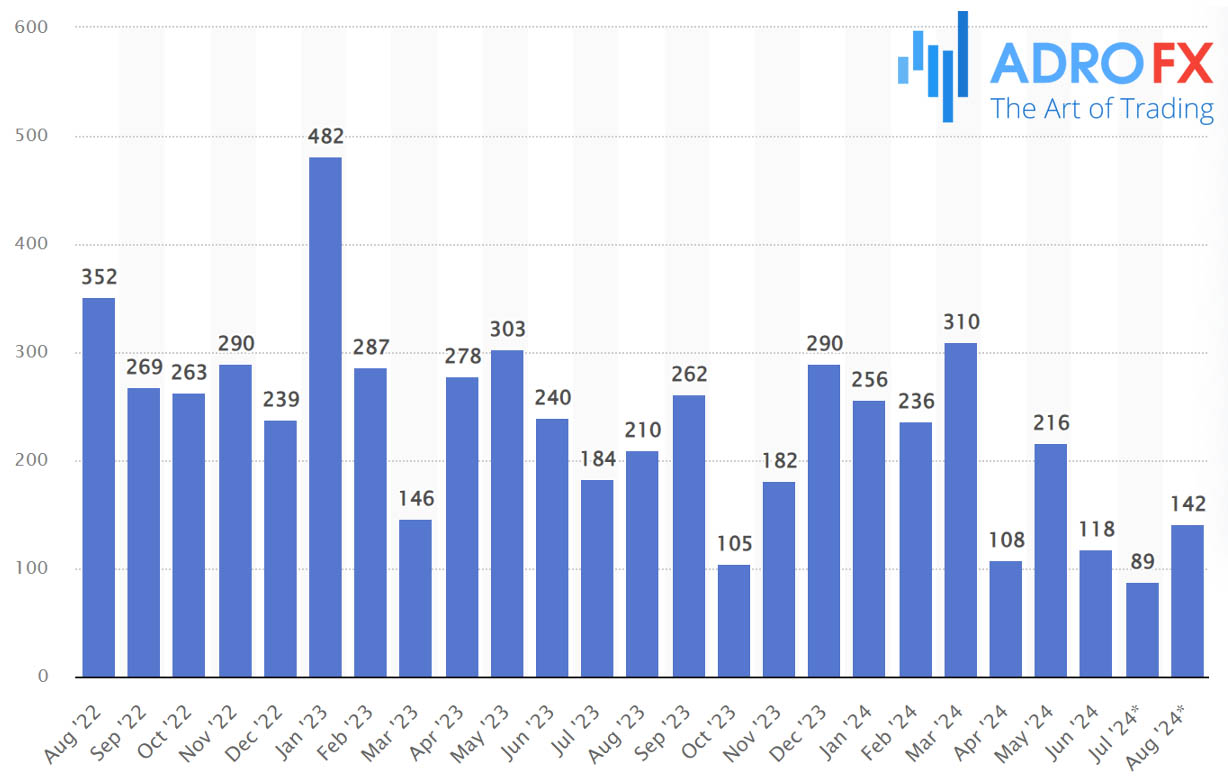

The most closely watched unemployment data release is the US Nonfarm Payrolls (NFP) report, published on the first Friday of every month. This report provides insight into the number of jobs added or lost in the US economy, excluding the farming sector.

As the US economy is one of the world’s largest, the NFP report often influences global currency pairs like EUR/USD or GBP/USD, and stock indices such as the S&P 500.

- Global Unemployment Data

Other major countries and regions also publish their unemployment data, including the Eurozone, the United Kingdom, Canada, and Australia. These data points are typically released monthly or quarterly. For example, the UK's unemployment rate is usually published mid-month by the Office for National Statistics, while Australia’s unemployment report comes out during the second week of each month. Monitoring these dates on the economic calendar helps traders anticipate market movements in forex pairs, stocks, and commodities that are closely tied to these economies.

Tracking these critical unemployment rate release dates allows traders to stay ahead of market reactions, providing the opportunity to adjust their positions based on the latest employment trends.

Also read: Top Trading Picks 2024: Navigating the Best Financial Markets for Success

Impact of the September 2024 US Unemployment Data on EUR/USD Movements

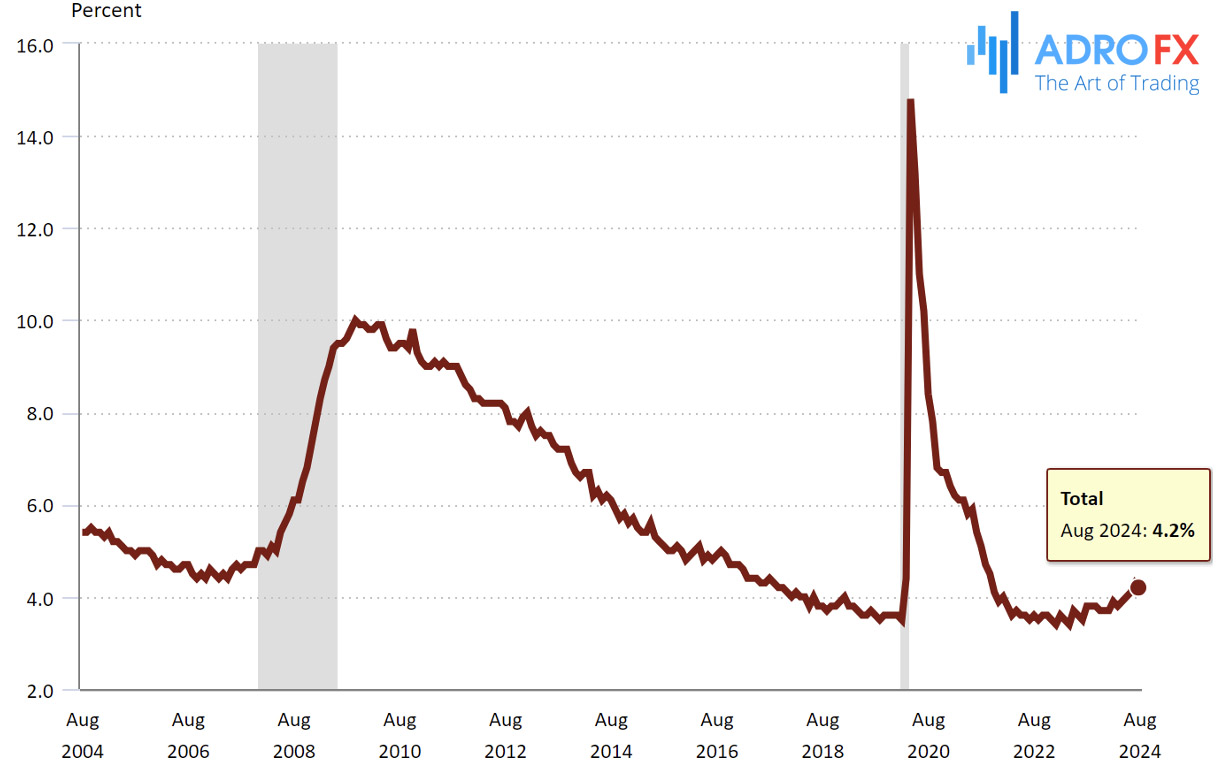

The US unemployment rate for August 2024, released on September 6, came in at 4.2%, which matched the forecast and slightly improved from the previous month’s figure of 4.3%. This stable unemployment rate suggests that the US labor market has not faced any significant deterioration or improvement beyond expectations, providing a relatively steady economic backdrop.

Looking at the EUR/USD daily chart in the context of the unemployment release, the following observations can be made:

Prior Trend

The chart indicates that EUR/USD had been in a general upward trend from mid-July, after a period of consolidation in June. The rise in the Euro against the US dollar could have been driven by various factors, including market sentiment regarding the US economy and expectations of monetary policy decisions.

Immediate Reaction

On September 6, 2024, the day of the unemployment data release, the EUR/USD showed minimal volatility in response to the news. The pair moved within a tight range, reflecting that the unemployment data, being in line with expectations, did not significantly alter market sentiment. There was no immediate breakout or breakdown following the release.

Consolidation Phase

Leading up to the release, EUR/USD had entered a brief consolidation phase, and the unemployment figures did little to break this sideways movement. This suggests that traders were likely waiting for more significant data or events to drive stronger directional moves.

Future Outlook

The relatively neutral response of the market could imply that traders are more focused on upcoming Federal Reserve decisions, inflation data, or other economic indicators that may have a more direct impact on expectations for interest rates. As the Federal Reserve often considers labor market strength when making decisions, the stable unemployment figure might support a more measured approach to monetary tightening.

The August 2024 unemployment rate of 4.2% had a muted effect on EUR/USD, with the pair remaining in a consolidation phase after an earlier rally. Market participants likely viewed the data as non-disruptive to the broader trend and are awaiting more influential events or data releases for clearer trading signals.

Conclusion

Understanding the unemployment rate is crucial for traders looking to refine their market analysis and strategies. This economic indicator provides valuable insight into the health of an economy, directly influencing market trends in stocks, forex, and commodities. A rise in unemployment often signals economic downturns, prompting traders to adjust their positions and consider safer assets, while a decline typically indicates economic expansion, offering opportunities for gains.

For traders, monitoring unemployment trends is not just a matter of tracking data; it is about interpreting these shifts to make informed decisions. Integrating unemployment rate analysis into your trading strategy can help forecast market movements, manage risks, and improve long-term profitability.

To stay ahead in trading, it's crucial to integrate unemployment trends into your strategy. Sign up with AdroFx today and discover how tracking this vital economic indicator can help you anticipate market shifts and improve your trading decisions.

FAQs

Q1: How does the unemployment rate affect forex trading?

The unemployment rate has a significant impact on forex trading. A rise in unemployment suggests a weaker economy, often leading to a depreciation in the country’s currency as investors lose confidence. Conversely, a drop in unemployment indicates economic strength, which can strengthen the currency as traders become more confident in that market.

Q2: Why do traders care about unemployment data?

Traders care about unemployment data because it provides a snapshot of the economic health of a country. High unemployment can signal economic trouble, reducing business activity and consumer spending, which often leads to falling stock prices and currency depreciation. By contrast, low unemployment suggests a strong economy, which tends to boost market confidence and asset prices.

Q3: What is the relationship between the unemployment rate and stock markets?

The unemployment rate and stock markets are closely linked. High unemployment usually means reduced corporate earnings and lower consumer demand, leading to declining stock prices, especially in sectors like retail and manufacturing. On the other hand, low unemployment indicates growth, which often boosts stock prices as businesses benefit from higher consumer spending and stronger economic activity.

Q4: How often is unemployment data released, and why is it important for traders?

Unemployment data is typically released monthly, with key reports such as the US Nonfarm Payrolls being highly anticipated by traders worldwide. These reports provide critical updates on labor market conditions, helping traders anticipate economic trends and adjust their positions accordingly in forex, stock, and commodity markets.

Q5: Can unemployment data predict central bank actions?

Yes, central banks often adjust their monetary policies based on unemployment trends. Rising unemployment may prompt central banks to lower interest rates to stimulate economic activity, while falling unemployment could lead to interest rate hikes to prevent inflation. These monetary policy shifts can have a profound effect on market performance, particularly in forex and bond markets.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.