S&P 500 Starts Second Quarter Cautiously Amid Surge in Treasury Yields while Tech Giants See Gains | Daily Market Analysis

Key events:

- USA - JOLTs Job Openings (Feb)

- USA - FOMC Member Bowman Speaks

- USA - FOMC Member Williams Speaks

- USA - FOMC Member Mester Speaks

- USA - FOMC Member Daly Speaks

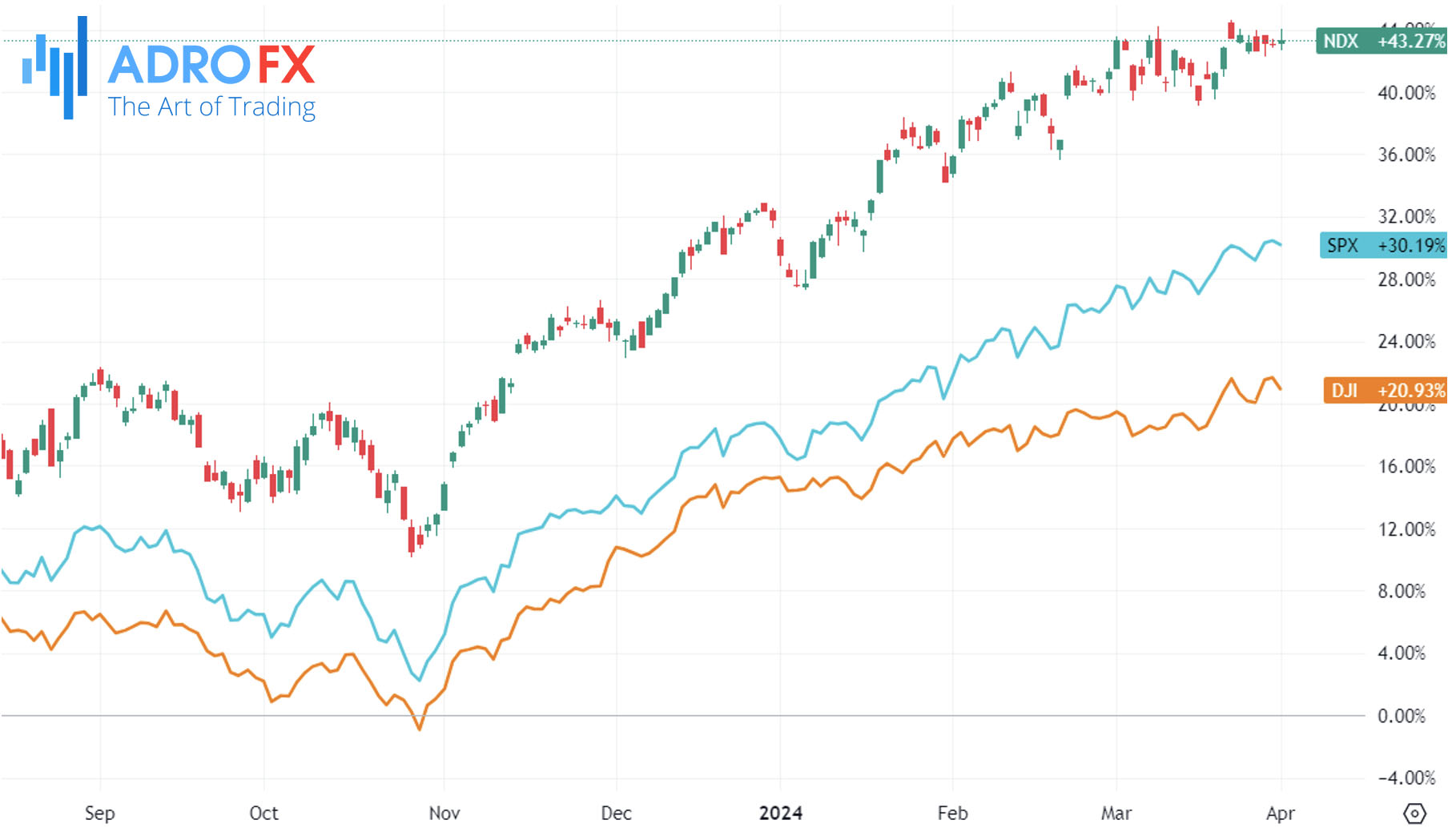

The second quarter kicked off with a hesitant start for the S&P 500 on Monday, as soaring Treasury yields tempered bullish sentiment following a surprising uptick in manufacturing activity, highlighting the robustness of the economy and dampening expectations for imminent Federal Reserve rate cuts.

The S&P 500 experienced a 0.3% decline, while the NASDAQ Composite saw a modest gain of 0.1%, and the Dow Jones Industrial Average dipped by 240 points, equivalent to 0.6%.

The yield on the 2-year Treasury, which reacts to Fed policy shifts, surged by 9 basis points to 4.712% following an unexpected rise in the ISM manufacturing purchasing managers' Index to 50.3 from 47.8. This marked the first expansion in manufacturing activity, indicated by a reading above 50, since September 2022.

The component of the index gauging inflation, known as the prices paid component, climbed to 55.8 from 52.5, signaling the swiftest increase in raw material prices since July 2022, according to Oxford Economics.

This data corroborated Fed Chairman Powell's recent remarks, made on Friday, suggesting that there is no urgency for rate cuts amidst indications of a robust economy.

Powell stated at a San Francisco Fed event, "We don’t need to be in a hurry to cut. The fact that the US economy is growing at such a solid pace, the fact that the labor market is still very, very strong, gives us the chance to just be a little more confident about inflation coming down before we take the important step of cutting rates."

Meanwhile, Microsoft (NASDAQ: MSFT) saw a nearly 1% increase as the tech giant announced plans to offer its chat and video app, Teams, as a standalone product globally, separate from its Office suite, as reported by Reuters on Monday. This move follows a similar initiative undertaken in Europe six months ago in response to regulatory scrutiny over product bundling practices.

Alphabet Inc. Class A (NASDAQ: GOOGL) closed 3% higher after Jefferies expressed optimism about the stock, anticipating that the company will address various investor concerns, including the "AI threat" to its advertising business and its cloud revenue lagging behind rival Amazon (NASDAQ: AMZN)'s AWS.

Additionally, Alphabet's Google agreed to revise its disclosures concerning private browsing data, settling a portion of a lawsuit alleging unauthorized data collection from users.

For the second consecutive day on Tuesday, the USD/CAD pair attracted some buyers, seeking to extend the rebound from the 1.3515 region, marking a one-week low. Currently trading around the 1.3580 area, spot prices are underpinned by continued US Dollar buying momentum. However, bullish Crude Oil prices may act as a limiting factor on further gains.

The USD Index, tracking the USD against a basket of currencies, has climbed to its highest level since February 14. Doubts surrounding the possibility of the Federal Reserve implementing three interest rate cuts this year have led investors to reduce their expectations for a June rate cut. This sentiment shift follows upbeat US data indicating growth in the manufacturing sector in March, the first time since September 2022. Elevated US Treasury bond yields, supported by this data, provide tailwinds for the USD/CAD pair.

Furthermore, the risk-off sentiment in the market favors the safe-haven USD. Despite this, Crude Oil prices remain near a five-month high amid signs of increased demand and potential geopolitical tensions in the Middle East. This supports the commodity-linked Canadian Dollar, potentially restraining bullish sentiment towards the USD/CAD pair. From a technical standpoint, repeated failures to breach the 1.3600 mark suggest a cautious approach.

In contrast, the Australian Dollar has rebounded from previous losses, gaining ground on Tuesday. The USD's strength, driven by surging US Treasury bond yields following positive ISM Manufacturing PMI data, created headwinds for the AUD/USD pair. Minutes from the Reserve Bank of Australia's March meeting revealed no inclination towards raising interest rates. The RBA is anticipated to maintain the current cash rate until at least November, given higher inflation rates relative to other countries and a tight job market.

Meanwhile, the Japanese Yen struggles to capitalize on a slight uptick during the Asian session against the USD, remaining near a multi-decade low reached last week. The Bank of Japan's stance, committing to maintaining easy monetary policy, undermines the JPY. Additionally, Japanese government officials continue verbal interventions to support the domestic currency. Despite this, the USD/JPY pair attracts dip-buying near the mid-151.00s on Tuesday, aided by ongoing USD strength.

Looking ahead, market participants await US economic data releases, including JOLTS Job Openings and Factory Orders, during the early North American session. Speeches by influential FOMC members, movements in US bond yields, and broader risk sentiment will likely dictate USD demand.