Powell's Speech To Hint At the Fed's Position on the U.S. Economy | Daily Market Analysis

Key events:

- Australia - Retail Sales (MoM)

- Australia - RBA Interest Rate Decision (Mar)

- Australia - RBA Rate Statement

- China - Exports (YoY) (Feb)

- China - Imports (YoY) (Feb)

- China - Trade Balance (USD) (Feb)

- USA - Fed Chair Powell Testifies

- USA - EIA Short-Term Energy Outlook

Yesterday, the France CAC40 reached a new record high of 7,401, while the FTSE100 lagged behind due to disappointment surrounding China's GDP target for 2023. This led to a downturn in the mining sector as China's modest target of 5% for 2023 GDP suggested weaker demand for commodities. It seems the Chinese government is adopting a more conservative approach, focusing on stability and avoiding the financial instability of recent years.

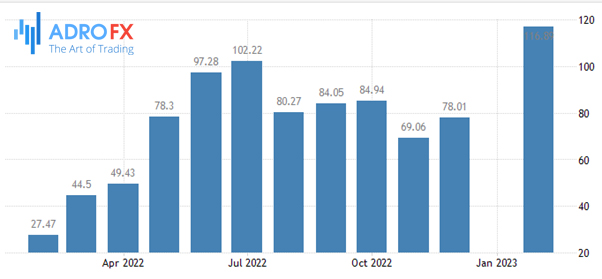

Today's China trade numbers for February showed improvement following the impact of lockdowns and restrictions in the last two months of 2022. In Q4, the Chinese economy stagnated with 0% growth, resulting in annual GDP growth of 3%. Today's trade numbers for January and February give insight into the pent-up demand released by the relaxation of lockdown restrictions, but also consider the stronger comparatives of a year ago before the Omicron wave.

Exports decreased by -6.8%, which was slightly better than expected, while imports decreased by -10.2%, which was more than expected. The Reserve Bank of Australia raised rates by 0.25% to 3.6% as expected, while the Australian dollar slipped slightly back.

The European Central Bank's top official signaled that there will be many more interest rate hikes after an expected 50 basis point increase at next week's ECB meeting.

Philip Lane, the bank's chief economist, warned that underlying price pressures remain strong and that shocks from the pandemic and the war in Ukraine are only gradually subsiding. Lane, one of the most dovish members of the ECB's governing council, made his comments less than a week after data showed core inflation accelerating to an annualized rate of 5.6 percent in February, nearly three times the ECB's target of 2 percent.

In 2021, Lane was the first to argue that the surge in inflation was likely to be temporary.

Tesla has lowered prices again, less than two months after the last round of discounts. The electric car maker cut the starting price of its Model S and Model X by $5,000 and $10,000, respectively, in the latest sign that customers can't accept high prices in an increasingly constrained economy.

The company got some respite on prices thanks to a sharp drop in lithium prices in recent weeks, which promises to lower the cost of batteries for electric cars in the coming months. Lithium carbonate prices in China have fallen 40 percent from their November highs and hit their lowest level in 14 months last week.

Today, the focus will be on the testimony of Fed chairman Jay Powell to US lawmakers, with questions likely to center on the resilience of the US economy. The U.S. equity markets have recovered to the same levels as the February Fed meeting, but bond yields are much higher, suggesting a disconnect between inflation pricing in bond markets and equity markets. The euro outperformed yesterday, with more ECB policymakers suggesting the prospect of further multiple 50bps rate hikes beyond next week's expected hike.