Dow Soars on Weak Jobs Report, Gold and RBA Rate Hike Expectations | Daily Market Analysis

Key events:

- Canada - Ivey PMI (Oct)

- UK - BoE MPC Member Pill Speaks

The Dow concluded the week on a high note, achieving its most substantial weekly gain of the year, largely driven by a weaker-than-expected jobs report that fueled optimism about the Federal Reserve's rate hike intentions, causing Treasury yields to plummet.

The Dow Jones Industrial Average saw a 222-point or 0.7% increase, while the S&P 500 experienced a 0.9% rise, and the NASDAQ Composite surged by 1.4%.

The Dow, often regarded as the blue-chip index, finished the week with a remarkable 5.1% gain, marking its most impressive performance since October 2022. The broader S&P index posted a strong 5.9% gain for the week, and the technology-focused NASDAQ outperformed with a robust 6.6% increase.

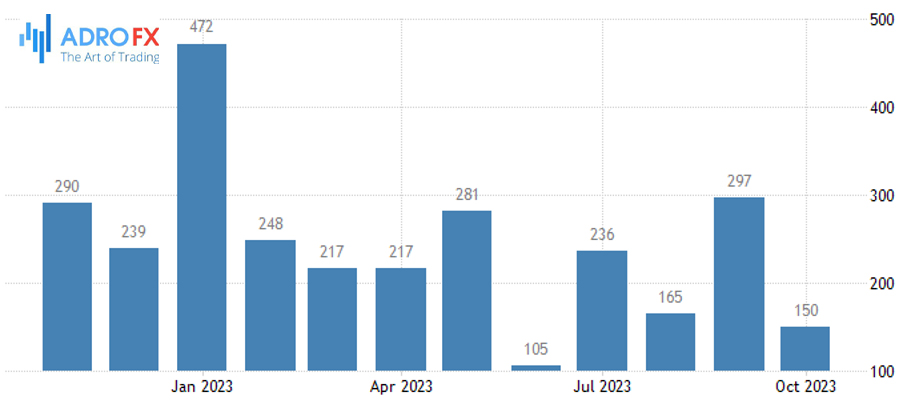

The economic landscape in October saw the addition of 150,000 jobs, which fell short of the anticipated 180,000 and was notably lower than the 336,000 jobs added in September. Concurrently, the unemployment rate inched higher from 3.8% to 3.9%, and average hourly earnings showed a modest 0.2% increase, below market expectations.

The underwhelming job creation figures for October and the easing of wage pressures have instilled investor confidence that the Federal Reserve is unlikely to implement another rate hike this year. In response, Treasury yields saw a considerable decline, with the 2-year Treasury note's yield dropping by 14 basis points to 4.837%, and the 10-year Treasury yield slipping by 11 basis points to 4.559%.

Apple Inc. (NASDAQ: AAPL) managed to pare down most of its losses by closing the day with a 0.5% decline. The tech giant had earlier announced a less optimistic sales forecast for the upcoming crucial holiday quarter, attributing the weaker demand for iPads and wearables, particularly in the crucial Chinese market. The company also noted that its December quarter revenue is expected to be in line with the corresponding timeframe from the previous year, albeit one week shorter.

Gold displayed some strength last week, benefiting from weaker-than-expected US nonfarm payrolls data and less hawkish signals from the Federal Reserve. These factors led to significant declines in the US dollar and Treasury yields. However, the upward potential for gold was limited as many traders shifted their focus towards risk-driven assets like stocks and currencies. Additionally, the safe-haven demand for gold diminished due to a decrease in the risk premium associated with the Israel-Hamas conflict, even though the conflict had not shown significant signs of de-escalation.

Israel rejected calls for a ceasefire, and there were media reports indicating that the Russian mercenary group Wagner was planning to provide air defense systems to Hezbollah. While concerns over the conflict had driven substantial gains in gold throughout October, it became apparent that the conflict was unlikely to spread to the broader Middle East region. As a result, many traders chose to lock in their profits on the yellow metal.

The Reserve Bank of Australia (RBA) is widely expected to raise interest rates during its upcoming meeting, following signs of inflation resurgence and some hawkish comments from central bank officials. The RBA is anticipated to increase its target cash rate by 25 basis points to 4.35%, with several analysts adjusting their expectations due to stronger-than-expected third-quarter inflation data released in October. Australian banks such as ANZ and Westpac moved up their forecasts for a rate hike from December to November, while UBS and ING also expect a rate increase at the RBA's November 7 meeting.

In response to these expectations, the Australian dollar rose 0.1% to a two-month high on Monday.

Looking ahead, Australian economic growth is anticipated to cool off in the coming months, influenced by high interest rates and persistent inflation. This situation has made the RBA somewhat cautious about implementing further rate hikes, as the central bank aims to strike a balance between combating inflation and promoting economic growth.

The economic data calendar in the United States for this week is relatively light, offering a welcome respite after a busy schedule in the previous week. Nonetheless, the focus remains on Treasury yields. Two weeks ago, 10-year US yields briefly exceeded the 5% mark for the first time since the Lehman Brothers crisis. Currently, they have retraced and are trading below 4.60%. This reversal can be attributed to a series of events that favored the bond markets, starting with the November refunding announcement and culminating in a softer-than-expected payroll report, which contributed to a bond market rally.