Dow Jones' Streak in Jeopardy as Tech Soars and Currency Dynamics Unfold | Daily Market Analysis

Key events:

- USA - Average Hourly Earnings (MoM) (Nov)

- USA - Nonfarm Payrolls (Nov)

- USA - Unemployment Rate (Nov)

- USA - Michigan Consumer Sentiment

The Dow Jones Industrial Average appears poised to conclude its five-week streak of gains, as the index experienced a decline over the initial three sessions of the week. Despite a modest 0.2% uptick on Thursday, confidence in the DJIA's upward momentum remains tentative.

In contrast, the S&P 500 and NASDAQ Composite have demonstrated resilience, recording gains of 0.8% and 1.3%, respectively, as of the current writing. The stock market's positive performance is attributed to favorable US Jobless Claims data, revealing fewer-than-expected job losses. Additionally, the decline in US Treasury yields, a trend typically supportive of stock prices, has contributed to the overall market buoyancy.

Alphabet Inc Class A (NASDAQ: GOOGL) experienced a notable surge of over 5%, propelled by the introduction of its latest AI model, Gemini. This advanced multi-model AI system exhibits proficiency in comprehending audio, photos, and videos, positioning Alphabet to compete fiercely against rivals such as OpenAI, Microsoft (NASDAQ: MSFT), and Meta (NASDAQ: META).

Chip stocks played a pivotal role in supporting the broader tech sector, registering an impressive nearly 3% gain, driven by a substantial upswing in Advanced Micro Devices.

On the currency front, the US Dollar encountered headwinds from the Japanese Yen following indications from Bank of Japan's (BoJ) Chairman Kazuo Ueda hinting at an imminent change in monetary policy.

While the BoJ has maintained negative rates for an extended period, signs suggest an impending shift. Consequently, the Japanese Yen strengthened by over 1.25% against the Greenback, contributing to the US Dollar Index slipping into negative territory and ending the week's winning streak.

Conversely, the Canadian Dollar witnessed a retracement of recent gains, displaying weakness or stabilization against major currency counterparts. It demonstrated a marginal 0.5% gain against the Swiss Franc, marking Thursday's most substantial decline among major currencies.

The Bank of Canada (BoC) opted to maintain interest rates during its December meeting while leaving room for potential future hikes. The central bank highlighted signs of moderation in monetary policy's impact on spending and inflationary pressures, affirming the decision to hold the policy rate at 5% and continue the process of normalizing the bank's balance sheet. The BoC remains vigilant about potential risks to the inflation outlook and stands prepared to implement further policy rate hikes if deemed necessary.

Additionally, the recovery in oil prices presents a potential boost for the commodity-linked Canadian Dollar, given Canada's position as a leading oil exporter to the United States.

The imminent focus of the market centers around the release of crucial economic indicators, particularly the November Nonfarm Payrolls data, Unemployment Rate, and Average Hourly Earnings reports, all scheduled for Friday.

Dow Jones News reported a slight increase in US Initial Jobless Claims for the week ending December 1, standing at 220K. While this marked a marginal uptick from the previous week's 219K, it remained below the anticipated 220K forecast. Concurrently, Continuing Jobless Claims witnessed a significant decline from 1.925 million to 1.861 million, surpassing the consensus estimate of 1.91 million. These reports collectively depict a resilient labor market, defying expectations amid the Federal Reserve's commitment to prolonged higher interest rates and contributing to the prevailing narrative of a "soft landing."

Despite lower inflation throughout the year, the Fed's interest rate strategy has not translated into substantial job losses, fostering a relatively healthy labor market. This scenario, coupled with lower inflation, creates an optimistic backdrop for the stock market, evident in the upward trend of equities on Thursday.

However, the Challenger Job Cuts report released the same morning presented a contrasting picture, revealing a surge in corporate layoffs from 36.8K to 45.5K in November.

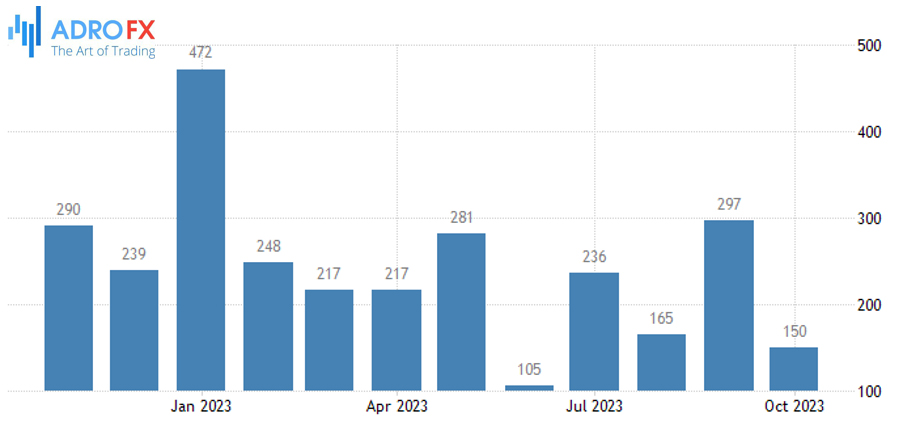

Looking ahead to Friday's significant economic releases, the spotlight will be on the November nonfarm payrolls report, with consensus expectations set at 180K new hires, up from October's 150K. Any figure below 200K may excite equity traders while surpassing this threshold could trigger concerns. A weaker, yet not excessively weak, Nonfarm Payrolls figure is viewed favorably by the market as potential evidence for the Fed to reconsider its current stance on interest rates.

The Unemployment Rate is anticipated to remain steady at 3.9% in November. A lower reading might induce market worries about tightening labor market conditions leading to increased wage inflation. Concurrently, Average Hourly Earnings for November are expected to show growth of 0.3% from October and 4% from a year earlier. The preliminary Michigan Consumer Sentiment Index for December is also poised for release, with an expected rise from 61.3 to 62, reflecting an optimistic sentiment reinvigorated by the holiday season. The culmination of these economic indicators on Friday is anticipated to introduce substantial volatility to the market.