Dow Ends with Decline as Fed Signals Interest Rate Hikes; Tech Giants Surge Ahead of Twitter Rival Launch | Daily Market Analysis

Key events:

- USA - ADP Nonfarm Employment Change (Jun)

- USA - Initial Jobless Claims

- USA - Services PMI (Jun)

- USA - ISM Non-Manufacturing PMI (Jun)

- USA - JOLTs Job Openings (May)

- USA - Crude Oil Inventories

On Wednesday, the Dow ended the day with a decline as the Federal Reserve's meeting minutes for June revealed an increased interest in resuming interest rate hikes. However, the tech giants experienced mostly positive performance, with Meta (formerly Facebook) surging to a 52-week high in anticipation of its upcoming Twitter competitor.

Specifically, the Dow Jones Industrial Average dropped by 0.38%, equivalent to 129 points, while the Nasdaq and the S&P 500 both experienced a 0.2% decrease.

The minutes from the Federal Reserve's June meeting, released on Wednesday, revealed that "almost all" members supported the idea of resuming rate hikes in the future due to the persistently high level of inflation, which they deemed "unacceptably high." The minutes also indicated a hawkish stance among some members, with a preference for raising rates rather than pausing in June. Concerns about a tight labor market, which could drive up wages and inflation further, were also raised.

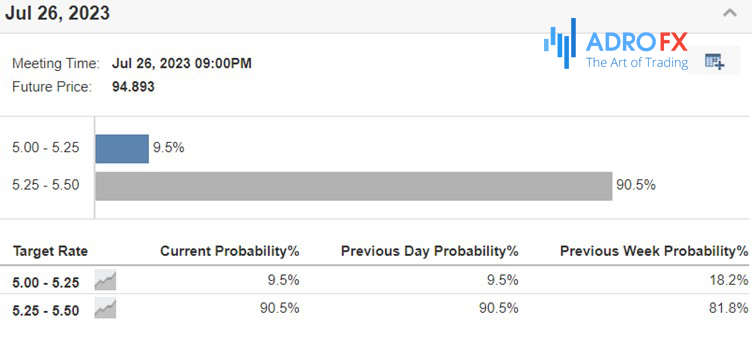

However, the decision to hike rates in July will largely depend on upcoming data expected this week and next, according to Pantheon Macroeconomics. Approximately 90% of traders, as indicated by Fed Rate Monitor Tool, anticipate that the Federal Reserve will resume rate hikes in July.

Investor concerns about a global economic slowdown were intensified by disappointing services data from China. Nonetheless, the performance of big tech companies helped mitigate early losses in the broader market. Meta (formerly Facebook) saw a surge of over 3% and reached 52-week highs ahead of the launch of its rival Twitter app, Threads, scheduled for Thursday. This launch follows Twitter's recent announcement that it will temporarily limit the number of posts users can read on its platform.

While Apple experienced a 0.6% decline, its market capitalization remains above $3 trillion. On the other hand, Microsoft saw a slight increase, with Wedbush predicting that the company will join the exclusive $3 trillion club alongside Apple by early 2024, driven by advancements in artificial intelligence (AI).

Wedbush stated in a note on Wednesday, "[W]ith AI the next step, we believe on a sum-of-the-parts valuation that MSFT should join Apple in the exclusive $3 trillion club by early 2024."

Over the course of the US Independence Day holiday, major currencies exhibited a relatively consistent pattern of limited trading ranges when compared to the US dollar. Among the G10 currencies, the New Zealand dollar (NZD) showed the strongest performance. This could be attributed to the unwinding of long positions in the Australian dollar/New Zealand dollar (AUD/NZD) pair.

These positions were initially established with the anticipation that diverging central bank policies would drive the pair's value higher.

European markets have experienced daily declines throughout this week, with yesterday's losses being particularly severe. The trend of falling markets appears likely to continue today.

The weakness seen yesterday was primarily driven by concerns surrounding softer-than-expected services Purchasing Managers' Index (PMI) data from China and Europe. These concerns have contributed to growing worries about a global economic slowdown. Additionally, rising interest rate risks have led to weakness in sectors such as basic resources, energy, and financials, further exacerbating the market downturn. These negative sentiments have spilled over into Asian markets as well.

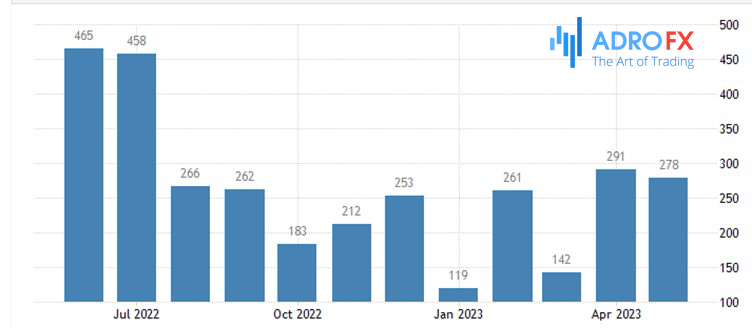

Today, the release of the ADP payrolls report is anticipated to reveal a solid figure of 225,000, slightly lower than the previous month's 278,000. Given the current level of job vacancies, it is unlikely that we will witness a weak jobs report in the coming months. Therefore, the labor market is unlikely to be the trigger for the Federal Reserve to signal a pause in its policies in the near future.

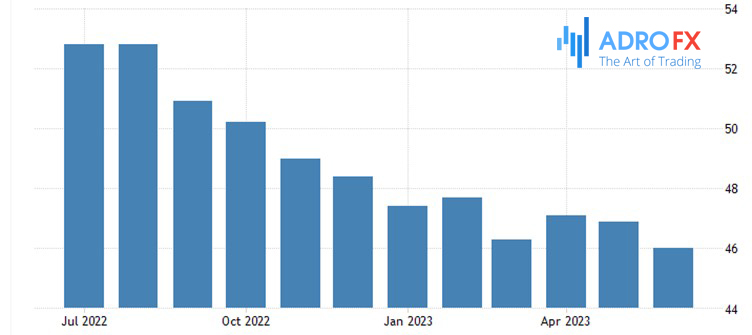

The Federal Reserve has expressed concerns about the potential stickiness of services inflation. Today's ISM services report is expected to show a slight increase in headline activity to 51.3. However, close attention will be paid to prices paid, which experienced a slowdown to 56.2 in May, marking a three-year low.