High Reward, Low Risk: The Power of the Crab Pattern in Forex

Forex trading patterns are essential tools for traders aiming to predict market movements and make informed decisions. These patterns, formed by price movements on charts, help traders identify potential turning points and market trends. Among the various types of trading patterns, harmonic patterns stand out due to their precision and reliability. Harmonic patterns are based on specific Fibonacci ratios, providing a structured approach to analyzing market behavior.

Fibonacci Precision: Using the Gartley Pattern to Predict Forex Trends

Chart patterns play a crucial role in forex trading, serving as a visual representation of market psychology and helping traders make informed decisions. These patterns, derived from historical price data, can indicate potential future price movements, offering valuable insights into market trends and reversal points. By recognizing and interpreting these patterns, traders can develop strategies to capitalize on market opportunities and mitigate risks.

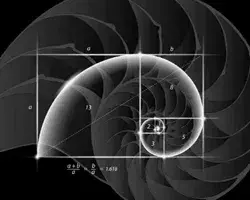

Demystifying the Fibonacci Circle in Forex Trading

Within the forex trading domain, where precision and timing wield significant influence over trade outcomes, grasping the intricacies of technical analysis holds utmost importance. Amid the array of tools at traders' disposal, the Fibonacci Circle emerges as a potent ally, aiding in pinpointing potential price targets, forecasting market reversals, and charting trend trajectories.

Harmonizing Success: The Transformative Power of Confluence Trading in Forex

In the dynamic world of forex trading, confluence trading emerges as a distinctive and powerful strategy, setting itself apart through its focus on identifying unique zones where diverse trade signals and technical indicators intersect. These strategic convergence points, known as confluence zones, serve as pivotal areas where forex traders strategically initiate actions. The potency of these zones lies in the amalgamation of multiple indicators, collectively signaling potential price movements in both upward and downward directions.

Support and Resistance in Forex Trading | Definition & Strategies

Support and resistance levels play a crucial role in the world of trading, particularly in forex markets. These levels represent areas on a price chart where buyers and sellers interact, shaping market dynamics. Understanding how support and resistance levels affect the market is essential for traders to make informed decisions and maximize their trading opportunities. This article will delve into the significance of support and resistance levels, how to identify and draw them correctly, strategies to trade them effectively, and methods to filter out false signals.

What Is Fibonacci Retracement? Definition & How to Use It

Setting the support and resistance levels is usually a problem for traders. It is especially inconvenient when trying to figure out from the beginning where to place them on the chart: one may think there are no good points to be plotted and it may be better to choose another time frame. Then the chart begins to change direction - and the support that has just been plotted becomes resistance. Immediately the question arises: "Where to build new support and how long to wait for it?"

Fibonacci Retracement Levels in Forex Trading

Fibonacci levels are one of the most universal and widespread tools, which beginners and experienced traders use for trading forex and other markets. It is widely known that market prices tend to gravitate towards levels where the greatest volume of market orders is accumulated. There are several techniques for detecting and predicting such levels.