Mastering the Art of Determining Beneficial Forex Trading Opportunities

Embarking on the dynamic journey of forex trading demands more than financial acumen; it requires a nuanced understanding of economic indicators, market trends, and geopolitical events. This article serves as your guide to recognizing and capitalizing on beneficial forex trading opportunities. Whether you're a seasoned trader refining your strategies or a newcomer navigating the complexities of the currency market, understanding the keys to profitability in forex is vital for sustained success.

Insights into Leading and Lagging Technical Indicators

In the fast-paced realm of financial markets, traders navigate a landscape influenced by two pivotal types of indicators: leading and lagging. Much like fortune-tellers and historians, these indicators serve distinct roles, predicting future shifts and confirming past trends. To comprehend the intricate dance between these indicators, we first need a glimpse into the world of technical analysis.

Beyond Currency Pairs: The Transformative Role of Forex Indices

The dynamic world of forex trading demands traders to stay ahead and make informed decisions. Forex indices stand out as indispensable tools in technical analysis, rooted in the study of historical price data. They serve as potent indicators, enabling traders to pinpoint entry and exit points, identify trends, and manage risk with precision. Delving into their integration into analytical frameworks, this article emphasizes the transformative role of forex indices.

Top Technical Indicators for Day Trading in 2024

Being a day trader means your livelihood depends on executing short-term trades and capitalizing on quick gains. This can prove highly lucrative for seasoned traders but can be a harrowing experience for those lacking experience. Distinguishing experienced day traders from novices lies in their mastery of key trading strategies. Some excel in fundamental trading, while others specialize in technical analysis. A few even possess expertise in both realms.

Market Volatility: Strategies, Tools, and Insights for Traders

Volatility stands as a pivotal element within the financial market, denoting the degree and speed at which an asset's price changes over time. Greater volatility indicates rapid fluctuations in the asset. For instance, if a stock commences trading at $10, ascends to $13, and then descends to $9 within a single session, particularly in a brief span, it qualifies as highly volatile - especially pertinent for scalpers.

Benefitting from Crossovers: Everything You Need to Know

In the ever-evolving landscape of financial markets, the term "crossover" stands as a key beacon for traders seeking to decipher market trends and capitalize on strategic opportunities. A crossover occurs when two or more indicators intersect, offering valuable insights into potential shifts in an asset's price trajectory.

Trading Without Indicators – Why You Need To Try It Out

In the world of trading, indicators have long been considered essential tools for analyzing market trends, identifying entry and exit points, and making informed trading decisions. Traders often rely on indicators such as moving averages, oscillators, and trend lines to gain insights into price movements and potential trading opportunities. However, there is an alternative approach that challenges the conventional reliance on indicators: trading without indicators.

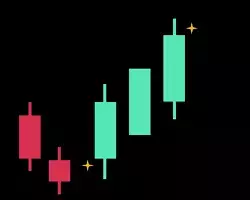

Three White Soldiers Candlestick Pattern in Trading Explained

As experienced traders know, not all candlestick patterns provide an entry point and indicate a market reversal. There are trend continuation patterns among them, they are used to assess the current market situation, and they do not give a signal to enter the market. The pattern of three white soldiers belongs to this category. It is suitable for both forex and the stock market, so be sure to include it in your arsenal.

Depth of the Market: Definition and Meaning

Depth of the Market is a special technical indicator developed for the MetaTrader 4 terminal. It is designed to monitor the current price movement and also to determine the supply and demand zones. This tool has the form of a histogram or, as it is also called - the price ladder. Let's consider its installation, settings, and process of use in practice in detail.

Technical Analysis for Beginners: Yes, It Is Possible

Technical analysis in trading is used to make forecasts of price movements and helps to determine the exact entry and exit trading points. There are many analytical methods used by traders, which are able to track the statistical direction and speed of value and quotes in the market. In this article, we will provide insight into the fundamental aspects of technical analysis every beginner should know.