Technical vs. Fundamental Analysis in Forex: Which Is Right for You?

In the dynamic world of forex trading, the ability to make informed decisions can mean the difference between substantial gains and significant losses. Analysis serves as the cornerstone of successful trading strategies, helping traders navigate through volatile markets and identify profitable opportunities. Whether you’re a novice or an experienced trader, understanding the nuances of analysis is crucial to achieving consistent success in forex trading.

Pitfalls of Forex Trading: Fundamental vs. Technical Analysis

Both fundamental and technical analyses are essential strategies in forex trading, each offering distinct perspectives on market trends and trading opportunities. Fundamental analysis looks at economic indicators, geopolitical events, and central bank policies to determine the true value of a currency. Conversely, technical analysis uses historical price data, chart patterns, and indicators to predict future price movements based on past behavior.

From Pitfalls to Profits: Learning from the Mistakes of Forex Traders

The forex market, with its promise of substantial gains and the allure of financial freedom, attracts traders from all walks of life. However, beneath the surface of success stories lie the harsh realities of significant losses encountered by many traders. Despite its potential for profit, navigating the forex market is fraught with challenges that can lead to financial setbacks for the unprepared. Understanding the prevalence of losses among forex traders is paramount for those aspiring to thrive in this dynamic and complex environment.

A Comprehensive Guide to OHLC Charts

OHLC, an acronym for Open, High, Low, Close, may sound like cryptic jargon to the uninitiated, but for traders, it's a fundamental concept that holds the key to deciphering market dynamics. In this article, we will demystify OHLC charts and explore their significance in trading. We will also delve into the challenges posed by forex and extended-hours trading, shed light on interpreting OHLC data, and discuss trading strategies tailored for these charts.

Support and Resistance in Forex Trading | Definition & Strategies

Support and resistance levels play a crucial role in the world of trading, particularly in forex markets. These levels represent areas on a price chart where buyers and sellers interact, shaping market dynamics. Understanding how support and resistance levels affect the market is essential for traders to make informed decisions and maximize their trading opportunities. This article will delve into the significance of support and resistance levels, how to identify and draw them correctly, strategies to trade them effectively, and methods to filter out false signals.

Technical Analysis for Beginners: Yes, It Is Possible

Technical analysis in trading is used to make forecasts of price movements and helps to determine the exact entry and exit trading points. There are many analytical methods used by traders, which are able to track the statistical direction and speed of value and quotes in the market. In this article, we will provide insight into the fundamental aspects of technical analysis every beginner should know.

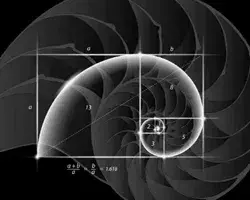

What Is Fibonacci Retracement? Definition & How to Use It

Setting the support and resistance levels is usually a problem for traders. It is especially inconvenient when trying to figure out from the beginning where to place them on the chart: one may think there are no good points to be plotted and it may be better to choose another time frame. Then the chart begins to change direction - and the support that has just been plotted becomes resistance. Immediately the question arises: "Where to build new support and how long to wait for it?"

The Inside Bar Trading Strategy Guide

An inside bar can be part of an extremely effective price action strategy. However, the effectiveness of the inside bar is highly dependent on the market context. In other words, the inside bar by itself is not a working trading setup. We need to see additional factors that tell us that the potential profit is worth the corresponding risk. And that's not always easy, because you have to consider several components at once.

George Soros and His Theory of Reflexivity

Traders and investors use various methods of fundamental and technical analysis, which mostly belong to the branches of economic and mathematical sciences. However, there is another less popular approach in describing stock price movements - stock market reflexivity theory.

Markowitz's Portfolio Theory: Fundamentals and an Example of Calculating Returns

Any investment of funds is accompanied by risks. Their degree is determined by their final income. If it is high, the risks are also high. Investors and traders of the securities market dream about maximum returns with minimal risks. A lot of attention is paid to the ratio of these two parameters.