Mixed Start to the Week with Anticipation for Key Events in Focus | Daily Market Analysis

Key events:

- UK - Composite PMI

- UK - Manufacturing PMI

- UK - Services PMI

- UK - BoE Gov Bailey Speaks

- USA - Building Permits

- USA - Services PMI (May)

- USA - New Home Sales (Apr)

The beginning of the week hasn't been particularly exciting, but the prospects of upcoming events make it highly unlikely for the lackluster trend to persist. We can anticipate engaging in discussions on the debt ceiling, releases on inflation, PMIs, and the unveiling of the Federal Reserve minutes, all of which promise to bring a wave of intrigue and activity.

On Monday, Wall Street closed with a mixed performance as the Nasdaq received a boost from the upward movement of Alphabet and Meta Platforms. Meanwhile, the S&P 500 finished near unchanged, indicating that investors exercised caution and avoided making significant market bets.

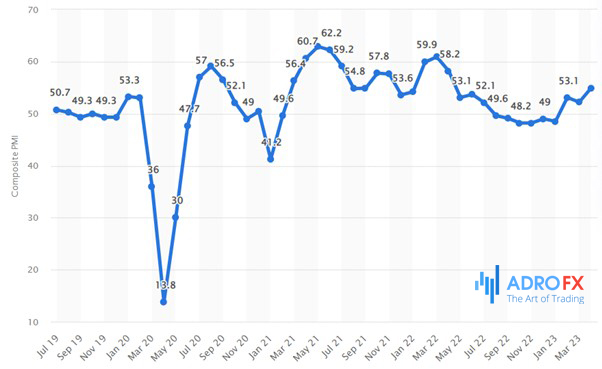

The rest of the week is filled with significant fundamental data to monitor, including the May PMI readings. These readings have the potential to reveal a slowdown in the service sector, which could increase the risks of a recession. The service sector has been a crucial pillar supporting the global economy thus far this year.

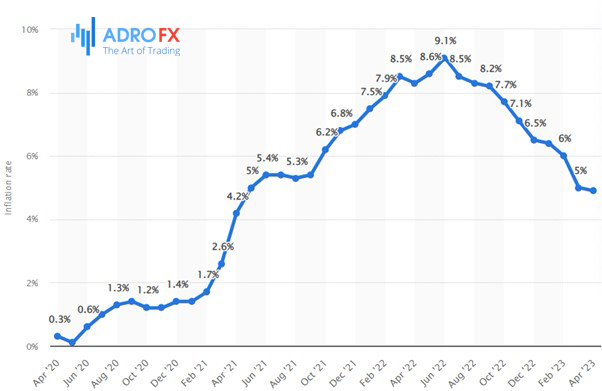

Another key data point to keep an eye on is UK inflation. Headline prices are anticipated to experience a significant decline, dropping to 8.3% for April from 10.1% in March. This is primarily due to the removal of annual energy price increases from the index. However, if there is an unexpected upside surprise in the inflation figures, it could exert substantial pressure on UK asset prices, particularly impacting the FTSE 250 and domestically focused sectors. Additionally, it may lead to higher bond yields and weigh on Gilt prices. The Bank of England (BOE) is currently seeking a sharp decrease in inflation to stimulate growth later in the year and provide room for interest rate adjustments.

Core inflation is also a crucial metric to monitor, as the annual rate is expected to remain stable at 6.2%. Any unexpected upward surprise in core inflation could also dampen sentiment toward UK asset prices.

Meanwhile, gold prices experienced a slight decline, reversing a brief recovery, as market attention remained fixed on discussions regarding the increase of the US spending limit. Meanwhile, copper stabilized after enduring significant losses in recent trading sessions.

The limited safe-haven demand for gold was influenced by optimistic remarks from both Democrat and Republican lawmakers regarding a potential agreement. House Speaker Kevin McCarthy's statement that a US default was improbable further contributed to the subdued interest in the precious metal.

Gold has struggled to find substantial support in the past week due to uncertainties surrounding the debt ceiling, despite reaching record highs earlier in May. The market saw a significant amount of profit-taking, causing a downward movement in gold prices.

Today, our focus will be on the comments made by some Federal Reserve policymakers. While James Bullard's statement suggesting two more interest rate hikes this year may have sparked attention and stirred conversations on this Monday morning in the US, it is important to approach such remarks with a certain level of skepticism at this stage.

Over the next few months, we will gain valuable insights into how the US economy is managing its highly aggressive tightening cycle. This, coupled with the repercussions of the mini-banking crisis in March, may necessitate a reassessment of interest rate decisions heading into the year-end.

While investors have the freedom to adopt their positions based on their judgment, Federal Reserve officials face a different challenge in the absence of concrete evidence. It would be illogical for them to change their stance without substantial supporting data, as it would undermine their previous efforts.

Nonetheless, the release of the Federal Reserve minutes on Wednesday will be of interest as it will provide an understanding of where different officials stand on this matter. It may reveal whether a consensus is forming to pause at the upcoming June meeting. However, the most crucial factor to consider is the inflation data to be released on Friday. This data holds the utmost significance, even if it comes a couple of weeks after the Consumer Price Index (CPI) report. The Federal Reserve can only make a pivot when core inflation shows a decline. Until then, we can expect a meeting-by-meeting approach with potential pauses along the way.