ECB's Decision to Raise Rates Indicates That The Fed May Follow the Lead | Daily Market Analysis

Key events:

- Eurozone – CPI (YoY) (Feb)

Yesterday's ECB decision was crucial as it gave the first glimpse of what bank stress means for monetary policy.

And it meant nothing special – good news for the markets.

The ECB decided not to blow up the banking problems and announced a 50bp rate hike during yesterday's decision, pointing to high inflation.

The opening sentence of ECB head Christine Lagarde's speech stated that the bank has been forecasting "too high inflation for too long."

Indeed, the final CPI data due out today is expected to confirm February inflation at around 8.5%, a high but not bad figure compared to the double-digits recorded a couple of months earlier, but core inflation is now at a record high and needs to be tackled.

As for bank shocks, Lagarde said that European banks are strong and resilient, they have plenty of liquidity, and in all cases the ECB has a set of tools - beyond interest rates and broad monetary policy - that can help solve liquidity problems if needed.

This was clear and well played.

What remained unclear, however, was what would happen next with ECB policy. Lagarde gave no indication for the future. She said that future decisions would depend on economic data.

The lack of conviction on the need for a further 50bp rate hike certainly kept the euro from rallying more vigorously after yesterday's 50bp ECB rate hike.

The EUR/USD strengthened, but the advance was barely noticeable. The next natural target for the bulls is the 50-DMA, which is near the 1.0730 level, and whether the pair can break it depends on what happens on the Fed front.

The ECB's clear focus on inflation rather than bank stress reinforced expectations of a 25bp rate hike from the Federal Reserve (Fed) next week.

The ECB's decision was a hint that the Fed could also downplay stress in the banking sector, emphasize that liquidity problems can be solved with available tools, and keep its focus on economic data.

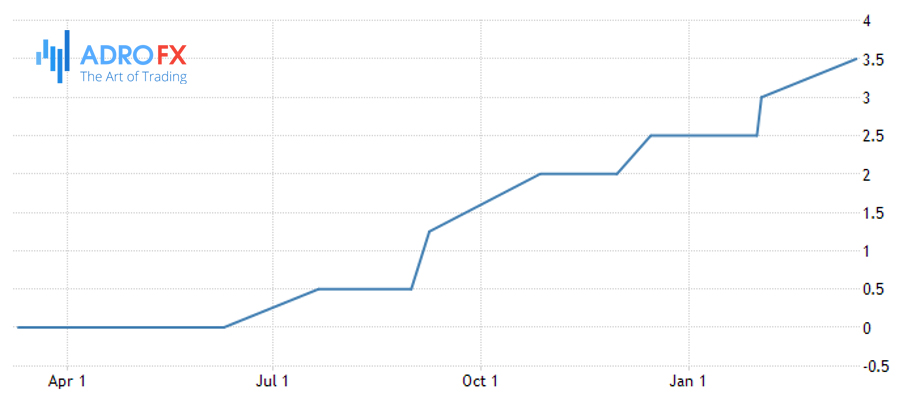

After the ECB decision, activity in federal funds futures gives a 25 basis point probability of a 25 basis point rate hike of over 80%. Before the ECB decision, that probability was about 65%.

What does this mean for the U.S. dollar? It probably means a further reduction in the gains made earlier in the year as we return to a scenario where the Fed raises the rate by the last 25 bps and pauses. That was the expectation earlier this year, before the Fed raised the expected rate to 5.6%. That rate is almost dead. It could come back to life, but the impact of the Fed tightening on banks could help limit borrowing from here and weaken inflation, and the need for further Fed action.

So much for the reversal, ladies and gentlemen.

The U.S. bond markets are now licking the wounds of last week. Two-year U.S. bond yields are rising, but remain well below pre-BBS collapse levels. BoFA's MOVE index, which represents the implied volatility of Treasuries, hasn't been this high since the subprime crisis of 2008, which calls for caution.

Caution is caution, but stock markets are in high spirits. European indices liked yesterday's dovish 50-basis-point hike in the ECB rate.

Also, Credit Suisse's relief in Switzerland and First Republic Bank boosted sentiment on the other side of the Atlantic. Stoxx 600 bounced off the goalpost and rebounded, S&P 500 rebounded about 1.75%. At the same time Nasdaq 100 rose nearly 1.70% as Amazon, Alphabet and Microsoft jumped over 4%, Nvidia gained over 5%, Intel gained over 6%, and AMD gained nearly 8% after the major US banks decided to place $30 billion in First Republic Bank in a show of support.

Bitcoin, which tends to move in close association with tech stocks, has risen more than 30% since last week and is now above the $25K psychological level, looking to move further toward the $30K mark.

Either way, the last trading day of a chaotic week could be a quiet one (who knows!). Investors will be watching U.S. industrial production and the University of Michigan Sentiment Index, expect further upward correction in yields and pray that nothing major happens before next Wednesday's FOMC decision.