Top 5 This Week: Confrontation Over the U.S. Government Debt Ceiling and Tech Giant Reports | Daily Market Analysis

Key events:

- UK - Composite PMI

- UK - Manufacturing PMI

- UK - Services PMI

- Eurozone - ECB President Lagarde Speaks

- New Zealand - CPI (QoQ) (Q4)

The standoff over the U.S. government debt ceiling is likely to weigh on the financial market for a long time to come as earnings reporting season continues. The market will get an update on U.S. economic growth in the fourth quarter, which is expected to remain solid despite recent signs of a slowdown. The Eurozone will release PMI data, while inflation data from Japan will also be under scrutiny. Here's what you need to know early in the week.

- Controversy Over the National Debt Ceiling

The U.S. government exceeded the $31.4 trillion borrowing limit last Thursday amid a standoff between President Joe Biden's Republicans and Democrats over raising the national debt ceiling.

Republicans are demanding cuts in government spending before they approve raising the ceiling; a similar demand in 2011 caused S&P to lower the U.S. credit rating for the first time and caused chaos in the financial market.

The stalemate over the high rate is expected to last several months, and could drag on until the last minute as each side tests the other ahead of June, the date after which Treasury will likely run out of emergency maneuvers to prevent a default.

- Tech Sector Earnings

Earnings results this week will test the recent recovery in tech stocks amid questions about whether giant companies can boost earnings while cutting costs, as the U.S. economy shows signs of slowing and a possible recession.

Microsoft, the second-largest U.S. company by market value, will report today, followed by Elon Musk's Tesla on Wednesday and Intel on Thursday.

According to Refinitiv, Q4 earnings at S&P 500 companies are expected to decline by 2.9 percent, compared with a 1.6 percent decline at the beginning of the year last year.

Alphabet said Friday that it would cut about 12,000 jobs, or 6% of its workforce, becoming the latest tech giant to announce layoffs. On Wednesday, Microsoft said it would cut 10,000 jobs, and Amazon began notifying employees that it would cut 18,000 jobs.

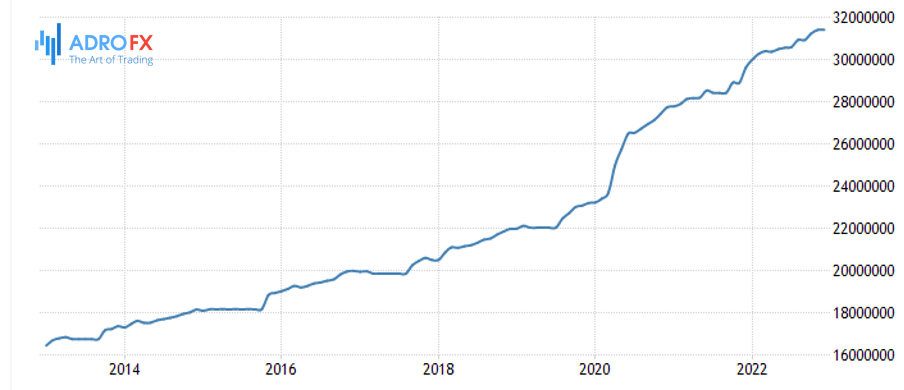

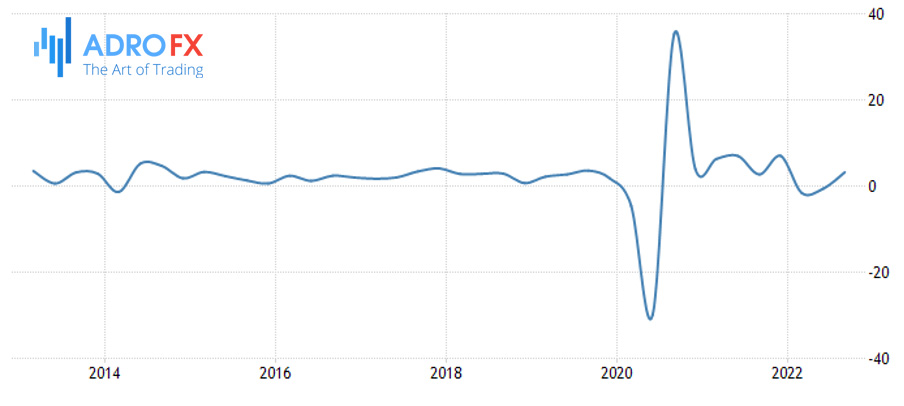

- U.S. Economic Data

On Thursday, the U.S. will release its first estimate of Q4 GDP. Analysts expect the economy to grow at an annualized rate of 2.6% after 3.2% in the third quarter.

While that figure seems high, recent economic data suggests that the economy has lost momentum by the end of 2022, with retail sales down 1% or more in the last 2 months, industrial production down in the last 3 months, and housing construction declining for six months in a row.

GDP is expected to weaken in the coming quarters as the Federal Reserve's tight rate hikes continue to weigh on demand.

The economic calendar also includes initial jobless claims, durable goods orders, and new home sales on Thursday and the personal consumption price index on Friday.

- Eurozone

Several European Central Bank officials are scheduled to speak before policymakers traditionally take a break before Thursday's monetary policy meeting. The next ECB meeting will be held on February 2.

ECB chief Christine Lagarde, who last week rebutted market forecasts that the bank would slow the pace of rate hikes given the recent drop in inflation, is scheduled to speak at the 2 meetings.

Meanwhile, eurozone data may provide further indications of the state of the economy.

On Tuesday, the bloc will release PMI data, which is expected to rise, and on Wednesday the closely watched German Ifo business climate index is expected to improve for the second month in a row.

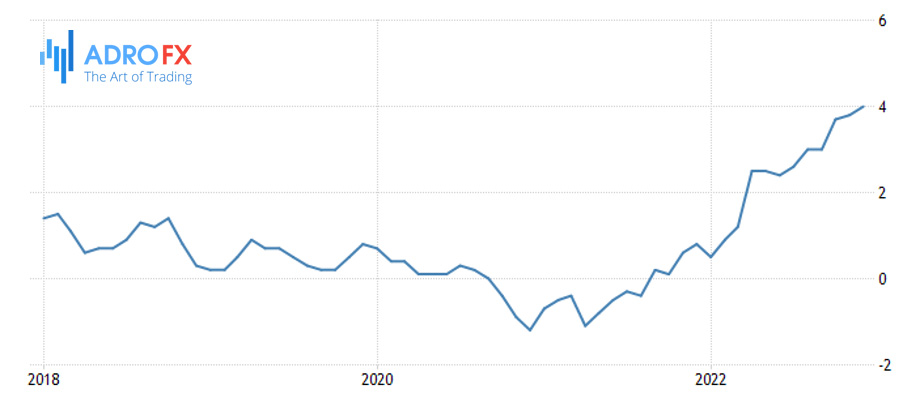

- Inflation

On Friday, Japan will release Tokyo consumer price inflation data, which will be closely watched after the Bank of Japan last week rebutted market expectations for a more hawkish policy by keeping the pace of yield curve adjustment.

Japanese inflation is at a 40-year high and twice the BOJ's 2% target, but the BOJ is resisting market predictions that an end to its multi-year ultra-soft monetary policy is near.

Meanwhile, inflation data are due out Wednesday in Australia and New Zealand, as the Reserve Bank of Australia ponders whether it is time to suspend rate hikes and the Reserve Bank of New Zealand ponders how much to tighten monetary policy.