What May Be the Fed's Next Step? | Daily Market Analysis

Key events:

- USA – Core Durable Goods Orders (MoM) (Dec)

- USA – GDP (QoQ) (Q4)

- USA – Initial Jobless Claims

- USA – New Home Sales (Dec)

Although the U.S. PMI fell further in January, inflation did accelerate. It is still unclear whether the Fed should take a more dovish or hawkish stance – and that cannot help but affect gold.

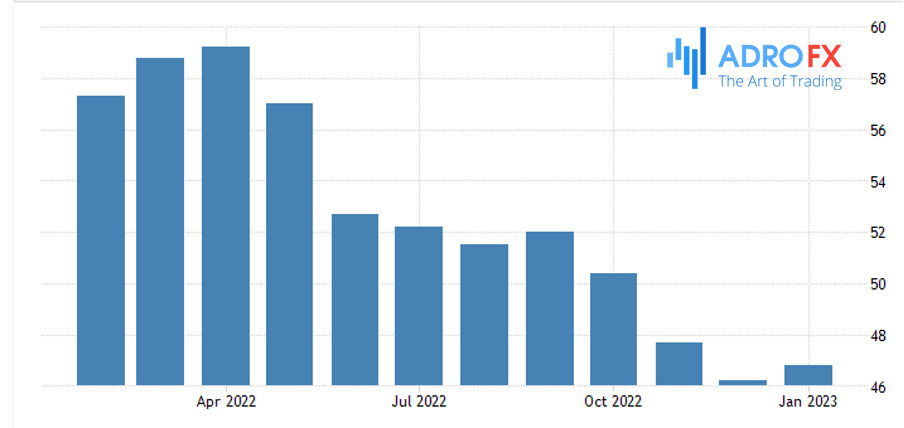

The composite U.S. PMI for January was 46.6, up from 45.0 in December. This means that the decline in business activity softened to its slowest in three months. However, it was a further drop, as every number below 50 means a decline in economic output.

The main factors in the decline were the impact of higher interest rates, uncertainty, and high inflation on consumer spending.

The U.S. Services Business Activity Index was 46.6 in January, down from 44.7 at the end of 2022. Thus, the service sector saw another significant decline, albeit the mildest since last October. The U.S. manufacturing index also rose slightly from 46.2 in December to 46.8 in January, but it was still the second fastest decline since May 2020.

The good news is that the numbers exceeded experts' expectations. The bad news, however, is that factor inflation has hit back. It has accelerated since December, ending a seven-month sequence of moderate cost pressures.

While January's data came in above expectations, it showed that private sector contraction continued into the new year. As Chris Williamson, a chief business economist at S&P Global Market Intelligence, commented:

"The U.S. economy started 2023 on a disappointingly weak note, with business activity falling sharply again in January. While the rate of decline declined from December, it was one of the sharpest since the global financial crisis, reflecting a drop in activity in both manufacturing and services".

But the most interesting thing about the report is the stagflationary flavor, an indication of a weakening economy and rising inflationary pressures. As Williamson said, the concern is that the survey not only points to a slowdown in economic activity early in the year, but also an acceleration in the rate of manufacturing cost inflation in the new year, due in part to upward pressure on wages, which could encourage further aggressive Fed policy tightening despite the growing risks of a recession.

That's the way it is. Although a 25 basis point rate hike in February seems certain, the Fed could provide more hikes than currently expected. So it wouldn't surprise anyone if "dovish" action at the upcoming FOMC meeting is accompanied by "hawkish" signals. Given that a small (well, until 2022 was the standard size of an interest rate hike) move is already priced in, any hawkish signals will negatively impact gold prices.

What does all this mean for the outlook for gold (and silver) in 2023? As you can see from the chart below, the price of gold has been on the rise lately. This upward movement has been driven by hopes for more "dovish" monetary policy and, ultimately, a Fed turnaround. Consequently, any hawkish surprise could cause gold prices to fall.

However, it is too early to declare a return to inflation. It has only been one month of accelerating production costs, and it has not led to a rise in output prices. Therefore, we can assume that a dovish forecast is more likely, especially since the most prominent hawks will not be voting in 2023 (due to the rotation of FOMC members Bullard, Mester and George are out this year).

Obviously, with stagflation, monetary policy will swing from dovish to hawkish, and gold prices will react accordingly. However, the weakening economy should encourage the Fed to take a more dovish stance in the coming months, which should be favorable for gold.