Markets Remain Under Pressure Amid the Fed Officials' Speeches | Daily Market Analysis

Key events:

- Australia – Retail Sales (MoM) (Nov)

- USA – Crude Oil Inventories

Yesterday's speech by Fed chief Jerome Powell at the Stockholm forum gave no hints about the regulator's plans as he did not directly address economic or monetary policy issues. Investors are now waiting for the key event of the week - the release of the U.S. consumer inflation data for December, which the consensus forecast suggests slowed to 6.5% y/y from 7.1% y/y.

This will be the last bundle of key macroeconomic data the Fed will receive before its rate decision on Feb. 1. The federal funds rate futures market is pricing in a 78 percent chance of a 25bp hike and a 22 percent chance of a 50bp move.

Yesterday the S&P 500 fluctuated near Monday's closing levels. Durable goods, health care, and IT were the best performers, with housing, financials, and industrials lagging.

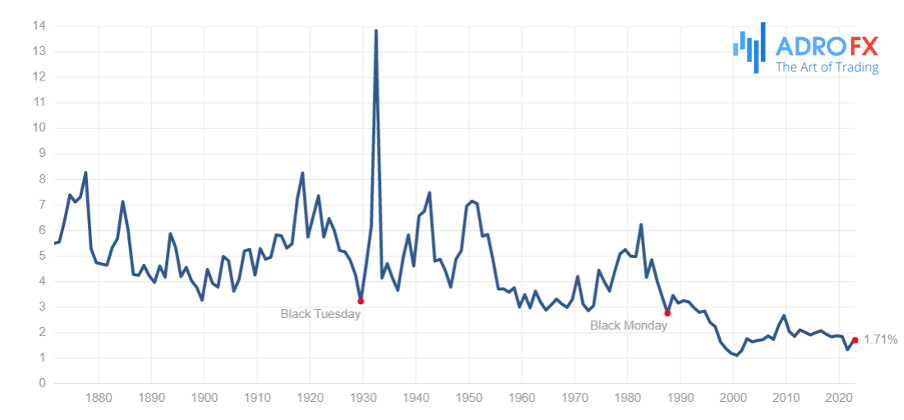

The S&P 500 has a dividend yield of 1.7 percent. The index trades at 18.9 to last year's earnings (P/E) and 15.7 to its member companies' projected earnings for the coming year (projected P/E).

Of the S&P 500: 64.5% of companies in the index are trading above their 50-day MA, 69.1% are trading above their 100-day MA, and 57.4% are trading above their 200-day MA.

At the same time, the Stoxx Europe 600 also retreated from its 8-month highs of the previous day, but so far it looks like just a local correction. As of yesterday evening all of its 11 major sectors were down. The greatest strength was demonstrated by financials, utilities, and telecoms, while the outsiders were materials production, real estate, and industrials.

The pressure on the European stock market, as well as on other risky assets, was put by rather harsh comments from the Fed representatives. The speeches of Mary Daly and Rafael Bostic, the heads of the San Francisco and Atlanta Fed indicated the prospects of interest rate growth above 5% and keeping it at a high level for a long time.

Goldman Sachs (NYSE: GS) strategists upgraded Europe to "above market" from "neutral".

Oil prices spent Tuesday's session consolidating in a fairly narrow range within the range of previous sessions.

Oil prices rose steadily on Monday, amid a declining dollar and news that Chinese refineries and oil traders received generous import quotas. However, speeches of Mary Daly and Rafael Bostic, the heads of the Federal Reserve Bank of San Francisco and Atlanta, cooled down the ardor of investors. Ms. Daly said she expected the interest rate to rise above 5%, while her colleague said that the Fed should raise the rate above 5% at the beginning of the second quarter and keep it there for "a long time". This event triggered a decline in oil prices and continues to limit their rise today.

Brent and WTI futures curves remain in a slight contango, which suggests at least a sufficient supply of oil in the market.

COPPER hourly chart

Copper and aluminum continue to assault multi-month and multi-day highs, respectively. China's continued economic opening probably remains the main driver here.

As for investor sentiment, the share of bullish sentiment, i.e. expectations that stock prices will rise over the next six months, decreased by 6 percentage points to 20.5% and remains below the historical average of 37.5%. This is the second time in the past three weeks that this indicator has been among the 60 lowest in the entire period of data collection, that is, since 1987.

The share of bearish sentiment, that is, expectations that stock prices will fall in the next six months, is 42%, remaining above the historical average of 31%.