US Indices Set To Break Yearly Lows | Daily Market Analysis

Key events:

Eurozone - ECB President Lagarde Speaks

USA - Pending Home Sales (MoM) (Aug)

USA - Fed Chair Powell Speaks

USA - Crude Oil Inventories

So far, the problem is obvious. Inflation will take longer to rise than expected. The same goes for the Fed's plans to raise rates. Forecasts for both the economy and income are moving in the wrong direction - and fast. In response, the appropriate multiplier to be applied to declining earnings is also changing.

In short, the bear market is back, and the summer rally that gave hope that we were over the worst has been wiped out. Completely.

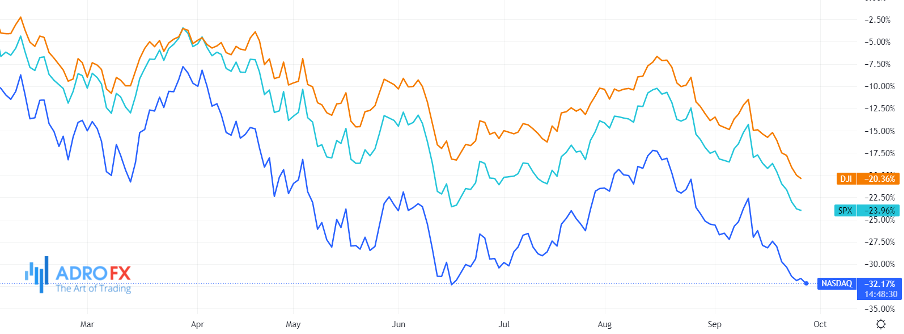

The S&P 500 is down 23% for the year, the Dow Jones Industrial Average is down 19.6%, and growth funds have lost 31.3%. Oh, and for those doing the math, the ARK Innovation ETF is down 70% from its high again, which requires a rise of about 230% from this point to get back to the glory days. Such is the case.

SPX, NASDAQ, and DJI chart

While U.S. futures have managed to bounce back after a few rough days, there is no fundamental or technical basis for a market bottom yet. Thus, expect the downtrend to resume.

More on the fundamentals later, but given the lower highs and lower lows, not to mention all the other bearish technical indicators, it is better to look for short positions in the indices now than long ones, even if the markets are a bit oversold in the short term.

With that in mind, there is a good chance that the S&P 500 futures and European markets will not be able to hold their current positions or, at best, move significantly higher from current levels.

In fact, after yesterday's bounce, the S&P 500 futures came up to a key short-term resistance area, the base of which is at 3723. Previously, that area was support in mid-July. But after Friday's drop, that area will now be the first line of defense for the bears.

Since the Dow has already hit a new yearly low, it is likely that the S&P and Nasdaq will follow suit. So the S&P futures are headed below the June low of 3639, where people who were buying yesterday on "support" placed their stop orders. On a sharp move, those stops are likely to trigger. So watch out.

If the S&P breaks and holds below this summer low, we could see more technical selling in the coming days, after which the index will probably head to the 127.2% Fibonacci level at 3452.

Prior to yesterday's small bounce, markets had been falling for 5 days in a row. While some may be tempted to consider opportunistic long trades at short-term oversold levels, clearly the larger and more frequent moves have been downward. We are in a bearish trend, so it is better to swim with the current than against it.

It's not a matter of being permanently bearish, just that there is no good fundamental reason for investors to go long just yet.

GBP/USD chart

For markets to bottom, either stock prices need to get even cheaper to justify the risk, or something must change fundamentally. Currently, central banks around the world, led by the U.S. Federal Reserve, are actively tightening their monetary policies while concerns about the health of the global economy continue to grow. Moreover, emerging market currencies are collapsing and the currencies of some major economies are reaching either multi-decade lows or, in the case of the British pound, new historic lows. And while the pound has stabilized and yields have recovered since Monday's fiasco, which forced the Bank of England to issue an emergency statement promising not to let inflation get out of control.

This has become a much tougher task after a massive fiscal handout from the new government, overwhelmingly in favor of people with higher incomes. An opinion poll conducted after the budget plan released Friday gave the opposition Labor Party a record 17-point lead, suggesting that new Prime Minister Liz Truss and her Treasury chief Kwasi Kwarteng may have misjudged their priorities.