Dow's Decline, Asian Stocks Slide, and Gold's Resilience Amid Global Economic Concerns | Daily Market Analysis

Key events:

- Australia - Trade Balance (Oct)

- China - Exports (YoY) (Nov)

- China - Imports (YoY) (Nov)

- China - Trade Balance (USD) (Nov)

- USA - Initial Jobless Claims

- Canada - BoC Gov Macklem Speaks

On Wednesday, the Dow closed in negative territory, extending its sluggish performance for the week, despite growing indications of a slowdown in the job market that fueled hopes for an eventual Federal Reserve rate cut.

The Dow Jones Industrial Average managed a modest rise of 70 points, equivalent to 0.2%, while the S&P 500 experienced a 0.4% decline, and the NASDAQ Composite saw a 0.6% drop.

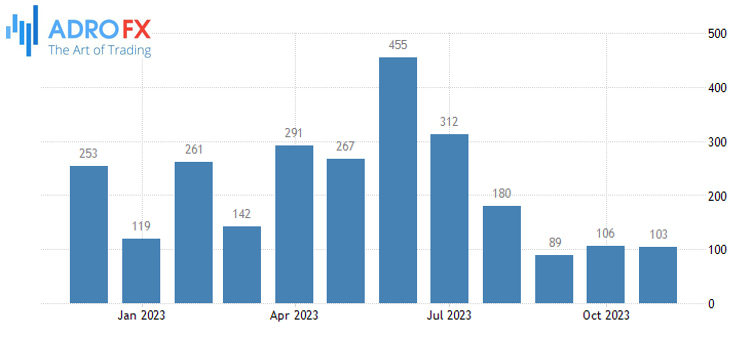

Data from payroll processor ADP revealed that private US employers added only 103,000 jobs last month, a decrease from the revised figure of 106,000 in October. This figure fell short of economists' expectations, who had predicted an increase of 130,000 jobs.

This jobs report follows a day after job openings reached their lowest point in over two years in October, indicating a decelerating job market that not only poses a threat to the economy but also raises the likelihood of an early rate cut by the Federal Reserve in the coming year.

The focus on jobs data will persist on Thursday and Friday with the release of weekly initial jobless claims and nonfarm payrolls, respectively.

Energy stocks were the primary drivers behind the market's decline, influenced by a drop in oil prices below $70 a barrel, the lowest since June. This occurred despite a larger-than-expected draw in weekly US inventories, as a surge in gasoline supplies and record US crude production dampened sentiment.

Weekly US inventories saw a decrease of 4.6 million barrels, contrary to estimates of a decline of $1.03 million, while gasoline supplies spiked by 5.4 million barrels, surpassing expectations for a 1 million barrel build.

This surge in gasoline supplies coincided with earlier data this week revealing that US oil production reached a record high in September.

ExxonMobil (NYSE: XOM) experienced a more than 1% decline, despite outlining plans to accelerate its share buybacks following the completion of its $60 billion acquisition of shale producer Pioneer Natural Resources (NYSE: PXD).

On Thursday, a majority of Asian stocks experienced declines due to lingering concerns about a potential economic slowdown in China, contributing to subdued market sentiment. Japanese stocks, in particular, faced significant losses as Bank of Japan Governor Kazuo Ueda deliberated on options for a potential shift away from negative interest rates.

The Nikkei 225 index in Japan tumbled by 1.6% as Governor Kazuo Ueda expressed concerns about an "even more challenging situation" facing the Bank of Japan in December and January.

Ueda's discussions included considerations for lifting interest rates from record lows, reinforcing expectations that the BOJ might conclude its ultra-loose policies by 2024. Such a pivot by the BOJ would mark the end of nearly a decade of accommodating monetary policy, which played a crucial role in the remarkable rally of Japanese stocks throughout the year.

Despite the contemplation of policy adjustments, Ueda underscored the importance of maintaining a dovish stance in the short term, citing potential vulnerabilities in the Japanese economy.

In Australia, the ASX 200 declined by 0.4% on Thursday, driven by lower-than-expected growth in the country's trade surplus for October. Export improvements, particularly in China, remained lackluster.

Meanwhile, the Japanese Yen staged a reversal, recouping a significant portion of its losses against the US Dollar accumulated over the past three days. This shift dragged the USD/JPY pair to the 146.70 area during the Asian session on Thursday. The JPY's relative safe-haven status benefited from a weakened trading sentiment surrounding equity markets, contributing to the currency's strength.

During the Asian session on Thursday, the price of gold (XAU/USD) exhibited a modest positive trend, although it lacks significant momentum and remains confined within a narrow range that has persisted over the past three days. The recent release of weaker JOLTS Job Openings data from the United States on Tuesday has strengthened the anticipation that interest rates may soon undergo a downward adjustment. This has resulted in a decline in the benchmark 10-year US Treasury yield to its lowest level in three months.

Adding to this sentiment, the dovish statements from officials at the European Central Bank (ECB) and the decisions of the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) to maintain steady interest rates on Tuesday and Wednesday, respectively, have fostered hopes of a global peak in interest rates. This collective outlook is perceived as a significant factor acting as a supportive force for the non-yielding precious metal, gold.