Global Markets Fall Amid Concerns of Economic Growth and Bank Stability, Fed Eyed | Daily Market Analysis

Key events:

- New Zealand - Employment Change (QoQ) (Q1)

- New Zealand - RBNZ Gov Orr Speaks

- Australia - Retail Sales (MoM) (Mar)

- USA - ADP Nonfarm Employment Change (Apr)

- USA - Services PMI (Apr)

- USA - ISM Non-Manufacturing PMI (Apr)

- USA - Crude Oil Inventories

- USA - FOMC Statement

- USA - Fed Interest Rate Decision

- USA - FOMC Press Conference

Yesterday, European markets had a disappointing start to the week as the FTSE 100 plunged to its lowest level since April 11th due to a collapse in energy prices. This drop in energy prices is indicative of broader concerns about the global economic outlook and, subsequently, the recovery of the Chinese economy. In April, a surprise contraction in Chinese manufacturing activity caused the DAX and CAC40 to decline sharply, with a particular weakness in industrials and luxury stocks.

The mounting apprehensions about economic growth were not limited to Europe, as US markets also experienced a sharp decline while investors sought refuge in government bonds. The slide in bond yields was exacerbated by the news that lending had slowed down more than expected during Q1, as revealed by the latest ECB banking survey. This has raised concerns about a potential halt in the recovery and fears that the ECB might repeat its 2008 mistake of over-tightening when it meets to raise rates soon. On Monday, US 2-year yields slipped below 4%, after reaching a peak of 4.16%.

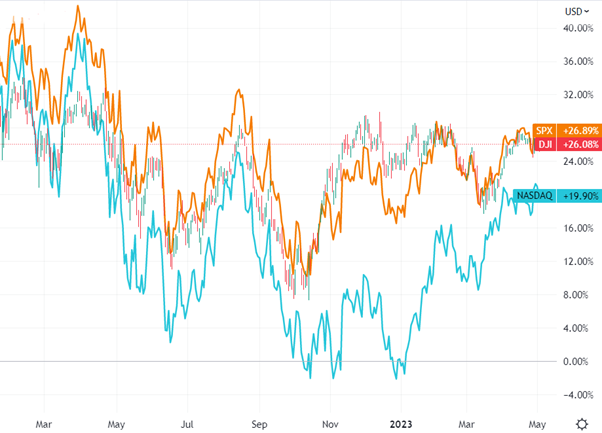

Yesterday, global equities saw a broad-based risk-off sentiment, with increased volatility. The energy sector was hit the hardest, falling by 4% due to another drop in oil prices. Consumer discretionary stocks outperformed, but regional banks in the US faced heavy selling pressure. The flight to safety was visible in the outperformance of minimum volatility and quality styles. In the US, the Dow fell by 1.1%, the S&P 500 by 1.2%, the Nasdaq by 1.1%, and the Russell 2000 by 2.1%. Today, Asian markets are lower, with low trading volumes as mainland China and Japan markets are closed. However, losses are limited, and US and European futures are higher.

Early on Wednesday, gold prices were relatively stable in Asian trade, but supported by increased demand for safe-haven assets due to renewed fears of a banking crisis and uncertainty surrounding monetary policy ahead of a Federal Reserve rate decision. On Tuesday, gold prices rose sharply as the U.S. bank stocks saw a wave of selling triggered by JPMorgan Chase & Co's government-brokered takeover of First Republic Bank (NYSE: FRC), which raised concerns about solvency issues among several other regional US lenders. As a result, regional bank stocks, including PacWest Bancorp (NASDAQ: PACW) and Western Alliance Bancorporation (NYSE: WAL), declined by 15% to 30%. This bank rout occurred just before the Fed concluded a meeting on Wednesday, where a 25 basis points interest rate hike is expected.

Also, currencies linked to oil prices, such as the Norwegian krone (NOK) and Canadian dollar (CAD), experienced significant losses. The EUR/NOK pair is now approaching the 11.90 mark. The EUR/USD pair fluctuated during the session but remains around the 1.10 level, while the EUR/SEK pair rose slightly. The EUR/GBP pair rose above 0.88 due to the risk-off sentiment, while the USD/JPY pair decreased to 136.50 as US yields declined.

The focus for today is on the Fed meeting amidst yesterday's sharp decline in US banks. There doesn't seem to be a clear reason for the rout in regional bank shares, but concerns about future rate increases impacting financial stability may have played a role. Against this backdrop of volatility, the Fed will make a decision on whether to raise rates later today, following their last increase of 25bps in March. While concerns over financial stability and the US banking system are still present, there is a sense that it is being contained. However, there is evidence that it may be materially affecting the US economy, and yesterday's sell-off in regional banks indicates the potential for further concern.