US Stock Futures Hold Steady Amid Positive Week and Holiday Closure, Fed Rate Pause Expectations | Daily Market Analysis

Key events:

- USA - Labor Day

- Canada - Labor Day

- Eurozone - ECB's Elderson Speaks

- Eurozone - ECB President Lagarde Speaks

US stock futures traded within a relatively stable range following a positive week for major benchmark averages, with the markets scheduled to be closed on Monday in observance of a public holiday. The optimism in the market was further buoyed by strong gains on Wall Street in the previous week, driven by Friday's official jobs report, which heightened expectations of the Federal Reserve pausing its rate hikes at the upcoming meeting.

Last week witnessed robust performances from the Dow Jones Industrial Average and the NASDAQ Composite, rising by 1.4% and 3.2%, respectively, marking their most substantial weekly gains since July. The S&P 500 also had an impressive week, gaining 2.5%, its best showing since June.

The latest jobs report is just one in a series of economic indicators suggesting that the economy is transitioning toward a so-called "soft landing," reinforcing the notion that the Fed is nearing the conclusion of its current rate-hiking cycle. Upcoming data releases for the week are unlikely to significantly alter this outlook.

On Wednesday, the Institute for Supply Management will release its August data on service sector activity, with economists anticipating a slight softening. Additionally, the Fed will publish its Beige Book, providing a survey of economic activity across all 12 districts.

Investors will also have the opportunity to hear from several Fed speakers in the upcoming week, starting with Dallas Fed President Lorie Logan on Wednesday, followed by appearances from New York Fed President John Williams, Governor Michelle Bowman, Governor Michael Barr, and Chicago Fed President Austan Goolsbee on the following day.

Meanwhile, European stock markets are anticipated to open slightly higher on Monday, benefitting from gains in Asia following a strong week on Wall Street.

This positive sentiment aligns with an upcoming speech by ECB head Christine Lagarde. European equity indices are expected to see a boost from the optimistic tone in Asian markets, particularly in China, where increased optimism about potential stimulus measures from Beijing has led to strong performance.

Monday's sentiment was further uplifted as property developer Country Garden Holdings received bondholder approval to extend certain debt deadlines, averting a possible default. Chinese authorities have recently directed their efforts toward supporting the troubled property sector, including actions such as enhancing local dollar liquidity and relaxing some mortgage rules.

China's economic condition, being the second-largest in the world, has a significant impact on several of Europe's major companies, and the ongoing struggles in China's recovery have weighed on the eurozone economy.

The Reserve Bank of Australia (RBA) is anticipated to maintain its current interest rates for the third consecutive meeting on Tuesday, reflecting recent data indicating a quicker-than-expected moderation in inflation.

Currently at an 11-year high of 4.1%, rates have witnessed a cumulative increase of 400 basis points since May 2022. Market expectations suggest that this may be the peak, especially after inflation exhibited an unexpected decline to 4.9% year-on-year in July, marking the lowest rate since its peak last December at 8.4%.

Furthermore, the latest jobs report revealed a rise in the unemployment rate to 3.7% in July, up from 3.5% in the previous month, further reinforcing the outlook that the RBA will maintain its current stance.

In the currency markets, the Dollar Index rebounded, surging above the 104 level to reach 104.25 (compared to 103.65 on Friday). Foreign exchange trading exhibited volatility as traders navigated through the market ahead of the three-day US weekend due to the Labor Day holiday.

The US Dollar initially faced downward pressure due to a spike in the US Unemployment rate in August, but it staged a recovery following strong job creation figures.

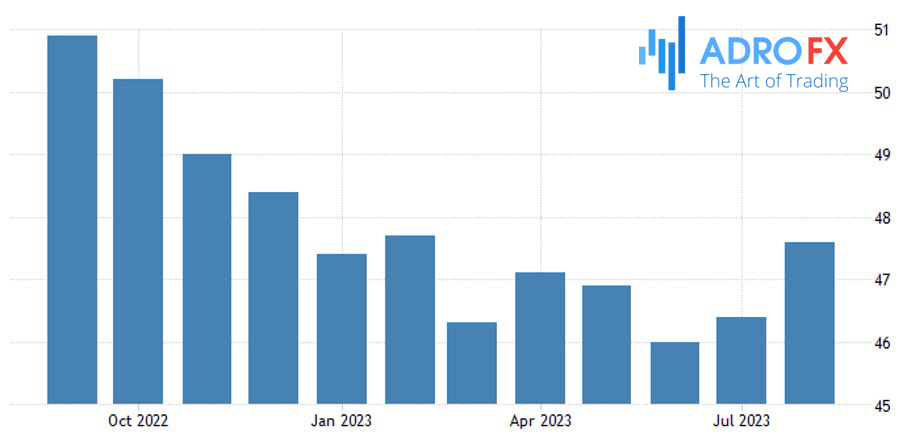

The US ISM Manufacturing Purchasing Managers' Index (PMI) climbed to 47.6, up from the previous reading of 46.4 and surpassing the median forecasts of 46.9. Additionally, ISM Manufacturing Prices in the US showed an upward trend.

In the bond market, the 10-year US bond yield increased by 7 basis points to 4.18% at the close of trading in New York, while the US 2-year treasury rate settled at 4.88%, up from 4.86%. Global bond rates exhibited mixed trends.

The Euro (EUR/USD) retreated to 1.0785 from its Friday opening level at 1.0845, with an overnight low at 1.0835. Sterling (GBP/USD) weakened against the overall stronger US Dollar, falling to 1.2595 from 1.2670.

Market activity is expected to slow down today due to the absence of trading in the US and Canada, both of which are observing Labor Day to honor workers and acknowledge their contributions to society.

The day's economic calendar began with New Zealand releasing its Q2 Terms of Trade, which saw a 0.4% increase, surpassing expectations of -1.3% and an earlier figure of -1.5%.

Australia is set to follow with its Company q/q Gross Profits, with forecasts indicating a decline of -0.9% from a previous figure of 0.5%. Australia's ANZ August Job Advertisements will also be released, with a month-on-month forecast of 0.6% compared to the previous reading of 0.4%.