US Inflation Report Evidence Further Rates Hikes | Daily Market Analysis

Key events:

- China – Industrial Production (YoY) (Feb)

- UK – Spring Statement

- USA – Core Retail Sales (MoM) (Feb)

- USA – PPI (MoM) (Feb)

- USA – Retail Sales (MoM) (Feb)

- USA – Crude Oil Inventories

- New Zealand – GDP (QoQ) (Q4)

The U.S. consumer inflation report was the most important statistical release of the week. According to data released on March 14 by the U.S. Department of Labor:

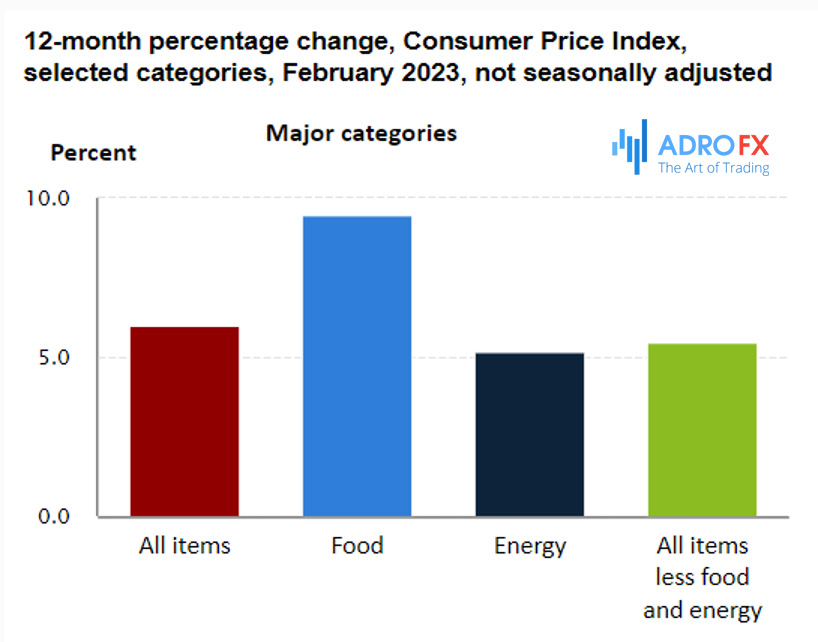

- Consumer Price Index (CPI) in February 2022 rose 0.4% over January (m/m) and rose 6.0% over the same month a year earlier (y/y).

The data was fully in line with the forecast of economists surveyed by Bloomberg.

- Core CPI, which excludes the most volatile items such as food and energy, rose 0.5% mom and 5.5% y/y in February.

The year-to-year core CPI was in line with economists' consensus estimates, while the month-to-month core CPI was stronger than the estimate (+0.4% m/m was expected).

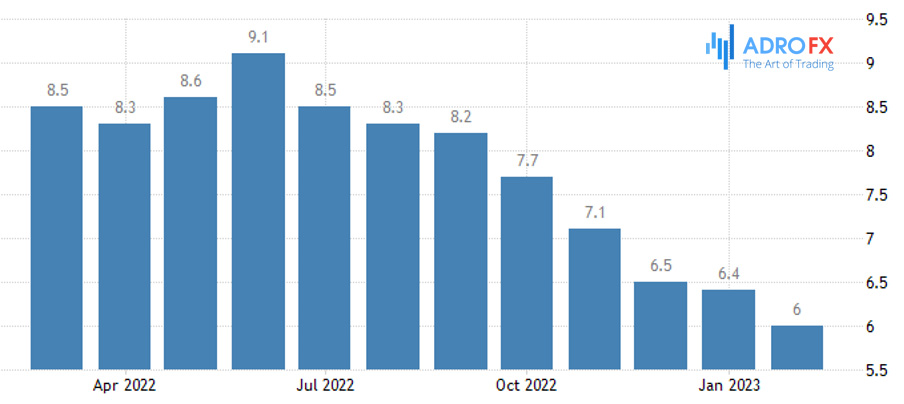

Nevertheless, U.S. inflation has been slowing for 8 months in a row and core inflation has been slowing for 5 months in a row.

We did not see any positive surprise for the Fed in the published report. Inflation is rising. The rate of inflation is slowing, but not fast enough for the Fed to contemplate a sharp interest rate cut by the end of the year, as the money market is now suggesting. This is evidenced by the steady inflation of basic services. The labor market does support upward price pressure in this sector. And here's the problem. The Fed is due to make its rate decision on the evening of March 22. And the Fed's priority inflation indicator, the Personal Consumption Expenditures Price Index (PCE), won't be released until March 31 (February). And that indicator could accelerate in the last month of the winter (+4.7% in January could turn into +4.8% y/y in February). Home rents rose 0.3% in February vs. January after 5 consecutive months of decline. While used car prices declined in the month under review, airfare, auto insurance costs, and new car prices rose.

That is why we expect the Fed to raise rates 25 bps to 4.75%-5.00% on March 22. So far we see a high probability that the U.S. Central Bank will implement a similar move in May (there is no rate meeting scheduled for April). As for rate cuts before the end of the year, much will depend on how successfully the U.S. financial authorities will be able to buy the problem in the banking sector.

Even if we are wrong and the Fed does not raise the federal funds rate next week because of the SVB bankruptcy, it would hardly be a signal that peak rates have already been reached. It would look like a tactical decision by the Fed to pause for 2 months, implying that it will raise rates again in May. So far, we see no clear signals that the rate of inflation is ready to slow down more substantially. Therefore, we cannot yet agree with current market expectations of a significant rate cut by the end of the year.

The federal funds rate futures market on the evening of March 14 was banking on a 70 percent probability of a 25 bps rate hike on March 22. (57% as of March 13). A peak rate of 4.9% is expected at the end of May. By the end of 2023, the market implies a 70 bps decrease in the rate to 4.2%.

Equities in Europe and the U.S. rebounded on Tuesday after falling on Monday. Treasury yields rose along the entire length of the curve. The yield on 2-year notes rose 24 bps to 4.22%, and the yield on 10-year bonds rose 5 bps to 3.63%. The VIX Greed and Fear Index rose above 30p on Monday for the first time in 2023, but by Tuesday evening it had fallen to 24.91p, which was still the highest value since December 2022.

Despite the rise in yields, the dollar index declined on Tuesday. Despite the cheaper dollar, gold prices declined but remained above $1900/oz.