European Markets Volatile as Economic Concerns and Interest Rate Uncertainty Heighten Anxiety | Daily Market Analysis

Key events:

- UK – Retail Sales (MoM) (Mar)

- UK – Composite PMI

- UK – Manufacturing PMI

- UK – Services PMI

- USA – Manufacturing PMI (Apr)

- Canada – Core Retail Sales (MoM) (Feb)

On Thursday, European markets are experiencing losses in what has been a volatile week of trading. The market uncertainty is driven by economic concerns and uncertainty surrounding interest rates. The recent mini-banking crisis has further complicated the tightening cycle, with the ripple effects expected to affect credit and the economy throughout the year.

The fear of overtightening is heightened for central banks, particularly the Fed, as they risk making a mistake just as price pressures are potentially easing. Another round of rate hikes is anticipated next month, but discussions will likely be more balanced thereafter.

During Thursday evening's trading, US stock futures remained in a narrow range, following a negative session triggered by mixed earnings from Tesla Inc. and contracting economic data.

Meanwhile, gold prices showed little movement but maintained critical levels, given a series of weak economic readings that raised concerns over slowing growth and led to increased demand for the safe-haven yellow metal.

Despite some pressure from the dollar's strength earlier in the week, softer-than-anticipated manufacturing and employment data impacted the greenback in recent sessions and fueled concerns of a potential recession this year. This development favored bullion prices, enabling them to remain above the essential $2,000 level. However, the hawkish signals from the Federal Reserve and other central banks restricted any significant gains in the value of the precious metal.

The current period of choppy trading appears to be driven by the economic data not meeting expectations. For example, the UK this week has demonstrated this. It will be challenging to justify a pause in tightening when inflation is above 10%, as it was believed to be transitory not long ago.

Central banks may not have the confidence or the credit to take risks in these uncertain times, making the next few months an anxious period. While the ECB's decision-making is slightly less complicated, as interest rates have not risen as much, the proximity of the meeting to the recent bank failures may still cause anxiety within the committee. The upcoming minutes will provide further insight into the ECB's perspective.

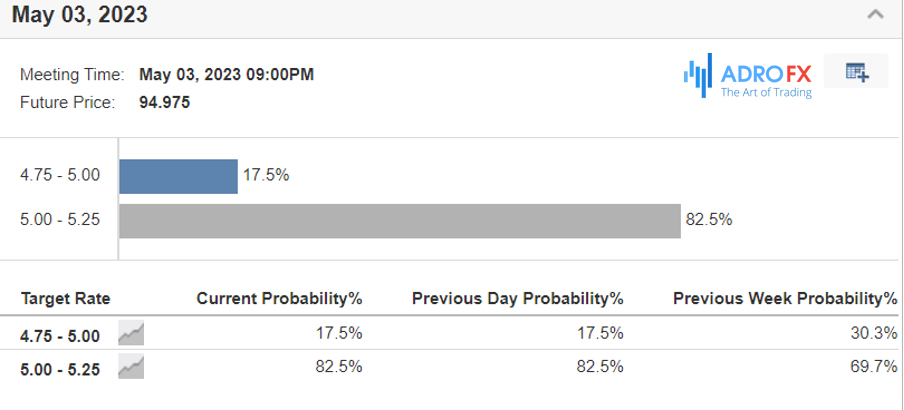

Keeping an eye on the Fed, the probability of a 25-basis-point increase next month remained constant at 87% this morning, according to the Fed Rate Monitor Tool:

Despite the cooler price gains in recent economic reports, Fed speakers continue to emphasize the issue of inflation. It is helpful to take a closer look at the data, and as Kevin Gordon, Schwab's senior investment strategist, notes, "There has been a lot of cheering over the disinflation in headline inflation metrics, but core measures- which strip out volatile food and energy prices- are not easing nearly as fast."

On a more positive note regarding inflation, Wednesday's Fed Beige Book Survey, which provides an overview of recent developments in the U.S. economy, describes consumer spending as "flat to down slightly." It also notes that lending volumes and loan demand are declining for both business and consumer-type loans. The Beige Book states that banks tightened lending standards amid increased uncertainty and "liquidity concerns." Additionally, it observes moderating growth in employment, which might come as a relief to the Fed since tightness in the job market could lead to extended price pressure.

Today, the focus of the markets will be on the PMI figures. The euro area is likely to be driven by the growth and inflation of the services sector, but it will be intriguing to observe whether the manufacturing sector will display any favorable spill-over impacts from the Chinese re-opening. Additionally, the US PMIs will provide clarity on economic activity after the indistinct picture of March.

Furthermore, we anticipate several Moody's and S&P sovereign debt ratings for countries including Ireland, France, and Italy, among others with Ireland to receive an upgrade.