U.S. Consumer Inflation Slows for the Sixth Month in a Row | Daily Market Analysis

Key events:

- UK – GDP (MoM)

- UK – GDP (YoY)

- UK – GDP (QoQ)

- UK – Manufacturing Production (MoM) (Nov)

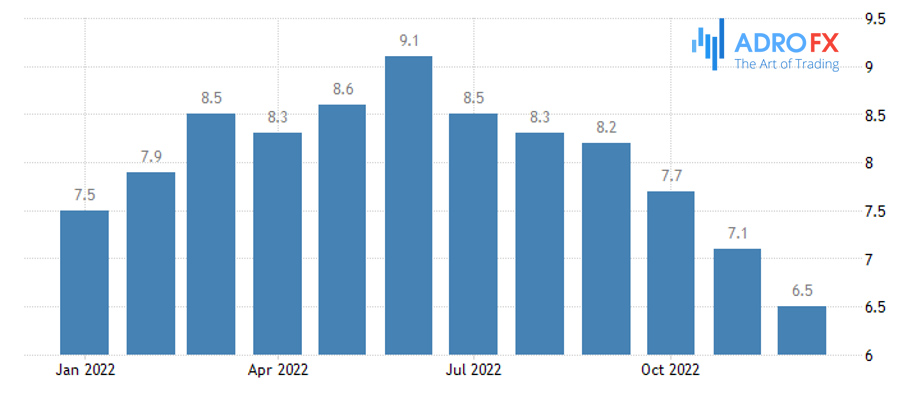

The U.S. consumer inflation report was the most important statistical release of the week. According to data released by the U.S. Department of Labor yesterday:

- The consumer price index (CPI) in December fell 0.1% from November (m/m) and rose 6.5% from the same month a year earlier (y/y);

The data were in line with the forecast of economists surveyed by Bloomberg.

- Core CPI, which excludes the most volatile items (food, energy), rose 0.3% mom and 5.7% y/y in December.

Here the actual result was also completely in line with the forecast.

Thus, U.S. inflation has been slowing for 6 months in a row, and core inflation has been slowing for 3 months in a row.

The data raises the possibility that inflation is declining steadily, primarily at the core level, as the core CPI reflects in more detail the dynamics of the Personal Consumption Expenditures (PCE) price index, which the Fed views as a key indicator of price pressures in the country.

The federal funds rate futures market is 100% confident that the Fed will raise rates by 25 bps on February 1, abandoning the possible option of a 50 bps rate hike as it did in December. While earlier this week the market saw a 25% probability of a 50bp hike on February 1, that move is now implied with less than an 8% probability.

Treasury yields have been falling along the entire length of the curve. The yield on the 2-year notes fell 11 bps to 4.1%, hitting a new 3-month low and we may see the day close below the 100-day moving average for the first time since August 2021. The 10-year bond yield fell 8.5 bps to 3.458%, its lowest since December 15.

The dollar index fell to 102.3p for the first time since June. Gold, in response to lower yields and dollar weakness, rose above $1900/oz (spot market) for the first time since May 2022. European stocks rallied steadily, but U.S. stocks were down after the inflation report. This might be because many expected to see actual numbers even below the forecasts. However, this did not happen.

The risk appetite is due to hopes for a faster peak in the Fed's rate hike, which should not rise above 5% per annum. This implies a 25bp rate hike in February and a possible 25bp hike in March and then a pause in the cycle. At the beginning of the week, the market implied a 100% probability of a 0.25% rate hike in March. However, at the moment the probability of such a step decreased to 80%. This indicates that the market is beginning to form expectations that February's 0.25% hike will be the last in the cycle. That said, the market is still banking on the possibility of a 25-50 bps rate cut by the end of 2023. Although Fed officials insist that the rate could rise above 5% per year and not be lowered until 2024. But the markets don't believe the Fed.

As we noted earlier, there is not yet enough reason to confidently assume a rate cut as early as the end of this year. If the U.S. economy avoids a serious recession and China manages to ignite economic expansion with realizable stimulus, China's demand for raw materials may support global inflation and the Fed may indeed still keep rates at their peak level until the end of 2023.

Based on hindsight from Goldman Sachs, there have been 8 instances since 1914 where inflation has been below 2.5%, then jumped above 5%, then dropped back below 2.5%. On average, it has taken 48 months to complete such a cycle. In the current cycle, January 2023 is only the 20th month of the cycle.

Prices of basic goods are still down, but inflation in basic services has risen. Again, this is primarily due to the still robust inflation in the housing cost component.

There is a risk that the market is overly optimistic in its expectations of the prospect of lower rates at the end of 2023. And it is also overly optimistic in forming expectations that the February rate hike may be the last in the cycle.