Uncertainty Looms as US Stocks Await Inflation Data and Federal Reserve Meeting; Australian Dollar Rises After Surprising Rate Hike | Daily Market Analysis

Key events:

- Australia - GDP (QoQ) (Q1)

- Canada - BoC Interest Rate Decision

- USA - Crude Oil Inventories

On Tuesday, despite some progress in economically sensitive sectors, US stocks exhibited a sense of uncertainty as investors awaited crucial inflation data and the upcoming policy meeting of the Federal Reserve.

The anticipated inflation data is expected to reveal a slight moderation in consumer prices during May on a month-over-month basis. However, core prices are likely to remain elevated. Meanwhile, the consensus is that the Federal Reserve will maintain interest rates at their current levels.

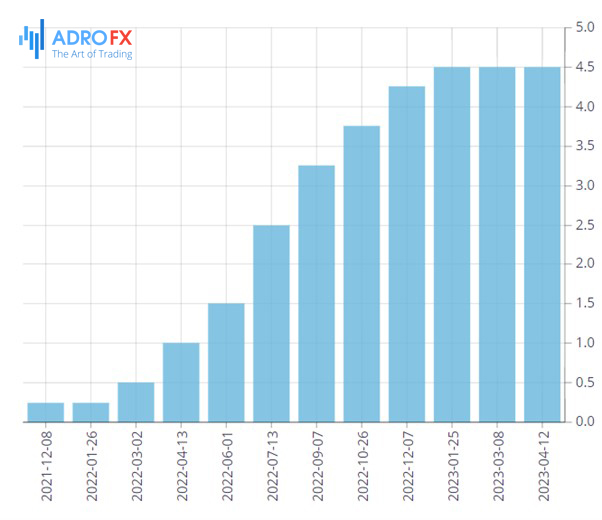

Investors were pausing for a moment after propelling the S&P 500 index up by nearly 20% from its lows in October 2022. This upward momentum was driven by the performance of mega-cap stocks, a positive earnings season surpassing expectations, and the optimistic belief that the US central bank is approaching the conclusion of its cycle of interest rate hikes.

Recent economic data and the dovish comments from Federal Reserve officials have increased the likelihood of the Federal Reserve maintaining interest rates during its upcoming meeting on June 13-14.

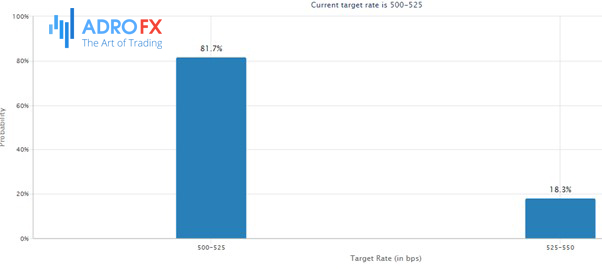

Based on Fed fund futures, traders have priced in an approximately 80% probability of the central bank keeping interest rates within the range of 5% to 5.25%. This information is derived from CME Group's Fedwatch tool. However, there is a 50% chance that the Federal Reserve may implement another 25-basis-point rate hike in July, according to market expectations.

Furthermore, the CBOE volatility index, also known as the VIX, has reached its lowest level since July 2021. Currently, it has declined to 13.95. This suggests a relatively lower level of market volatility at the present time.

On Tuesday, the dollar index exhibited renewed strength, surpassing the 104 mark and poised to fully recover from its recent pullback between the levels of 104.58 and 103.30.

In recent days, the performance of the greenback has been uncertain due to increased market volatility triggered by the Federal Reserve's comments regarding its policy outlook, including discussions of a potential pause or continuation of tightening measures during the June meeting. Additionally, employment and services sector data have contributed to the fluctuation in the currency's value.

Despite the release of strong US payroll data for May, which heightened expectations for another interest rate hike, there is a growing belief that the Federal Open Market Committee (FOMC) will maintain interest rates unchanged in June. However, the likelihood of a 25 basis points rate hike in July is increasing, which has been providing support to the dollar.

Meanwhile, European markets experienced a lackluster trading session as higher interest rates and disappointing economic data dampened sentiment throughout the day. However, as the session draws to a close, there is a slight upward movement in prices.

Currently, it has become increasingly challenging to determine a clear direction for the markets as there is a lack of significant catalysts influencing investor sentiment in either direction.

The unexpected decision by the Reserve Bank of Australia to raise interest rates by 25 basis points, marking the second consecutive month of such action, has affected risk appetite and raised concerns about the economic outlook. Additionally, another discouraging report on German factory orders for April has added to the concerns. Meanwhile, oil prices have reversed the gains made from the Saudi production cuts announced on Monday.

Following the Reserve Bank of Australia's (RBA) unexpected decision, the Australian dollar has emerged as the strongest performer. This move has brought the cash rate to 4.1%. The RBA's decision was uncertain until yesterday, but recent weeks have witnessed a shift in how the central bank is perceived in Australia, as well as its perceived competence. The rate hike indicates that the recent criticism has made an impact, and the hawkish guidance provided suggests the possibility of further rate hikes, with room for rates to go even higher. The RBA has been lagging behind for months, and the concern is that in their effort to catch up, they might do more harm than good.

Apart from the Australian dollar, there is also a notable upward movement in the Canadian dollar, as investors anticipate a potential surprise rate hike during the Bank of Canada's meeting scheduled for today. This aligns with the trend of central banks taking unexpected actions in their monetary policies.

The Bank of Canada takes center stage today, with Governor Tiff adopting a rather secretive approach, keeping the upcoming rate decision undisclosed. This has raised questions about the unusually low post-meeting volatility. There is speculation that, at the very least, we could anticipate a "hawkish hold," but the absence of any pre-communication about the rate decision has created an air of uncertainty. If the Bank of Canada were to surprise the market with a rate hike, it would undoubtedly trigger significant activity in the foreign exchange markets, particularly given the contrasting backdrop of the Federal Reserve's communicated pause for June.