Markets Rally as Powell Hints at Rate Cuts Amid Cooling Inflation and Economic Uncertainty | Daily Market Analysis

Key events:

- USA - Durable Goods Orders (MoM) (Jul)

US stocks surged on Friday as Treasury yields dropped following Federal Reserve Chair Jerome Powell's hints at upcoming rate cuts.

The S&P 500 increased by 1.1%, resulting in a 1.5% weekly gain. Meanwhile, the Dow Jones Industrial Average jumped by 462 points, or 1.1%, and the NASDAQ Composite rose by 1.5%.

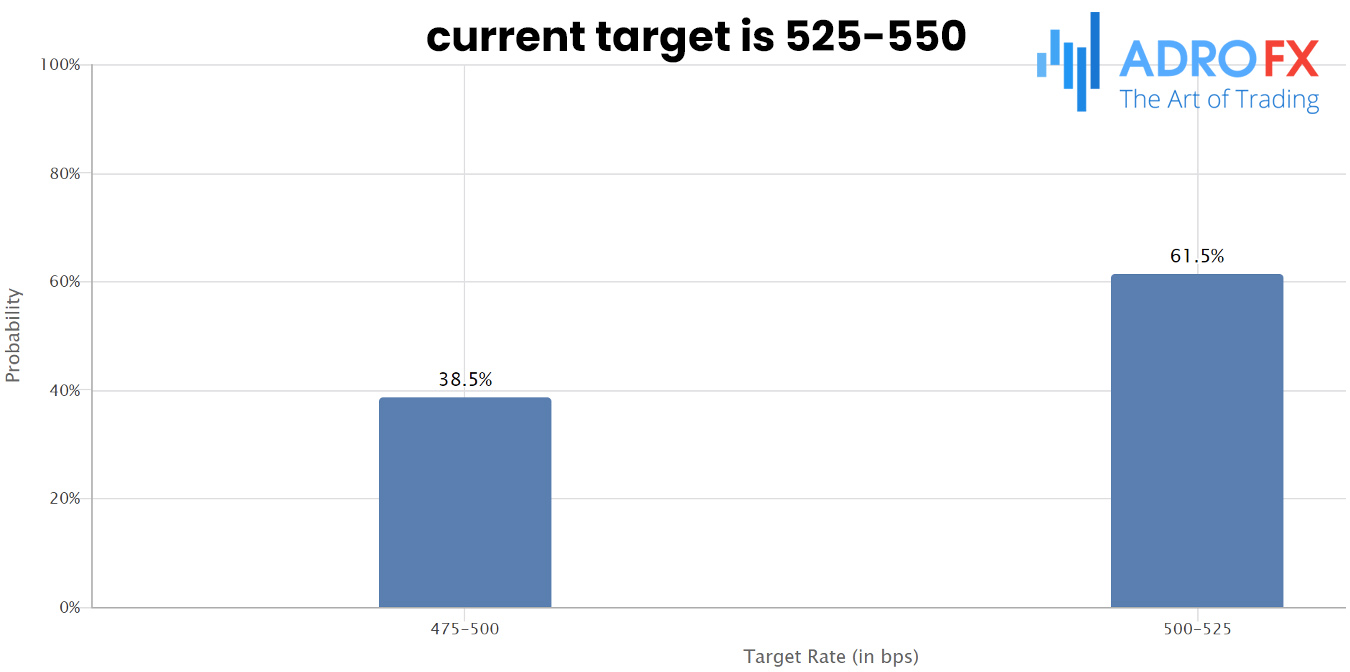

During the Jackson Hole Symposium, Powell indicated that the time had come to adjust monetary policy in response to cooling inflation and a slowing labor market. He also suggested that the scope and frequency of future rate cuts would be data-dependent.

“The direction is clear, but the timing and pace of rate reductions will hinge on incoming data, the evolving economic outlook, and balancing risks," Powell stated at the Kansas City Fed's annual conference in Jackson Hole, Wyoming, on Friday.

Following Powell's speech, Philadelphia Fed President Patrick Harker emphasized the need for the US central bank to gradually lower interest rates. Concurrently, Chicago Fed President Austan Goolsbee noted that monetary policy is currently at its most restrictive level, and the Fed is now shifting its focus toward fulfilling its employment mandate.

Treasury yields experienced a significant decline, with the 2-year yield, which is sensitive to Fed policy, dropping 8 basis points to 3.93%.

Gold prices are trading with a slight negative bias near the $2,500 psychological level on Monday. However, expectations that the Federal Reserve will start lowering interest rates in September may limit the downside for the precious metal. Lower rates tend to be favorable for gold, as they reduce the opportunity cost of holding the non-yielding asset.

Additionally, rising geopolitical tensions in the Middle East and ongoing economic uncertainty could increase demand for safe-haven assets like gold. On the flip side, weaker demand from the Chinese economy, the world's largest producer and consumer of gold, might weigh on prices.

The AUD/USD pair traded lower around 0.6790 during early Asian trading on Monday. However, the US Dollar is expected to remain under pressure after Federal Reserve Chairman Jerome Powell's dovish remarks at the Jackson Hole Symposium. The US Durable Goods Orders for July are set to be released later on Monday.

Minutes from the Reserve Bank of Australia revealed that board members believe a rate cut is unlikely in the near future. RBA Governor Michele Bullock highlighted that the central bank would not hesitate to raise rates again if inflationary pressures persist. These hawkish comments may provide additional support for the Australian Dollar against the US Dollar.

The Australian Dollar edged lower but remained close to a seven-month high of 0.6798 on Monday. The AUD/USD pair gained traction due to rising risk-on sentiment following Powell's dovish speech. The Australian currency also benefited from the hawkish outlook of the RBA, as recent minutes indicated that rate cuts are not expected anytime soon. Additionally, RBA Governor Michele Bullock reiterated the bank's readiness to hike rates again if necessary to combat inflation.

Meanwhile, the GBP/USD pair strengthened to around 1.3215 during early Asian trading on Monday. The US Federal Reserve's signal of potential monetary easing in September weighed on the Greenback, lending support to the British Pound. Additionally, speculation that the Bank of England's policy easing cycle will be slower than that of other major central banks provided further support for the Pound. BoE Governor Andrew Bailey cautioned on Friday that, despite some easing in pricing pressures, it is too soon to declare victory over inflation, which remains a significant concern for the UK central bank.

Later on Monday, the US July Durable Goods Orders report is due. Key economic data releases this week include the preliminary US Gross Domestic Product for the second quarter and the Personal Consumption Expenditures-Price Index (PCE) for July, which are scheduled for Thursday and Friday, respectively.