Inflation Data and Central Bank Meetings in the Spotlight | Daily Market Analysis

Key events:

- UK – Average Earnings Index +Bonus (Oct)

- UK – Claimant Count Change (Nov)

- UK – BoE Gov Bailey Speaks

- USA – Core CPI (MoM) (Nov)

- USA – CPI (YoY) (Nov)

- USA – CPI (MoM) (Nov)

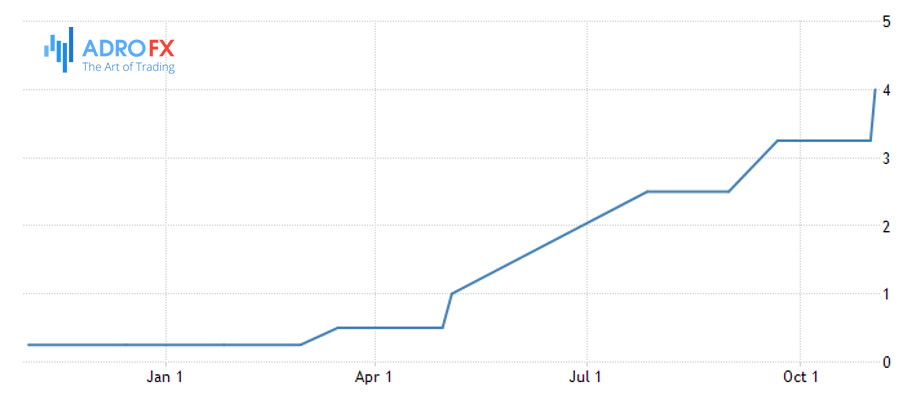

We live in a world where inflation plays a major role in the economy, so investors are looking forward to today's release of the U.S. Consumer Price Index (CPI). Unless the numbers diverge very much from the forecast, the Fed will raise interest rates as expected. The consensus forecast calls for a 50 basis point hike after four hikes of 75 basis points. The Fed Funds rate is expected to be in the 3.75-4.00% range after six hikes.

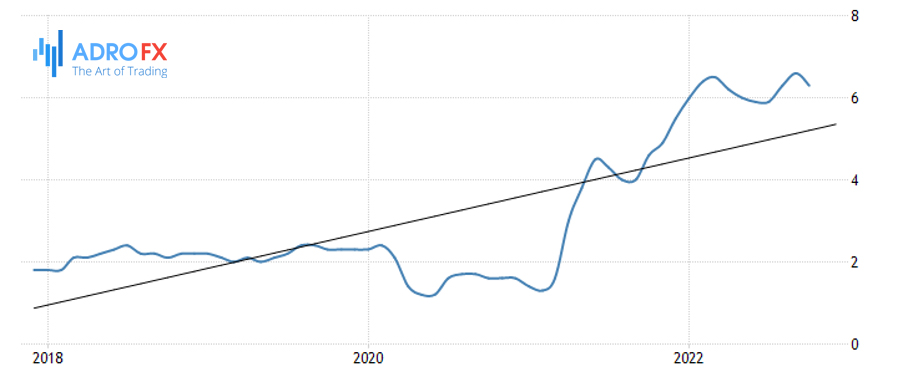

Inflation is projected by economists to be 0.3% and core inflation at 0.4%, up from 0.4% and 0.3%, respectively, in October. (Core inflation does not take into account volatile energy and food prices, thus being a more telling indicator.)

Annual inflation, according to the consensus forecast, should have fallen to 7.3% from 7.7%. If the data shows the same or stronger price growth than last year, the Fed could raise rates again by 75 basis points.

While the Fed is too lax an institution to have its rate hike plans changed by the time of Wednesday's FOMC meeting after Tuesday's CPI release, the data could still influence Chairman Jerome Powell's statement. The language he uses, as well as what he didn't say, has often bogged down markets in the past. As we can see, investors' expectations for monetary policy become optimistic or pessimistic according to the short-term trend.

If the link between policy and the short-term trend continues, expectations could soon turn bearish again, with another short-term sell-off coinciding with a medium-term downtrend.

The European Central Bank is also expected to follow suit on Thursday, along with the Bank of England and the Swiss National Bank.

Any doubts about the Bank of England's hike this week were probably removed earlier by data showing that the U.K. economy recovered slightly more than expected in the month after Queen Elizabeth's funeral, though a recession over the next six months seems inevitable.

We also should not forget that COVID fears in China are increasing. Chinese stock indices fell along with the yuan after authorities announced a sharp increase in the number of referrals to clinics in the country.

The figures, along with numerous unconfirmed reports that the health service is under increasing pressure, show how quickly COVID-19 has spread since travel restrictions were lifted earlier this month in response to mass protests.

On Sunday, clinics in Beijing admitted 22,000 people, 16 times more than the week before. Other media reports noted long lines of people outside hospitals waiting for treatment and disruptions in delivery services because couriers were sick. State media urged people not to call the ambulance hotline unless they were seriously ill.

Also of note, crude oil prices tested 13-month lows overnight in response to news of COVID-19 from China, which raises growing doubts about the country's growth prospects for the next six months. Analysts at Citigroup cut their average forecast for oil next year by 10% to $80 a barrel.