Global Markets Primed for New Quarter: Eyes on Inflation, Monetary Policy, and Safe-Haven Assets | Daily Market Analysis

Key events:

- USA - S&P Global US Manufacturing PMI (Mar)

- USA - ISM Manufacturing PMI (Mar)

- USA - ISM Manufacturing Prices (Mar)

As the new quarter kicks off, Asian markets prepare to embark on a promising trajectory, bolstered by indications of a gradual easing in US inflation data last Friday and positive macroeconomic figures from China over the weekend. Notably, both the manufacturing and service sectors exhibited an uptick in the closely monitored PMI prints.

With much of Europe observing Easter closures, trading volume in the London session on Monday may be lighter than usual. However, US stock and bond futures markets remain operational, offering investors the opportunity to respond swiftly to the latest economic developments.

Federal Reserve Chair Jerome Powell weighed in on Friday's inflation data, remarking that it aligned "fairly well with our projections." He stressed the importance of refraining from interest rate adjustments until there's confidence in inflation's trajectory toward the central bank's target of 2%.

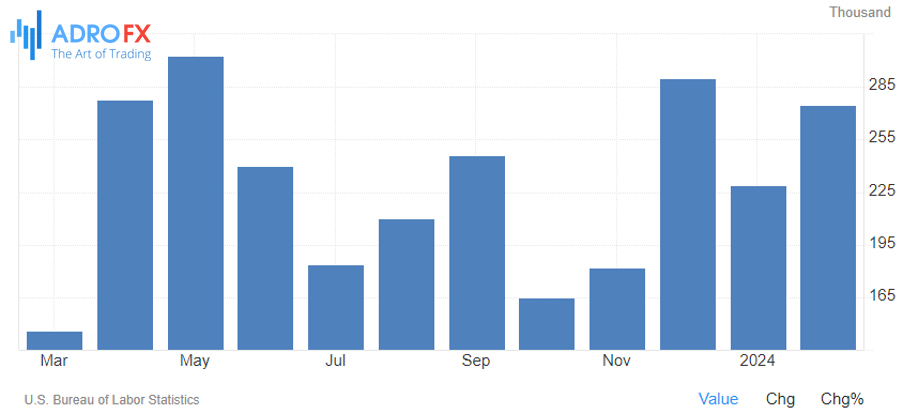

Given the Fed's data-driven approach, investors eagerly anticipate the release of key economic indicators at the start of each month. The upcoming Non-Farm Payrolls report holds particular significance, often shaping market expectations regarding future monetary policy decisions. However, deeper insights into the Fed's stance won't emerge until April 10th, following the release of the March CPI data, which will clarify the Fed's interpretation of elevated inflation readings from earlier months.

Gold prices continue their upward trend, marking a fifth consecutive day of gains and reaching a new record high above $2,250 during the Asian session on Monday. The recent US Personal Consumption Expenditures Price Index release, indicating moderate inflation growth in February, reinforces expectations of an impending rate cut cycle by the Federal Reserve in June. This dynamic strengthens the appeal of gold as a non-yielding asset. Additionally, geopolitical tensions from conflicts like the Russia-Ukraine war and Middle Eastern turmoil further support gold's status as a safe-haven investment.

Despite a prevailing risk-on sentiment, which typically dampens gold prices, the underlying bullish momentum remains resilient. Even sporadic bouts of US Dollar buying fail to undermine the strong upward trajectory of XAU/USD. This reaffirms Friday's breakout above the previous all-time high around the $2,223 level, suggesting that the path of least resistance for the precious metal continues to be upward.

At the outset of the new week, the Japanese Yen presents a softer stance against its American counterpart, albeit without significant follow-through, as it remains within a familiar range observed over the past fortnight. The cautious approach of the Bank of Japan and uncertainty surrounding future rate hikes, coupled with a prevailing risk-on sentiment, continue to weigh on the safe-haven appeal of the JPY. However, prospects of potential government intervention to counter excessive declines in the domestic currency could deter significant bearish positions on the JPY.

Meanwhile, the Australian Dollar retraces its recent losses on Monday, potentially boosted by encouraging Chinese PMI data. Additionally, diminished US Treasury yields exert downward pressure on the US Dollar, providing further support to the AUD/USD pair. Trading activity is expected to be subdued due to the observance of Easter Monday.

However, the Australian Dollar faces headwinds amidst weaker Consumer Inflation Expectations, hinting at anticipated interest rate cuts by the Reserve Bank of Australia later in 2024. Investors eagerly await the release of the RBA Meeting Minutes scheduled for Tuesday, which could offer valuable insights into the central bank's monetary policy outlook.

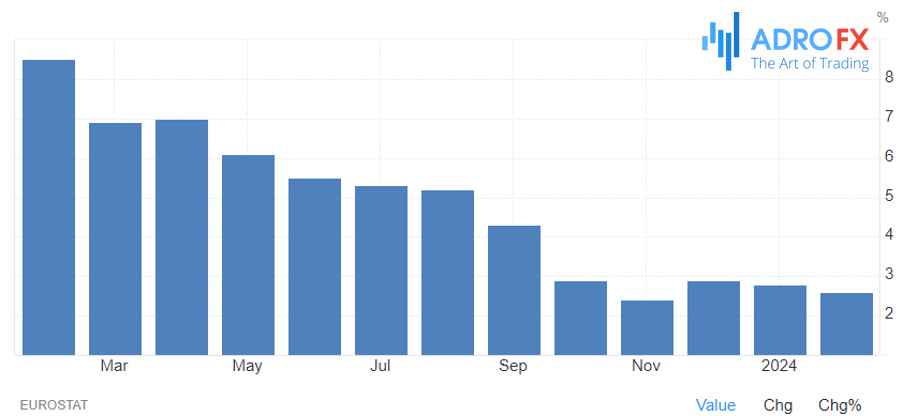

Wednesday brings anticipation as the Eurozone prepares to unveil its flash inflation data for March, a release that will be scrutinized closely amidst speculation surrounding the European Central Bank's potential rate cut in June.

Inflation within the euro area has maintained elevated levels since the year's commencement, necessitating a further decline to pave the way for an ECB rate reduction in the summer months. Consequently, the upcoming trio of inflation reports holds paramount importance for both markets and the ECB.

Should inflation exceed expectations, predictions of a rate cut would likely be postponed.

Addressing the matter on Saturday, ECB Governing Council member Robert Holzmann hinted at the possibility of the ECB lowering its key interest rate prior to the Federal Reserve, underscoring the comparatively sluggish growth of the European economy in contrast to its American counterpart.