Federal Reserve's Rate Cut Signal Propels US Stocks to New Highs Amid Retail Rebound | Daily Market Analysis

Key events:

- Eurozone - EU Leaders Summit

- USA - S&P Global Services PMI (Dec)

On Thursday, US stocks experienced an upward surge, building on the strong gains from the previous session. This was prompted by the Federal Reserve's indication of upcoming interest rate cuts in the next year, along with a rebound in retail sales.

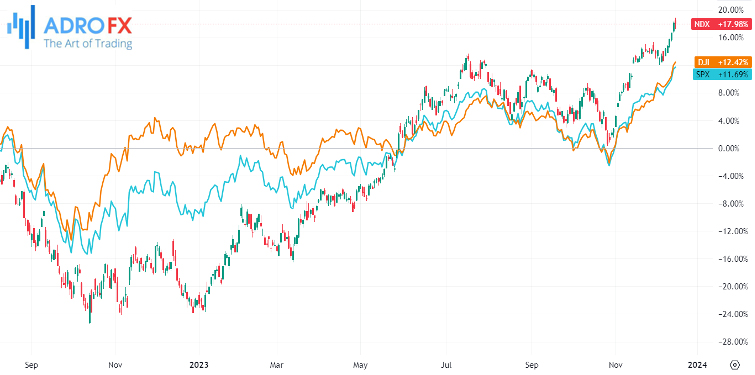

The Dow Jones Industrial Average showed a 105-point increase, equivalent to 0.3%. The S&P 500 index traded 24 points, or 0.5%, higher, while the NASDAQ Composite climbed by 88 points, or 0.6%.

Following Wednesday's impressive performance, where the DJIA gained over 500 points (1.4%), achieving an all-time closing high, the S&P 500 and NASDAQ Composite also rose by 1.4%, reaching their highest closing levels for the year.

Simultaneously, US Treasury yields experienced a significant decline. The rate-sensitive 2-year Treasury yield reached its lowest point since June, and the benchmark 10-year yield dropped to its weakest level since August.

The rally in these three major indices - DJIA, S&P 500, and NASDAQ - resulted in technically "overbought" conditions, surpassing the 70-level threshold on the relative strength index (RSI), indicating a potential overextension in market strength.

The surge in stocks occurred a day after the Federal Reserve outlined plans for three rate hikes in the upcoming year. Fed Chairman Jerome Powell also announced the consideration of rate cuts, influencing the market sentiment.

Apart from technical aspects, concerns have been raised about whether valuations have risen too rapidly. Although initial jobless claims saw a decrease of 19,000 to 202,000, suggesting economic strength, concerns persist about potential weaknesses, particularly for small businesses facing increased interest rates.

Nevertheless, the consumer sector displayed resilience, with US retail sales unexpectedly rising by 0.3% in November, signaling a robust start to the holiday shopping season.

While Apple closed at a new record high, some profit-taking occurred in the big tech sector, leading to declines for Alphabet Inc Class A and Microsoft Corporation. On the positive side, semiconductor stocks reached an all-time high, boosted by Intel's rise to fresh 52-week highs after unveiling new AI chips to compete with industry leaders NVIDIA Corporation and Advanced Micro Devices Inc.

A significant market shift occurred as the Federal Reserve's indication of a potential rate cut influenced trading dynamics. The DAX and CAC 40 initially surged to new record highs, supported by falling yields across various countries and durations. However, this bullish momentum waned in the afternoon as the European Central Bank (ECB) and the Bank of England (BoE) resisted adopting a similar rate cut outlook, leading to a decline in the DAX.

In contrast, the FTSE100 managed to withstand some of this resistance, benefiting from the sharp yield declines that boosted the commercial real estate and housing sector. The FTSE100 surpassed its 200-day Simple Moving Average (SMA), a crucial technical level, reaching its highest level in almost three months.

The Swiss National Bank opted to maintain unchanged rates while keeping the option open for currency intervention, responding to recent robust gains in the currency. Following the Bank of England's decision to keep rates steady, the pound reached daily highs. Notably, three MPC members - Mann, Haskel, and Greene - remained hawkish, advocating for an additional 25bps rate hike despite recent disappointing UK economic data.

The dovish shift by the Federal Reserve exerted downward pressure on the US dollar, leading to a four-month low against a basket of currencies. This abrupt change also posed a challenge to the ECB, which had raised rates in September. However, the ECB maintained its hawkish stance, despite Q3 contractions in the German and French economies and lower headline inflation in the euro area compared to the US.

The incongruence between the Fed's pivot and the ECB's stance is puzzling, especially given the data-dependent approach claimed by the ECB. The Fed's decision to pivot amid a robust Q3 GDP growth of 5% and headline CPI of 3.1% contrasts with the ECB's reluctance to lean towards rate cuts despite economic weaknesses in its major economies.

Gold experienced a rally from the 50-day SMA as yields plunged, and the US dollar retreated following the unexpected dovish pivot by the Fed. The weakness in the US dollar, coupled with expectations of multiple rate cuts next year, has contributed to a rise in oil prices, driven by the anticipation of economic stimulus and improved growth prospects.