Fed Comments Dampen Market Sentiment, S&P 500 and Nasdaq Close Lower | Daily Market Analysis

Key events:

- USA - Juneteenth

- Eurozone - ECB's Lane Speaks

- Eurozone - ECB's Schnabel Speaks

The S&P 500 closed lower on Friday due to the influence of market heavyweights like Microsoft, following comments from two Federal Reserve officials that dampened optimism regarding the central bank's imminent completion of aggressive interest rate hikes.

Similarly, the Nasdaq also concluded the week with a decrease, although both the Nasdaq and the S&P 500 remained near their 14-month highs. This was due to economic data during the week indicating a slowdown in inflation, which overshadowed concerns about additional rate hikes.

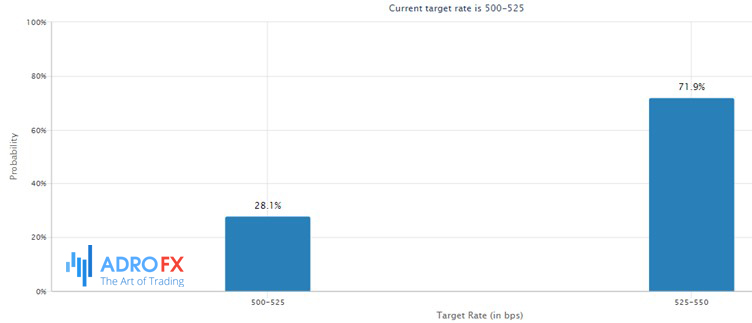

After maintaining interest rates on Wednesday, the US central bank hinted at the possibility of a half-percentage-point increase in borrowing costs by the end of the year. However, traders anticipate the Fed to pause hikes or potentially reduce rates in December, following an anticipated 25-basis-point rate hike in July, according to CMEGroup's FedWatch tool:

In an effort to temper this optimism, Fed policymakers expressed caution on Friday. Fed Governor Christopher Waller stated that "core inflation is not coming down like I thought it would," while Richmond Fed President Thomas Barkin indicated he was "comfortable" with further rate increases, as inflation had not yet returned to the desired 2% trajectory.

The recent rebound in the market can be attributed, in part, to the expectation of increased Chinese demand due to stimulus measures implemented by the Chinese authorities to support their struggling economy.

Furthermore, despite the Federal Reserve signaling a pause in its rate hiking cycle and the European Central Bank (ECB) implementing a 25 basis points rate hike last week, there is a growing belief that we are nearing the peak of rate increases. However, it is widely accepted that interest rates are unlikely to decrease in the near future.

Last week, the Bank of Japan stood out as an outlier by maintaining its current policy settings, seemingly ignoring the fact that core inflation is already at its highest level in 40 years.

In the upcoming week, market attention will focus on the Swiss National Bank and the Bank of England. Both central banks are expected to follow the ECB's lead and increase rates by 25 basis points.

Last week, the British pound experienced a significant surge, gaining 1.9% against the US dollar and reaching year-to-date highs at $1.2848. This upward movement allowed GBP/USD to break through both trendline resistance (drawn from the high at $1.4250) and resistance at $1.2767 on the weekly time frame. The pound is anticipated to have a significant week ahead as it currently sits at 14-month highs against the US dollar. Market expectations include the possibility of an additional 100 basis points (bps) of rate hikes.

In contrast, the US Dollar Index (DXY) is expected to face challenges in breaking above the 103.00 level and reaching the 104.00 range. Averages around the 102.00 and 103.00 levels are acting as barriers to prevent a significant rise in the DXY. On the downside, the mid-101.00 range is becoming oversold, presenting a dilemma for those considering short positions.

Gold prices remained relatively unchanged on Monday as investors awaited insights from a series of Federal Reserve speakers and testimonies scheduled throughout the week. These events are expected to provide further guidance on monetary policy.

Due to a public holiday in the United States, trading volumes in the metal markets are expected to be thin on Monday. Additionally, the anticipation of testimonies from Fed officials, notably Chair Jerome Powell, later in the week may discourage significant market movements and encourage more cautious trading.

During the upcoming week, investors will be paying close attention to several economic indicators and key speeches. The indicators include preliminary building permits and housing starts, Q1 current account data, existing home sales, and Markit's preliminary manufacturing and services Purchasing Managers' Index (PMIs).

Additionally, market participants will be closely monitoring speeches from members of the Federal Open Market Committee (FOMC) such as Bullard, Williams, Bowman, Barkin, Bostic, and Mester. Insights from the Federal Reserve's Chairman, Powell, along with speeches from Cook and Jefferson, will also be significant factors affecting market sentiment and direction. These speeches have the potential to provide valuable insights into the central bank's perspective on economic conditions, monetary policy, and potential future actions.