European Markets Fall as US Banks Struggle and Rate Hike Fears Mount | Daily Market Analysis

Key events:

- UK - Construction PMI (Apr)

- USA - Nonfarm Payrolls (Apr)

- USA - Unemployment Rate (Apr)

- Canada - Employment Change (Apr)

European markets experienced a negative session yesterday, erasing the slight recovery that occurred on Wednesday and more. The FTSE 100 dropped to a four-week low, while the DAX fell to a three-week low.

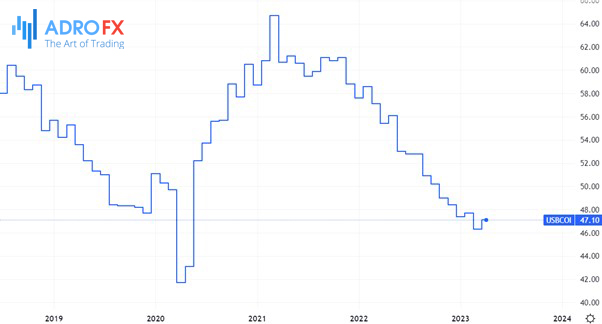

The European Central Bank's decision to raise interest rates by 25 basis points was as anticipated, but the euro retreated following the announcement. The ECB abandoned its pledge to continue raising interest rates, even though President Christine Lagarde emphasized that the bank had more work to do and had no intention of indicating a pause.

Regardless, the euro has retreated from its earlier highs due to the ECB's perceived less aggressive stance. With the Federal Reserve also adopting a less hawkish tone, central banks are increasingly cautious about pushing the limits without breaking something.

The US banking sector is already experiencing strains, with Western Alliance Bancorp and PacWest Bancorp struggling to stay afloat. US markets have finished lower for the fourth consecutive day, reflecting a "shoot first, ask questions later" mentality that is putting pressure on banks with a small deposit base. Western Alliance and PacWest Bancorp both have deposit bases of over 74%, which falls under the FDIC's $250k deposit guarantee scheme.

Although markets are fixated on the possibility of the rate hiking cycle ending and stock markets slipping from their recent highs, the bond market appears to have already made up its mind that the Fed and ECB are finished with raising rates. This crisis seems to have become a self-fulfilling prophecy of fear, with the market driving banks into trouble.

Naturally, economic data, such as today's April jobs report, could still affect the narrative, given that unemployment rates remain low in both Europe and the US.

The March jobs report proved to be a game-changer, debunking the notion of a sluggish US economy that had driven US 2-year yields to a low of 3.65% in early April. It showed a gain of 236k jobs, reducing the unemployment rate to 3.5% even as the participation rate increased to 62.6%.

Since then, the US 2-year yield has fluctuated, reaching a high of 4.28% as markets try to assess when the next rate change might happen.

The March data also revealed that people are returning to the workforce, most likely due to the cost of living, which is putting pressure on consumer finances. The labor force participation rate has increased for the fourth month in a row, now sitting at 62.6%.

Earlier this week, the JOLTs numbers for March confirmed a similar trend as more people returned to the workforce, pushing the numbers down to 9.6m. February had seen these numbers fall below 10m for the first time since May 2021. Additionally, the strong ADP report on Wednesday indicated resilience in hiring trends.

Although wages data for March showed a decline from 4.6% to 4.2%, it is expected that April's numbers will remain unchanged. This week's ISM services inflation saw a slight uptick, while employment stayed just above 50 at 50.8.

Today's job report is expected to be positive, although estimates are modest at 180k, which would be the weakest number in three years. While the Federal Reserve already hiked the rates by another 25bps earlier this year, a robust number today would keep the possibility of another rate hike in June alive. However, it would have to be a substantial number to make that happen.

Some believe that after Wednesday's events, the Fed is now on pause, and the question is not when we will see another hike, but rather when we will see the first rate cut.

Today's jobs report, along with next week's April CPI, will influence the discussion on this matter. However, even with the current banking turmoil, the timing of the Fed's decision to begin cutting rates is expected to play a crucial role in shaping market direction moving forward.