Dow Jones Rises Amidst Optimism for Last Rate Hike as Inflation Slows | Daily Market Analysis

Key events:

- UK - GDP (MoM) (May)

- USA - Initial Jobless Claims

- USA - PPI (MoM) (Jun)

The Dow Jones Industrial Average closed higher on Wednesday, despite giving up some of its gains. The positive finish was driven by a decline in Treasury yields and a boost in the tech sector following data that revealed the slowest increase in inflation in over two years. This development has sparked optimism that the anticipated rate hike later this month might be the last one.

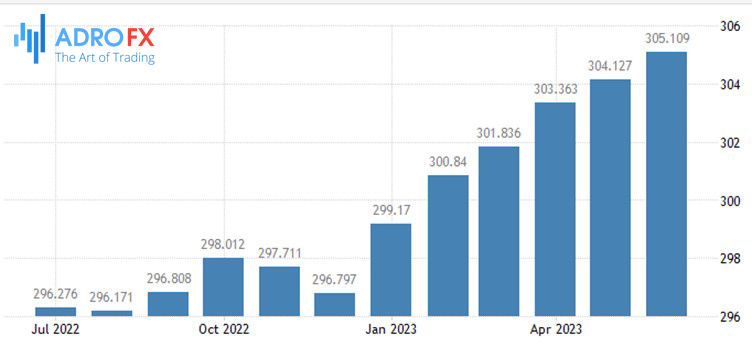

The Dow Jones Industrial Average climbed by 0.25% or 86 points, while the Nasdaq saw a gain of 1.2%, and the S&P 500 rose by 0.74%.

The consumer price index, which had risen by 0.1% in May, experienced a slight increase of 0.2% last month. Furthermore, the 12-month inflation rate eased from 4% to 3%, marking the lowest level of price pressures since March 2021.

Although there is still an expectation that the Federal Reserve will resume raising rates later this month, the possibility of further rate hikes beyond July is uncertain. This uncertainty arises from the likelihood of upcoming economic data indicating a further deceleration in inflation.

Jefferies, in a note, stated that if economic indicators in the coming months, such as the Employment Cost Index on July 28, as well as employment and inflation data released in August, continue to exhibit a slowdown similar to the recent Consumer Price Index data, then the rate hike in July may indeed be the final move in the current cycle.

Major technology companies, including Google (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Meta Platforms Inc (NASDAQ: META), rebounded from their recent downturn as Treasury yields experienced a significant decline. This shift was driven by expectations that the Federal Reserve's rate hikes are approaching their conclusion.

Microsoft saw an increase of over 1% as the tech giant made notable progress towards finalizing its $69 billion acquisition of Activision Blizzard Inc (NASDAQ: ATVI), the company behind the popular game Call of Duty. A Federal judge denied the Federal Trade Commission's request to postpone the acquisition, stating that there was insufficient evidence to suggest that the deal would harm competition. This development propelled Microsoft's positive performance.

The sell-off of the US dollar gained momentum following the release of the CPI data. As a result, the dollar index is rapidly approaching the 100 level, taking significant and consistent strides. This development is positive news for global inflation dynamics because a weaker US dollar tends to result in lower energy and raw material prices, which are typically negotiated in US dollars. Conversely, when the US dollar strengthens, it contributes to global inflationary pressures, so its depreciation can help alleviate such pressures.

In currency markets, the EUR/USD pair surged to 1.1150, while the GBP/USD pair surpassed the 1.30 level. Simultaneously, the USD/JPY pair extended its decline, dropping below the psychological level of 140.

In the precious metals market, gold is experiencing a boost due to lower yields and the weakening US dollar. The price of an ounce has rallied above $1960 and is currently consolidating around $1955 at the time of writing.

The Producer Price Index (PPI) figures for June, released today, are anticipated to confirm the ongoing trend of disinflation in the global economy. The headline PPI is expected to exhibit a significant deceleration, dropping from 1.1% in May to 0.4% in June. Meanwhile, the core PPI is forecasted to experience a more moderate slowdown, declining from 2.8% to 2.6%.

Irrespective of the specific viewpoint, continued weakness in these figures is likely to have a cascading effect on the Consumer Price Index (CPI) in the upcoming months. This outcome would further support the narrative of disinflation and, most notably, indicate that the upcoming rate hike in the United States will likely be the last one.

In summary, today's PPI numbers for June are expected to reinforce the prevailing disinflationary trend in the global economy. The anticipated slowdown in PPI figures suggests a potential impact on future CPI data, signaling the conclusion of rate hikes in the US, with only the upcoming move in two weeks' time remaining.