Tech Giants Propel S&P 500 to Best Week Since November, as Alphabet Hits Record High; Market Eyes Fed's Rate Decision | Daily Market Analysis

Key events:

- Eurozone - Eurogroup Meetings

- Eurozone - ECB's De Guindos Speak

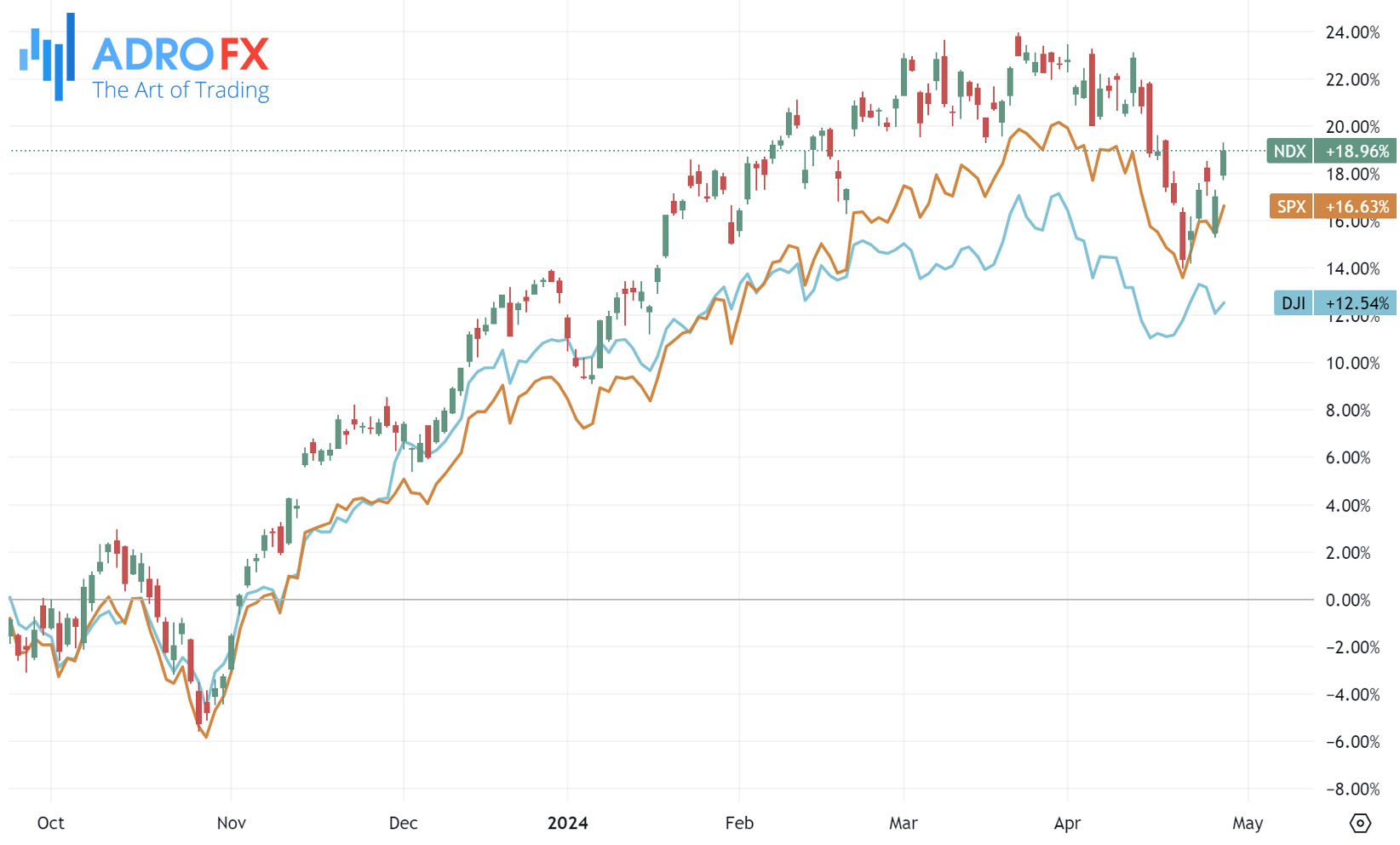

Friday saw a robust rally in the S&P 500, marking its best week since November, driven by upbeat earnings reports from tech giants Microsoft and Alphabet, reigniting investor confidence in the AI-driven tech sector.

The Dow Jones Industrial Average climbed 153 points, or 0.40%, while the S&P 500 surged 1%, and the NASDAQ Composite, led by tech stocks, soared 2%. With a gain of 2.7% for the week, the S&P 500 ended a three-week losing streak.

Alphabet, the parent company of Google, surged 10% to a potential record high after reporting strong first-quarter earnings fueled by robust demand for its new AI products. Additionally, Alphabet announced its inaugural dividend of 20 cents per share, signaling its resilience amidst concerns about GenAI trends, according to RBC analysts.

Earlier data revealed a 0.3% increase in the PCE price index for March, in line with expectations. Year-on-year PCE inflation stood at 2.7%, slightly above forecasts. Excluding volatile food and energy prices, the PCE index rose 0.3% monthly and 2.8% annually, aligning with expectations.

Hawkish remarks from several Federal Reserve officials had raised concerns about higher-than-expected inflation, potentially delaying anticipated rate cuts. However, the PCE data allayed some fears, keeping rate cut expectations in check for the year.

During Monday's Asian session, the Japanese Yen extended its decline following the post-Bank of Japan slump, breaking below the 160.00 psychological level against the US Dollar for the first time since October 1986. The BoJ's cautious stance on further policy tightening and the uncertain rate outlook indicate that the substantial Japan-US rate differential will persist. This, coupled with a generally positive risk sentiment, continues to divert capital away from the safe-haven JPY amid relatively thin liquidity due to a holiday in Japan.

However, intervention concerns are capping further losses for the JPY, given the excessively stretched conditions on the daily chart. Meanwhile, the USD begins the new week on a softer footing, retracing some of Friday's recovery gains from a two-week low. This hinders traders from initiating fresh bullish positions on the USD/JPY pair. Nevertheless, the underlying fundamental backdrop advises caution before expecting significant JPY appreciation ahead of the critical two-day FOMC policy meeting starting on Tuesday.

On the other hand, the Australian Dollar maintained its upward trajectory on Monday, reaching a three-week high near 0.6560. This bullish momentum stems from growing hawkish sentiment surrounding the Reserve Bank of Australia, fueled by last week's CPI inflation data surpassing expectations.

Warren Hogan, chief economic adviser at Judo Bank, predicted that the RBA could implement three cash rate hikes throughout 2024, potentially reaching 5.1%, with the initial increase likely in August. Investors are eagerly awaiting the release of March Retail Sales data on Tuesday, providing insights into Australia's consumer spending habits, which significantly influence inflation and GDP trends.

On Friday, the Canadian Dollar remained subdued amidst broader market movements, with investor attention focused on dwindling hopes for a Federal Reserve rate cut. The US PCE Price Index exceeded expectations, further dampening prospects for rate reductions.

Canada awaits significant data until next Tuesday's GDP release, while anticipation builds for the Fed's rate decision next Wednesday. Additionally, investors await next week's Nonfarm Payrolls report, seeking clues about a potential slowdown in the US economy that could prompt rate cuts.

During the Fed's upcoming policy meeting, investors will keenly watch for signals regarding potential interest rate adjustments this year. Fed Chair Jerome Powell emphasized the need for increased confidence in inflation's trajectory towards the 2% target before considering rate cuts.

Despite March's inflation data aligning with expectations, market sentiments regarding a first rate cut in September remain largely unchanged.

Expectations for rate cuts have waned as labor market and inflation data consistently surpass forecasts. Initially anticipated for March, the first rate cut projection was pushed back to June and subsequently to September.

The eurozone's forthcoming inflation and economic growth data, set for release on Tuesday, may strengthen market expectations for a June rate cut by the European Central Bank.

Although inflation has rapidly declined over the past year, the ECB intends to implement rate cuts in June. However, uncertainties persist due to escalating energy prices, persistent services inflation, and geopolitical tensions disrupting trade.

Economists anticipate the bloc's GDP to have expanded by a modest 0.2% year-over-year in the first quarter.

Inflation progress is anticipated to stall, with consumer prices projected to rise by 2.4% in April, matching the previous month's increase amid elevated energy costs.