Market Trends Await as Volume Returns to Normal; Employment Report and Data Releases in Focus | Daily Market Analysis

Key events:

- Eurozone - Spanish CPI (YoY) (May)

- Eurozone - Spanish HICP (YoY) (May)

- Canada - Current Account (Q1)

- USA - CB Consumer Confidence (May)

Today, volume levels are expected to return to normal following the US long weekend. This will provide us with a clearer understanding of market trends, particularly concerning the optimism surrounding a potential US debt ceiling agreement. Such positive sentiment is likely to continue supporting risk assets in the early part of the week. However, once the relief rally subsides, attention may once again shift to the numerous concerns that have consistently influenced Wall Street analysts to adopt a bearish stance.

A significant event that could disrupt the current state of affairs is the release of the employment report for May, scheduled for Friday. This report carries immense importance as it represents the last major data point that Fed officials will have the opportunity to comment on before their rate decision on June 14th.

In recent weeks, the value of the US dollar has experienced a notable strengthening. After hitting a low point of around 101 in the second week of May, it has since rebounded to the 104 range. This positive movement can be attributed to an improved sentiment surrounding the resolution of the debt ceiling issue.

However, the strength of the US dollar has been somewhat hindered by the prevailing narrative surrounding the '2023 US Debt Ceiling'. As a potential deal on the debt ceiling draws closer, it is anticipated that the markets will shift their focus to the next narrative, which could be the state of the labor market. If the labor market continues to slow down as anticipated, the US dollar might relinquish some of its recent gains. Nonetheless, there is also a possibility of further upward movement if any positive surprises emerge.

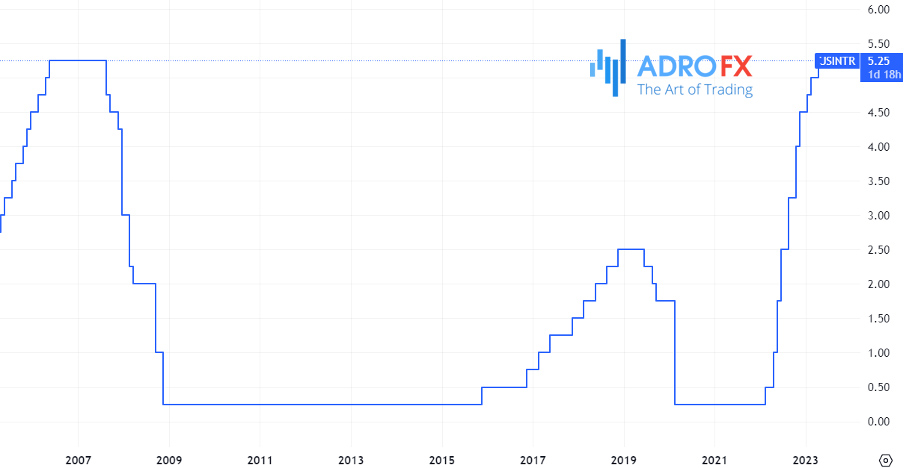

Analyzing the CME Group 30-Day Fed Fund futures prices provides insights into market expectations. Currently, the odds are leaning in favor of a 0.25% interest rate hike in June, although they have slightly decreased from 65% to 60%. On the other hand, the July meeting is priced in as a hold, with a rising probability of 50%.

At the same time, gold prices experienced a slight decline, remaining at levels not seen in over two months. This downward movement can be attributed to two key factors: optimism surrounding a debt ceiling agreement and expectations of additional interest rate hikes by the Federal Reserve, which led to an influx of funds into the US dollar.

Following its earlier record highs this month, the price of gold plummeted due to a series of hawkish signals from Fed officials. As a result, investors shifted their focus toward the US dollar. This shift in sentiment towards the dollar led to limited buying activity in gold, despite growing concerns and uncertainties surrounding a potential US debt default.

Today, there are several important data releases scheduled. Firstly, we have the Spanish flash inflation figures, which will provide initial insights into the upcoming euro area flash HICP data set to be released on Thursday. Consensus expectations suggest a slight easing in core inflation pressures.

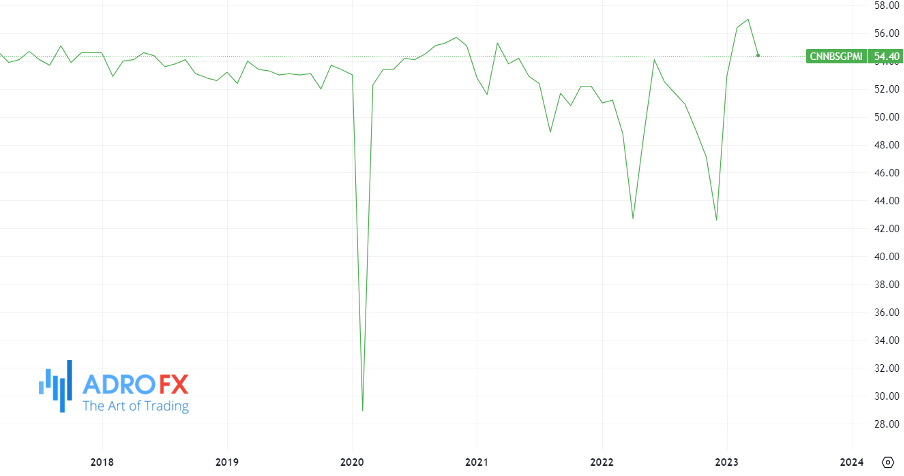

Overnight, the Chinese NBS PMIs (Purchasing Managers' Index) will be published. Early indications suggest a potential stabilization in the manufacturing index following a significant drop in April. However, it is anticipated that the service PMI may experience a modest decline from its currently elevated level.

As the week progresses, market participants will closely monitor whether the US Congress can successfully pass the preliminary debt ceiling agreement. The House of Representatives is expected to vote on Wednesday. Additionally, there are several important US data releases to watch, including the April JOLTs (Job Openings and Labor Turnover Survey) on Wednesday, May ISM Manufacturing data on Thursday, and the Jobs Report on Friday.