Dow Plunges Amidst Soaring Treasury Yields, Geopolitical Tensions, and Strong Retail Sales | Daily Market Analysis

Key events:

- USA - FOMC Member Williams Speaks

- UK - BoE Gov Bailey Speaks

- USA - Fed Chair Powell Speaks

On Monday, the Dow took a hit amidst surging Treasury yields, a backdrop of geopolitical tensions, and robust retail sales figures that dashed hopes for imminent interest rate cuts, overshadowing Goldman Sachs' strong earnings report.

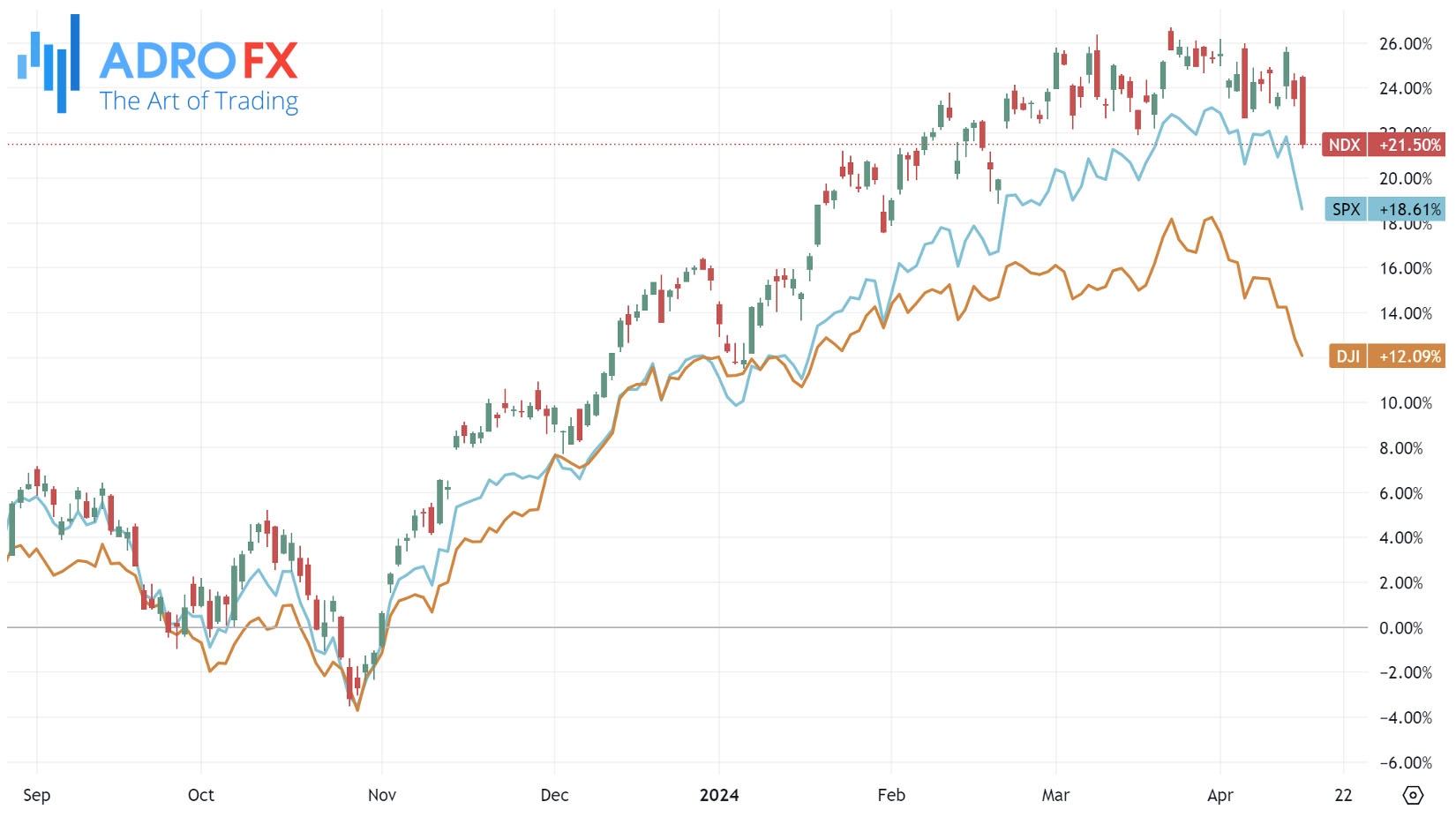

The Dow Jones Industrial Average stumbled by 248 points, marking a 0.7% decline, while the S&P 500 and NASDAQ Composite followed suit, slipping by 1.2% and 1.8%, respectively.

The momentum in Treasury yields continued upward, fueled by unexpectedly brisk retail sales last month, suggesting resilient consumer activity, a key driver of US economic expansion. This development tempered expectations for Federal Reserve rate reductions in the near term.

The yield on the US 10-Year Treasury surged by 11 basis points to reach 4.61%, reflecting market sentiment.

In a report released Monday, the Commerce Department revealed that retail sales climbed by 0.7% in the previous month, surpassing economists' projections of a 0.4% increase. Moreover, the retail sales control group, which holds substantial sway over US GDP, surged by 1.1%, outpacing the expected 0.4% rise.

In response to the data, some economists revised their forecasts for first-quarter economic growth upward and cautioned against anticipating imminent rate cuts.

Meanwhile, Apple shares took a 2% dip following revelations from research firm IDC that the tech giant relinquished its title as the world's leading phone maker to Samsung in the first quarter of 2024. Apple experienced a roughly 10% decline in smartphone shipments during this period, contrasting with a 7.8% global increase in smartphone shipments to 289.4 million units.

During Tuesday's Asian session, the Japanese Yen struggles against its American counterpart, hovering near a 34-year low reached the day before. The Bank of Japan remains vague about its plans to raise interest rates further, while markets anticipate that the Federal Reserve will hold off on rate cuts until at least September. This expectation maintains a substantial interest rate differential between the US and Japan, undermining the JPY.

Investors are wary of potential intervention by Japanese authorities to bolster the domestic currency. Moreover, ongoing geopolitical tensions, particularly from conflicts in the Middle East, add to a general risk-averse sentiment, offering little respite for JPY bulls. Meanwhile, the US Dollar climbs to its highest level since early November, supported by hawkish Fed expectations, suggesting a bullish trajectory for the USD/JPY pair.

The Australian Dollar extends its decline for the third consecutive session, possibly due to risk aversion amid anticipation of Israel’s response to Iran’s recent air assault. However, the AUD/USD pair trims losses following mixed data from China.

Concerns persist that the RBA might need to lower interest rates ahead of the United States. High inflation in the US raises uncertainty about the Fed's actions this year, given its traditional role in leading global rate-cutting cycles.

NZD/USD depreciates near 0.5880 during the Asian session on Tuesday as investors seek refuge in the US Dollar amid escalating geopolitical tensions in the Middle East. Market participants await Israel’s response to Iran’s recent airstrike. Additionally, the focus turns to New Zealand's CPI data for the first quarter of 2024, scheduled for release on Wednesday, with expectations of a slight uptick to 0.6% quarter-on-quarter.

The New Zealand Dollar remains unresponsive to mixed Chinese data, despite the close trading partnership between the two nations. China’s GDP rose by 1.6% quarter-on-quarter in the first quarter of 2024, surpassing expectations. However, China’s Industrial Production (YoY) increased less than expected in March.

EUR/USD continues its downtrend for the sixth consecutive session, trading near 1.0610 during the Asian hours on Tuesday. Elevated US Treasury yields exert pressure on the pair, compounded by dovish remarks from European Central Bank officials on Monday. ECB officials highlighted concerns about domestic inflation and hinted at potential future rate cuts, contributing to the Euro's weakness.

Traders are closely eyeing US macro data and speeches by influential FOMC members, including Fed Chair Jerome Powell, for market opportunities.