What Moves The Markets: BoE and ECB Rate Hikes | Daily Market Analysis

Key events:

- UK – Composite PMI (Jan)

- UK – Services PMI (Jan)

- USA – Nonfarm Payrolls (Jan)

- USA – Unemployment Rate (Jan)

- USA – ISM Non-Manufacturing PMI (Jan)

The dollar fell to a nine-month low, and Treasury yields fell after the U.S. Federal Reserve said the current rate hike cycle would end soon. The European Central Bank and the Bank of England intended to raise key rates by 50 basis points each. The technology sector is leading the market on Thursday. Here's what to know about the financial market on Friday, Feb. 3.

- The dollar and Treasury yields fell as the Fed signaled an end to rate tightening

The dollar fell to a 9-month low, and U.S. Treasury yields fell after the Federal Reserve signaled the end of its monetary tightening cycle.

The Fed raised its target range for the federal funds rate by 25 basis points to 4.50%-4.75%, and Fed Chairman Jerome Powell said it was "premature" to declare victory over inflation, but acknowledged that a "disinflationary trend" had begun.

The dollar index fell to a low of 100,675 before recovering and the 2-year bond yield fell to 4.09%. However, unlike the dollar, the 2-year bond yield did not make a new low.

After that, the market can expect more labor market data: weekly jobless claims will be released at 08:30 Eastern Time (1:30 p.m. GMT) and the U.S. labor market report for January will be released on Friday. Also at 08:30 ET, durable goods and factory orders data will be released, cross-checking the alarmingly weak ISM manufacturing survey released Wednesday

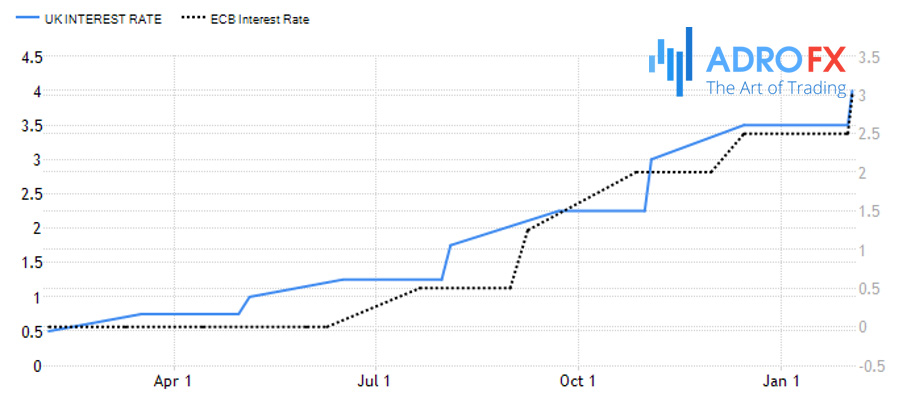

- ECB and Bank of England raise rates by 50 basis points each

Central bank action moves into Europe: both the European Central Bank and the Bank of England are expected to raise their key interest rates by 50 basis points, despite signs of economic stagnation (or worse) in data released earlier this week. German trade data released Thursday morning was particularly bad, with exports in December falling more than 6% MoM.

Bank of England raised its benchmark interest rate by 50 basis points to 4 percent from 3.5 percent at the end of its February meeting, according to a press release from the regulator. The central bank's decision coincided with analysts' forecasts.

ECB raised the rate by 50 basis points, also following expectations.

- The technology sector leads the market on Thursday

Nasdaq-saturated tech stocks got a boost from Meta Platforms Inc (NASDAQ: META), which rose more than 20% after the company announced tighter cost controls and a $40 billion share buyback.

The stock market also got a boost from a "dovish" message from Federal Reserve Charman Jerome Powell, who said that further rate hikes are expected after Wednesday's quarter-point hike.

Powell acknowledged that inflation was beginning to weaken, but said the Fed's job was not over yet. Instead, he said the risk of doing too little to fight inflation is greater than the risk of over-tightening.

The still-tense labor market remains in the spotlight, with the U.S. jobs report for January due out Friday. This morning, data on new jobless claims for last week showed that the number of claims fell to a 9-month low of 183,000, despite the massive layoffs announced in recent days. The number was lower than expected at 200,000.

Investors jumped on Powell's comments that Fed action was starting to gain traction and paid little attention to what he said about further rate hikes, sending stocks higher Wednesday. While most futures traders are betting on another quarter-point rate hike in March, about 17% of traders are betting on a pause for a rate hike, according to the CME FedWatch tool.