What to Look Out For This Week: Inflation and Corporate Reports | Daily Market Analysis

Key events:

- USA – Fed Chair Powell Speaks

- USA – EIA Short-Term Energy Outlook

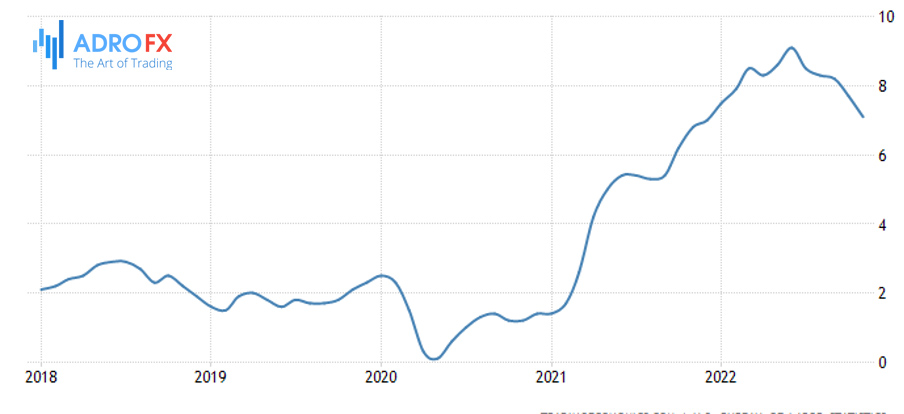

At the start of the new year, market participants are focused on corporate reports and inflation as key drivers. Inflation is forecast to have continued to slow in December, yet the rate of price growth is now higher than in recent years. This poses challenges for consumers, investors, and the Federal Reserve, which, despite the slowdown, is still dealing with a high rate of inflation. Thursday's consumer price index (CPI) for December will get a lot of attention from investors looking for signs of easing price pressures on consumers and companies.

This week is also the start of the Q4 2022 corporate earnings season. Many top U.S. banks, including Wells Fargo, Bank of America, and JPMorgan Chase, will release their results.

Investors will be interested to see how rising interest rates have affected banks' reporting after the Fed signaled it was not going to cut rates in 2023.

The truth is that market quotes are now pricing in a rate cut in Q4 of this year, given the possibility of a recession. While banks were doing well on net interest margins and earnings, the investment banking divisions probably continue to have problems due to the low number of deals and placements.

Fed Chairman Jerome Powell will participate in a panel discussion this week, and the U.S. will also release inflation data for December. Investors and the Fed will be watching these events closely to see if speculation about central bank easing is correct.

Last week's NFP data released showed 223,000 new jobs in the U.S. economy in December and a drop in the unemployment rate to 3.5%. However, investors' attention was drawn to the slowdown in average hourly earnings, which raises hopes of a slowdown in the Federal Reserve's interest rate hikes.

The combination of slowing wage growth and declining business activity in the service sector could allow the Fed to moderate the pace of rate hikes at its first meeting of the year on Feb. 1.

In the coming weeks, investors should keep an eye on corporate results and inflation. A slowdown in inflation would be positive. On the other hand, investors remain concerned about the risk of recession and its impact on corporate earnings.

In addition, there is considerable disagreement between the financial markets and Fed policymakers. As we understand, the central bank plans to continue raising rates until inflation reaches the 2% target.

If macro data shows that inflation and the economy remain resilient, yields may continue to rise as the market stops pricing in monetary policy easing.

According to some analysts, if the economy manages a rate hike and avoids a recession when the Fed completes monetary tightening, long-term yields will return to normal levels when inflation fears dissipate.

Meantime, the dollar has traded in a range for the sixth week in a row, having fallen to the 50-week Moving Average. The daily time frame recorded a series of lower peaks and lower lows, but the weekly time frame remains in an uptrend. Price fell below the first uptrend line in late October, while remaining above the uptrend line from May 2021 low.

Bitcoin has been trading sluggishly below $17,000, remaining in a sideways range since Nov. 9. A year ago, bitcoin was at nearly $43,000, and the consensus forecast at the time was that it would reach exorbitant heights. And here we are now!