What Does the FOMC Meeting Minutes Report Tell Us? | Daily Market Analysis

Key events:

- UK - Composite PMI (Dec)

- UK - Services PMI (Dec)

- USA - ADP Nonfarm Employment Change (Dec)

- USA - Initial Jobless Claims

- USA - Crude Oil Inventories

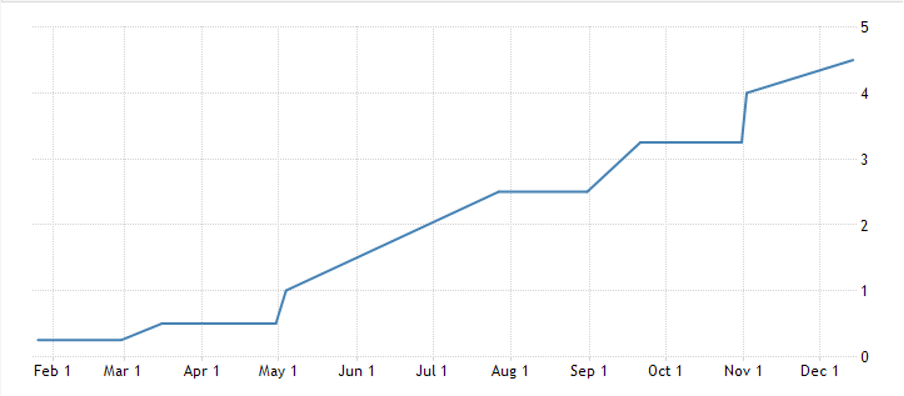

While markets wait for eurozone CPI and NFP on Friday, there are fresh reports to consider today, including the minutes of the latest Fed meeting. In addition, the ISM Manufacturing PMI and Jolts Index are released. The market can get confused trying to give any or all of them more importance. The question is whether the Fed might consider a 25bp rate hike. Feb. 1 or stick with 50 bps, while the ECB is going to stick with 50 bps, even though inflation data temporarily enhanced.

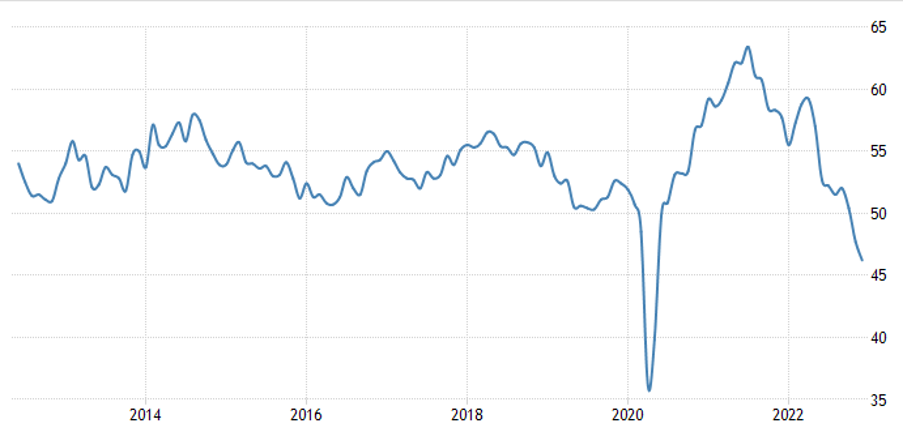

The PMI chart looks pretty grim. November's number was 49, and this time it is expected to be the same or lower to 48.5 (consensus). All components are down (orders, employment), but a tiny ray of light came from the retreat in prices. The market may well perceive the PMI as a harbinger of recession.

At the same time, the index will be scrutinized for signs that the stubborn resilience of the labor market is starting to crack. In last October's report, the number of open jobs fell by 353,000 to 10.3 million. This time the consensus suggests a drop to 10 million, which means a moderate decline, but not as strong as the market and the Fed would like. Analysts will also look at layoffs and other components, but overall there are still a huge number of job openings and a negligible number of job seekers in the U.S.

So, will the Fed start cutting interest rates? No. The market is looking forward to the federal funds rate peaking at 4.9 percent in the first half of 2023, then falling to 4.7 percent in September and 4.4 percent in December. However, an overwhelming majority of members believe that the rate will end in 2023 at or above 5 percent. This latter prediction will prove to be correct. As the Fed chairman warned in November, "History strongly cautions against a premature loosening of policy. We will stay the course until the job is done." The Fed does not want to repeat the mistake of complacency.

Note that critics of the Fed, including those who criticize "helicopter Ben" (Bernanke), seem to have forgotten that for decades the Fed has preferred to remain in the background. Its stance has been reactive rather than proactive. This was partly a political decision, imposed from above, mostly by Republicans, but also from within - after all, the Fed is an odd institution, both public and private, with a wide list of obligations, including regulatory ones (which it sort of failed to meet in the 2008-2009 housing crisis, though auditing rating agencies is not within its purview). The Fed has caused strong negative sentiment at various times and has avoided attention for good reason. The only place you could see real Fed intervention actively and consistently working is in short-term liquidity management from the New York Fed.

Should the stock market growth from 2009 onward be attributed to free and cheap money? Yes, probably. But curiously, it doesn't follow that rising rates and QT are what's eating away at the S&P. It may well be individual investors and "Chicken Littles" who get scared each time they hear the "R" word. The fact remains that over long periods of time, such as 10 and 20 years, stock market returns are always much higher than bond returns. That doesn't mean there won't be a recession in the first quarter, but it does mean that you can't blame everything on the Fed.

So far, if the Atlanta Fed is to be believed, a recession is not on the agenda. The latest Q4 GDP estimate rose to 3.9% from 3.7% on Dec. 23. Spending and investment have improved, and trade has had less of an impact on the economy. Tomorrow we will get another indicator. Of course, this is Q4, not Q1, and the Atlanta Fed's model tends to be overstated, but still - it's not a recession. Blu Chip analysts are predicting growth of only 1%, but in the same direction, albeit weaker.

The Fed's next meeting is February 1, followed the next day by the ECB, both of which are expected to raise rates by 50 bps. We should probably assume that the inflation numbers won't distract central banks too much, since they need more months of data to make sure they can take their foot off the brake. Fear of a recession is different in Europe than it is in the U.S. It will be hard for the Fed to worry aloud about a recession if the Atlanta Fed is even remotely right about GDP. The ECB expects that inflation has been artificially lowered by energy subsidies, so it cannot weaken.

What all this means for the currency market is still unclear. And it probably won't become clear anytime soon. It's a misleading, confusing set of conditions that points first in one direction, then in another. We should expect volatility, and not all of it is based on anything in particular.