This Week's Focus - SVB Сollapse Consequences and Inflation | Daily Market Analysis

Key events:

- UK - Average Earnings Index +Bonus (Jan)

- UK - Claimant Count Change (Feb)

- USA - Core CPI (MoM) (Feb)

- USA - CPI (MoM) (Feb)

- USA - CPI (YoY) (Feb)

Amid the fallout from the biggest U.S. banking meltdown since the 2008 global financial crisis, investors will focus on U.S. inflation data this week, which will be a key test for a market already under pressure from fears about the Federal Reserve's inflation-taming campaign. The European Central Bank is also expected to raise rates again, the UK will announce its budget and China will release a barrage of economic data. Here's what to watch out for this week.

Bank stocks continue to fall despite hopes for a rate freeze

Signs of panic over incipient financial instability have caused a sharp and sudden reassessment of interest rate prospects.

Goldman Sachs (NYSE: GS) and others said they now expect the Fed to leave rates unchanged at its March meeting, in contrast to the consensus of a 25-basis-point rate hike prior to last week's events. The dollar has fallen and risky assets have received widespread support after they declined on Friday.

But if the Fed and Treasury thought they had drawn a line under the fiasco, they were dead wrong. Shares of First Republic Bank (NYSE: FRC) were down 60% at the premarket amid bets that it would be the next domino to fall, while PacWest Bancorp (NASDAQ: PACW) was down 40% and Western Alliance (NYSE: WAL) was down 45%.

Banks with high concentrations of risky corporate deposits are considered most at risk because of liquidity concerns, while banks with a more stable retail deposit base are considered more secure.

U.S. inflation data

While Friday's U.S. jobs report eased some concerns about the prospect of a 50 basis point rate hike at the upcoming Fed meeting, Tuesday's higher-than-expected inflation numbers could reignite concerns among investors who are already balancing on a tightrope after the SVB crash.

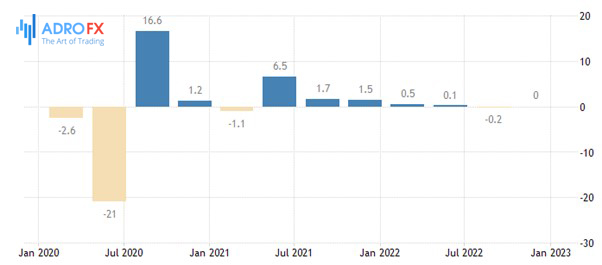

Economists expect monthly inflation to rise 0.4% in February after rising 0.5% the previous month, which would be 6.0% year over year.

Last week, Fed Chairman Jerome Powell said that the U.S. central bank would likely raise rates more than previously expected if upcoming data showed that the economy remains "hot" after nearly a year of tightening, but added that a decision on the upcoming March meeting has yet to be made.

Other economic data to watch this week include February U.S. retail sales, producer price inflation, housing starts, and industrial production.

ECB rate hike

The ECB looks set to raise interest rates another 50 basis points at its Thursday meeting after already raising rates by 3 percentage points since July in an attempt to rein in inflation.

Data that eurozone core inflation rose last month added to concerns that price pressures persist.

The market expects another 50 basis point rate hike at the ECB's May 4 meeting, and the minutes of the ECB's February meeting did little to change those expectations.

ECB head Christine Lagarde will likely be challenged to answer the question of how high the rate will ultimately be at a press conference following Thursday's ECB meeting.

UK budget

UK Chancellor Jeremy Hunt will present the spring budget Wednesday, and after the market turmoil in September, when his predecessor Kwasi Kwarteng and former Prime Minister Liz Truss unveiled generous tax cuts, forecasters expect Hunt to prioritize keeping public finances stable.

With that in mind, the market's focus will be on the growth and borrowing forecasts that will be released with the budget.

The Office for Budget Responsibility (OBR) forecasts GDP growth of 1.3% in 2024. The Bank of England predicts a slight contraction. A downgrade by the OBR could affect the pound, but the pound is driven mainly by the interest rate differential, with the U.S. rate expected to rise longer than the UK rate.

China retail sales

On Wednesday, China will release its first retail sales and industrial production data of the year, which will give market watchers some insight into whether Beijing's new 5% growth target is as modest as many analysts believe.

The data will come after Xi Jinping secured an unprecedented third term in office on Friday during a week-long meeting of the National People's Congress.

Li Qiang, best known for overseeing Shanghai's strict COVID-19 restrictions, was confirmed as premier, replacing the resigned Li Keqiang, who by all accounts was sidelined when Xi tightened his grip on the economy.