Weak US Economic Data Continues to Impact Markets While Nasdaq Experiences Greatest Declines | Daily Market Analysis

Key events:

- UK – Construction PMI (Mar)

- USA – Initial Jobless Claims

- Canada – Employment Change (Mar)

- Canada – Ivey PMI (Mar)

Yesterday, weak US economic data continued to impact the markets. European markets closed slightly lower, and US markets followed suit after the March ISM services survey reported a larger-than-anticipated drop in the headline number to 51.2. The Nasdaq 100 experienced the greatest declines.

Although the ADP payrolls report indicated a slowdown in job growth, it was the ISM survey that caused concern and contributed to further weakness in US treasury yields. Not only did the headline number decrease from 55.1 to 51.2, but the prices paid also slipped from 65.6 to 59.5, and the employment component weakened from 54 to 51.2. Upon closer examination, it became clear that the banking turmoil caused by SVB was beginning to have a ripple effect on the broader economy.

Following weaker manufacturing data earlier in the week, there seems to be a growing sense that the economy is slowing down, likely due to recent rate hikes, and that the Fed will need to reverse course on its rate policy soon. However, this last option is a matter of debate.

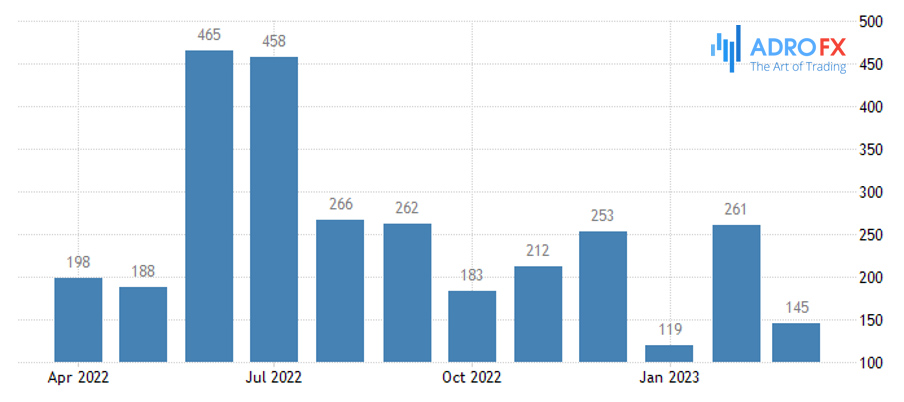

The upcoming non-farm payrolls report tomorrow will be the next catalyst for this narrative. However, recent data on weekly jobless claims suggests that the US labor market remains quite strong. Today's claims are projected to increase slightly to 200k from 198k. Nevertheless, it is unlikely that the market picture will become much clearer until next week when US markets have the first opportunity to respond to the payrolls report, as well as the March CPI report.

In contrast to the US, the service sector in Europe has improved since February, with Spain and Italy experiencing significant growth as the summer tourist season approaches. Spain's services sector activity reached its highest levels since late 2021, while Italy's services activity hit an 11-month high. Similarly, in China, the latest Caixin services PMI number surged in March, consistent with its official counterpart, as economic activity rebounds post-reopening.

ECB Chief Economist Philip Lane cautioned yesterday that food price inflation in the EU was still increasing, intensifying the pressure for further rate hikes from the ECB in the coming weeks. In contrast, expectations for future US rate hikes have decreased due to recent weak data.

The next few days will be critical in determining whether the Fed will raise rates another 25bps in May. A soft jobs report tomorrow, along with a weak CPI print next week, could signal the end of the possibility of another rate hike at the next meeting.

However, a rate cut by the Fed is not expected to occur at this time as inflation would need to drop significantly lower than current levels for that to happen, which does not seem to be the case presently.

The pound experienced a slight pullback yesterday after reaching 9-month highs against the US dollar earlier this week. Bank of England chief economist Huw Pill's recent remarks indicate that another 25bps rate hike is still on the table when the MPC next meets. Recent data that is better than anticipated indicates that the UK economy has improved substantially since the end of last year. Today's construction PMI for March is expected to round off a decent end to Q1, with a modest slowdown from 54.6 to 53.4 anticipated.

Additionally, we have Canada's March jobs report, which is expected to show 10.2k new jobs added and the unemployment rate to rise to 5.1%.

Tomorrow's US payrolls data is predicted to show 236k jobs added, down from 311k, with the unemployment rate remaining unchanged at 3.6%. Any downside miss will affirm the market's bias that a slowdown is approaching. However, an upside beat could cause a bit of a repricing and stir things up.