US Stocks Open Week with Gains Amidst Rate Cut Optimism | Daily Market Analysis

Key events:

- Australia - Retail Sales (MoM)

- Australia - RBA Interest Rate Decision (May)

- USA - FOMC Member Kashkari Speaks

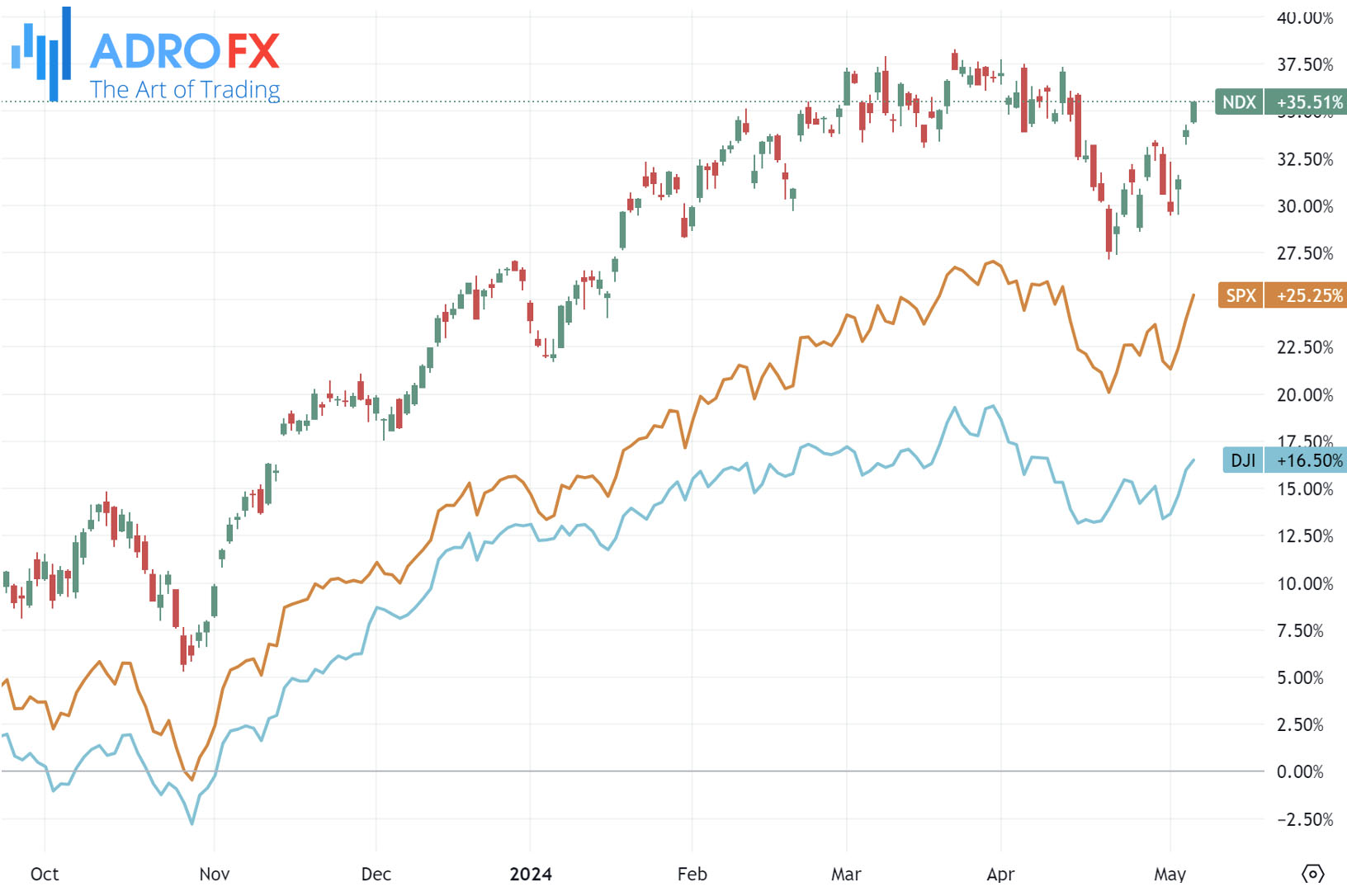

US stocks opened the week with gains on Monday, buoyed by renewed optimism for a Federal Reserve interest rate cut in September following a disappointing April jobs report.

The S&P 500, a key benchmark, advanced by 0.8%, while the Nasdaq Composite, heavily weighted towards technology stocks, climbed 0.90%. Additionally, the Dow Jones Industrial Average, comprising 30 major blue-chip companies, rose by 146 points or 0.4%.

The resurgence in hopes for a September rate cut stemmed from the softer-than-expected nonfarm payrolls data released on Friday, indicating a slowdown in the labor market and allaying concerns about inflation driven by wage growth.

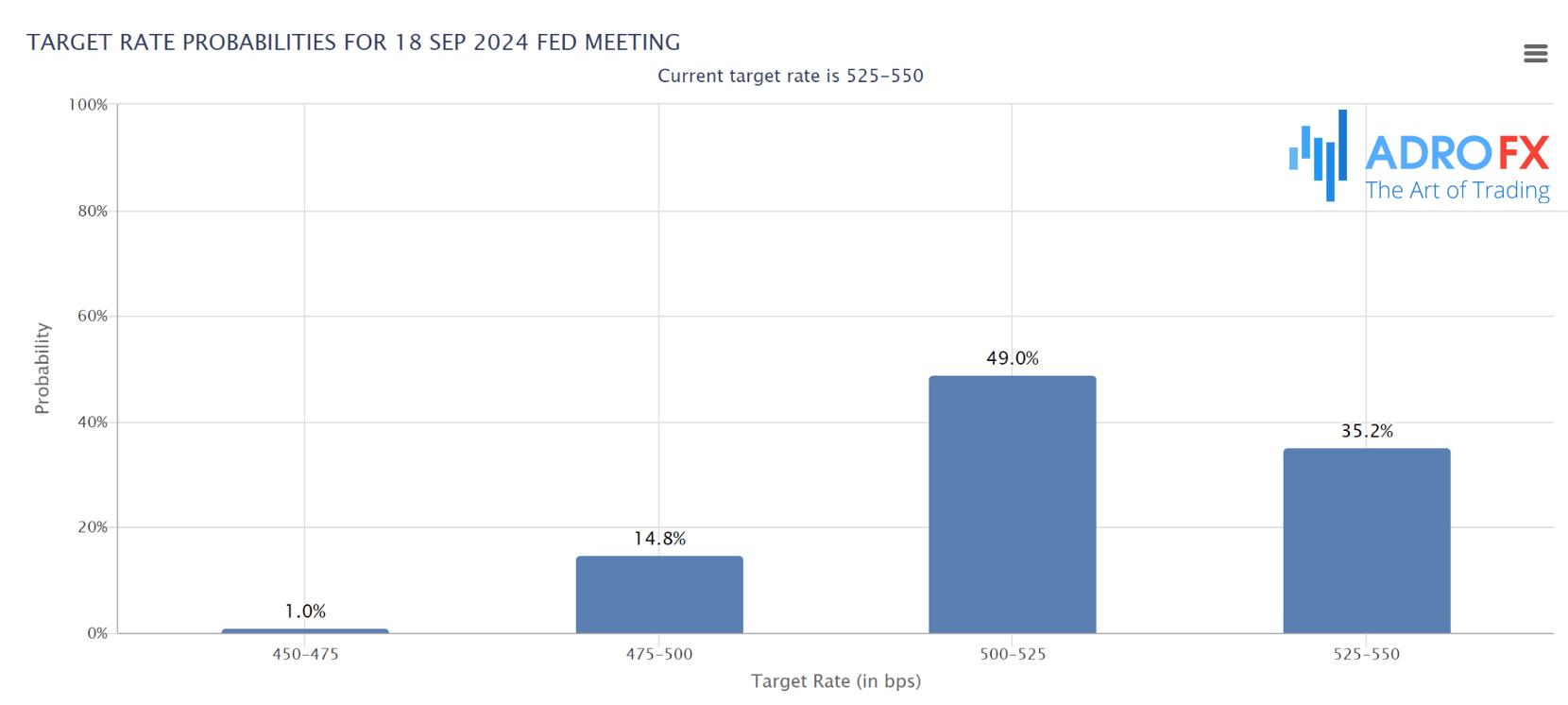

Market participants now anticipate the Federal Reserve to initiate rate cuts as early as September, although the probability of such an event stood at approximately 60%, according to the CME Fedwatch tool. Previously, expectations leaned towards a rate cut in November.

Federal Reserve officials, scheduled to deliver a series of speeches throughout the week, acknowledged the deceleration in job growth and hinted at a potential rate cut in the future rather than an increase.

Richmond Fed President Richard Barkin noted that the current policy appears restrictive, but the recent data had cast uncertainty on the pace at which the central bank could address inflation towards its 2% target.

Meanwhile, New York Fed President John Williams remarked on Monday that rate cuts would eventually materialize, although he cautioned against the unexpected upside surprises in inflation data resulting from trade-related factors, which could pose concerns for the central bank.

The GBP/USD pair maintains its upward trajectory for the fifth consecutive day, hovering around 1.2560 during the Asian session on Tuesday. A weakened US Dollar lends some support to the major pair, with investors eyeing the upcoming Bank of England interest rate decision scheduled for Thursday, where no change in rate is anticipated.

Following last week's slower-than-expected US employment data for April, investors have heightened their expectations of a potential interest rate cut by the US Federal Reserve this year. This sentiment is further fueled by anticipated insights from Federal Reserve officials regarding future monetary policy. Richmond Fed President Thomas Barkin suggested on Monday that current interest rates should sufficiently cool the economy, potentially bringing inflation down to the 2% target.

Conversely, New York Fed President John Williams expressed confidence in the current state of monetary policy, indicating that while rate cuts may occur, the present stance is favorable. The dovish sentiment from Fed officials could exert downward pressure on the Greenback, providing momentum for the GBP/USD pair. Market projections suggest a cumulative rate cut of 46 basis points (bps) by the end of 2024, with the first cut expected in either September or November.

Meanwhile, the BoE is anticipated to maintain its rates at 5.25% during its May meeting on Thursday. Market participants will closely scrutinize any indications of a potential timeline for rate adjustments and the BoE's guidance on interest rates. However, recent dovish remarks from BoE Governor Andrew Bailey and Deputy Governor Dave Ramsden have fueled speculation that the BoE's easing cycle may align more closely with the European Central Bank than with the Fed.

Bailey's expressed confidence in headline inflation returning to the desired rate of 2% by April indicates a dovish stance from the UK central bank, which could dampen the Pound Sterling's strength and limit downside potential for the pair.

In other currency news, the USD/JPY pair trades with strength around 154.10 on Tuesday, supported by a modest rebound of the US Dollar to 105.10 after bouncing off three-week lows. The risk-on sentiment continues to weigh on safe-haven currencies like the Japanese Yen, with Japanese authorities considering measures to address excessive market volatility.

Meanwhile, the EUR/USD pair snaps its four-day winning streak, trading around 1.0760 during the Asian session on Tuesday. Although the Euro faced some resistance, it found support from higher-than-expected Eurozone PMI data released on Monday. Retail Sales data scheduled for release during the upcoming European market session will offer further insights into the retail sector's short-term performance, which contributes approximately 5% to the total value added by Eurozone economies.

ECB Chief Economist Philip R. Lane's recent remarks on increased confidence in inflation returning to the 2% goal and the potential for an interest rate cut in June signal positive developments for the Eurozone economy. Improved demand and stronger output growth, as indicated by the HCOB Eurozone Services PMI, underscore the region's resilience amidst economic challenges.