US Stocks Close Lower Amid Debt Ceiling Vote and Rate Hike Concerns, Labor Market Shows Strength | Daily Market Analysis

Key events:

- UK - Manufacturing PMI (May)

- Eurozone - CPI (YoY) (May)

- Eurozone - ECB President Lagarde Speaks

- Eurozone - ECB Publishes Account of Monetary Policy Meeting

- USA - ADP Nonfarm Employment Change (May)

- USA - Initial Jobless Claims

- USA - ISM Manufacturing PMI (May)

- USA - Crude Oil Inventories

On Wednesday, US stocks closed lower as investors closely monitored a crucial congressional vote on raising the federal debt ceiling. Additionally, unexpectedly positive labor market data raised concerns among investors who fear a potential interest rate hike by the Federal Reserve in June.

The Labor Department released a report indicating a surprising increase in US job openings during April, signaling ongoing strength in the labor market and suggesting potential wage and inflation pressures.

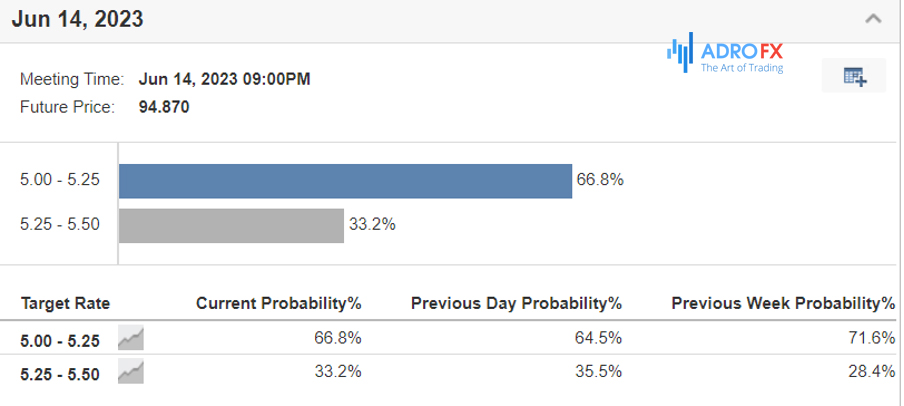

Following the release of this data, futures traders adjusted their probability of a 25 basis points interest rate hike at the Federal Reserve's June 13-14 policy meeting to 70%. However, this likelihood decreased to approximately 32% after comments from Fed officials, who hinted at a "hawkish pause" in rate increases.

The upcoming May unemployment report from the Labor Department, scheduled for release on Friday, is expected to play a significant role in determining whether a rate hike will occur.

After the comments from Fed officials, the major stock indices managed to recover some of their losses. The Dow Jones Industrial Average declined by 134.51 points, or 0.41%, closing at 32,908.27. The S&P 500 lost 25.69 points, or 0.61%, finishing at 4,179.83. Similarly, the Nasdaq Composite dropped by 82.14 points, or 0.63%, to reach 12,935.29.

In terms of monthly performance, the S&P 500 rose by 0.26%, the Dow experienced a loss of 0.48%, and the Nasdaq gained 5.80%.

Following the comments made by Fed officials, the dollar, which had previously reached a more than two-month high, experienced a decline. The dollar index increased by 0.163%, while the euro weakened by 0.44%, trading at $1.0686.

Despite the strength of the dollar, gold prices showed resilience. However, due to optimism surrounding the US debt deal, gold was still set to record its first monthly decline in three months. Gold could potentially attract more buyers throughout the year, particularly considering the deteriorating global economic conditions.

Recent data has indicated that the post-reopening economic recovery in China is losing momentum while manufacturing activity in the United States and the Eurozone is experiencing significant slowdowns. These factors may contribute to an increased interest in gold as investors seek a safe haven amidst the uncertain economic landscape.

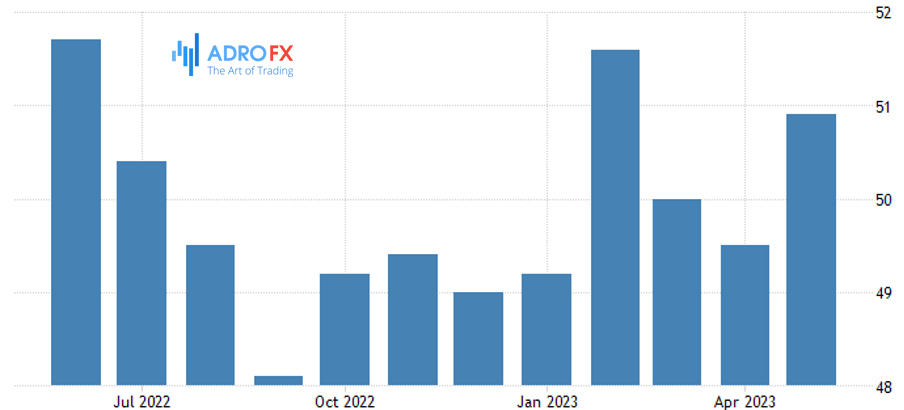

On Thursday, a private survey revealed that Chinese manufacturing activity in May exceeded expectations, in contrast to earlier government data indicating a sustained decline in China's major growth drivers. The Caixin Manufacturing Purchasing Managers' Index (PMI) recorded a reading of 50.9, surpassing the projected reading of 50.3 and the previous month's figure of 49.5.

A PMI reading above 50 indicates growth in the sector, indicating that production improved following an unexpected contraction in April. According to Caixin Insights, production rebounded from a slowdown in April and reached its highest pace since June 2022.

This data follows an official survey released the day before, which indicated a deepening contraction in China's manufacturing sector, raising concerns about a potential slowdown in the post-COVID economic recovery.

However, the Caixin survey, which focuses more on smaller, private enterprises rather than larger, state-run enterprises like the official survey, suggests that certain aspects of China's extensive manufacturing sector were recovering after most anti-COVID restrictions were lifted earlier this year.

All eyes are now on the upcoming release of US nonfarm payrolls data on Friday, as investors seek further indications for monetary policy. The anticipation of prolonged higher interest rates in the United States has dampened markets over the past year.