U.S. Jobs Reports Boost the Market | Daily Market Analysis

Key events:

- Switzerland – Unemployment Rate s.a. (Dec)

- Eurozone – Unemployment Rate (Nov)

- Canada – Building Permits (MoM) (Nov)

U.S. jobs data boosted the U.S. stock market Friday. Will it be able to hold on?

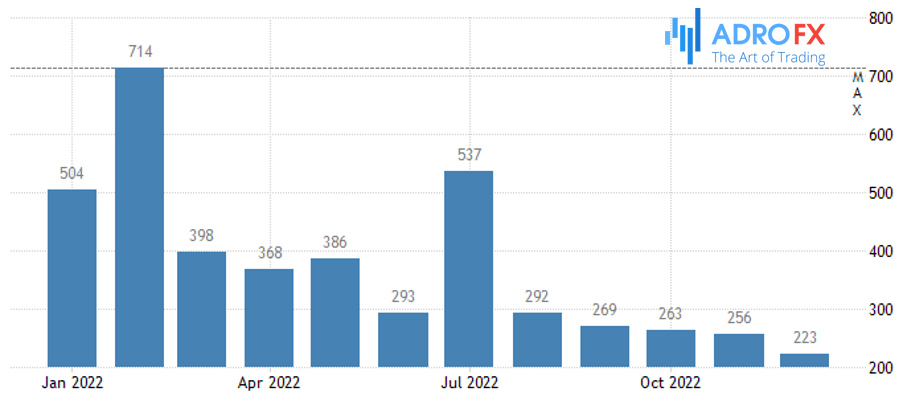

The U.S. jobs number came in at 223,000. It was the lowest number in a while and the market took it as good news.

Nevertheless, it was well above the expected 200,000 and still above pre-crisis levels. In other words, the employment situation remains too favorable for the Fed.

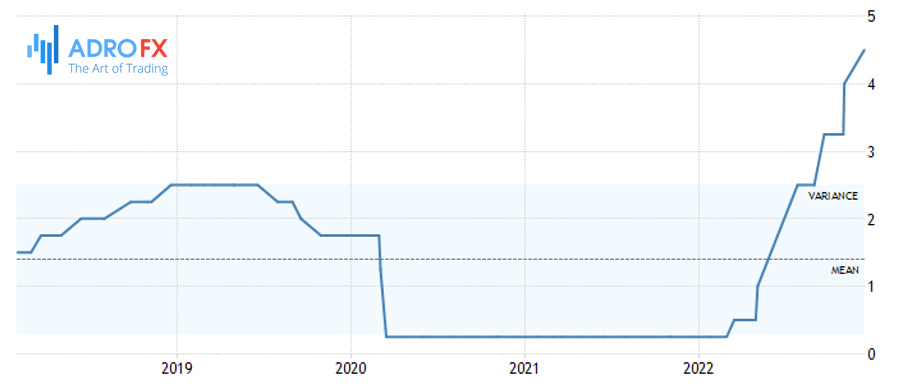

Friday's big employment data won't even affect the trajectory of the Fed's 50-point rate hike for the foreseeable future.

Again, the market wants to think double-edged. As if bad economic data is good news.

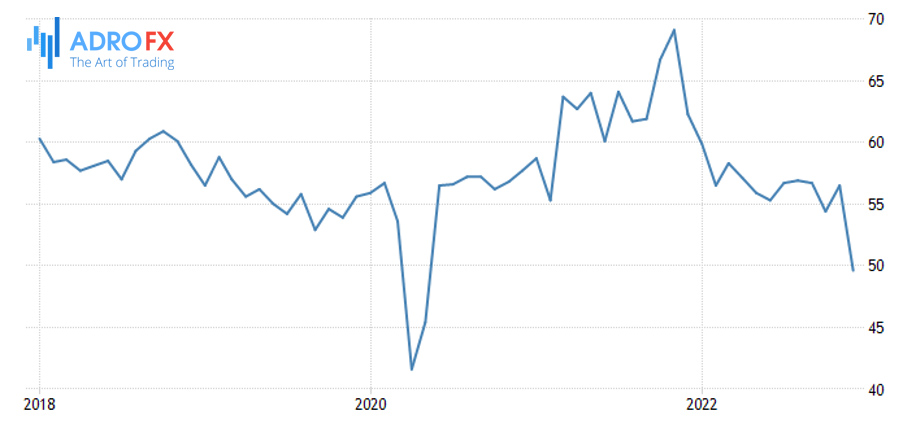

The ISM Services PMI moved to an apparent contraction, and that too was seen as a defeat for the Fed, and therefore for stocks. This was the first contraction since 2020, and it means that much of the U.S. economy has already gone into recession in December.

This does not bode well for the economic outlook for 2023, especially since we know that the Fed will continue to raise rates.

While the market wants to believe that the Fed will lower the rate below 5%, analysts` target area remains 5.75%-6.5%, with the risk of a hike. Of course, this is a very clear signal for a higher risk, but the Fed's own dot plot has already shifted from 5.1% to 5.4%. As expected, the Fed's own forecast is moving toward what experts forecast. Not the other way around.

The U.S. stock market does not value the Fed's results and even more hawkish rate projections. Therefore, the market is at risk and vulnerable to such events.

Traders and investors should pay special attention to the fact that in the first week of trading in 2022, the market was in the process of reaching new all-time highs. Some warned even then that it wouldn't be the first time the stock market hit "highs of the year" in that first week. Analysts were predicting a 20 percent drop in 2022, and it happened.

While investors may be a little hopeful on the back of Friday's trading, we should still be a little cautious about the possibility of a repeat of last year's gains starting a little later in this second week.

The economy is in decline. Earnings are expected to decline. The Fed will still be raising rates, and quite possibly higher than many expect.

Cautiousness is appropriate because we cannot be in any doubt now about the severity of the possible deterioration this year.